Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: PRODUCTIVITY EFFICIENCY

Total loans at credit unions increased 10.5% year-over-year. The industry loan portfolio was $947.5 billion as of Sept. 30, with credit unions netting an additional $24.2 billion over the course of the third quarter alone.

Total shares grew at a slower pace, 6.7%, than loans. This helped the loan-to- share ratio reach 81.3% as of third quarter 2017. That’s an increase of 1.7 percentage points over last quarter and 2.8 percentage points over last year.

The distribution of the loan portfolio as of Sept. 30, 2017, was similar to last year’s. First mortgages totaled $386.5 billion and comprised the largest portion, 40.8%, of the loan portfolio. Next, auto lending totaled $329.6 billion and comprised 34.8% of the loan portfolio. Within the total loan portfolio, used autos accounted for 21.2%, whereas new autos made up 13.7%. As of third quarter, credit unions captured 19.0% of the U.S. auto finance market, with 17.9 million loans granted year-to-date.

Growth rates for every category of the loan portfolio exceed 5.7%. Three categories hit double-digit growth. First mortgage loans increased 10.6% annually, totaling $386.5 billion. New and used auto loans increased 14.3% and 11.2%, respectively, and totaled $329.6 billion.

Although there is a $57.0 billion difference between first mortgages and auto loans, auto loans are increasing at a higher rate and closing the gap between the two loan categories.

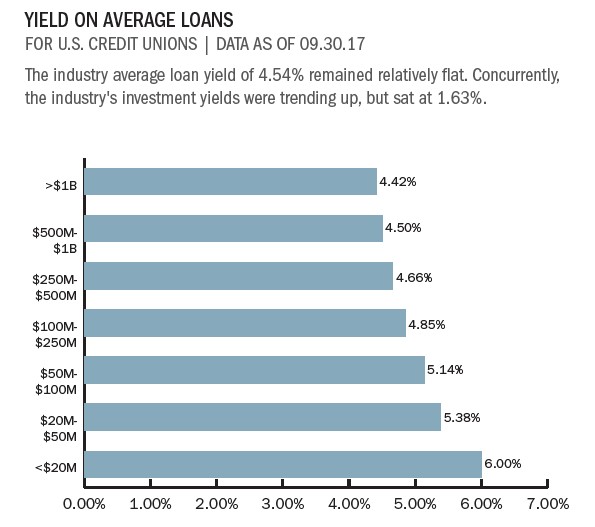

Interest on loans increased from $28.4 billion as of Sept. 30, 2016, to $31.1 billion as of Sept. 30, 2017. That’s a 9.6% jump. Despite an annual increase in interest on loans, the yield on average loans has decreased by 3 basis points. The 4.54% yield as of third quarter 2017 remains consistent with second quarter. Generally, it is still a low-rate environment, and the effects of the interest rate increases will come gradually with new loan originations.

Quickly find out if your credit union is keeping pace with the industry’s robust lending numbers with Callahan’s analytics software. Learn more today.

Click the graphs below to enlarge and then continue reading to see how Pioneer FCU uses credit score analysis to build long-term relationships and the loan portfolio.

The industry continued to post double-digit loan growth rates in the third quarter of 2017. Seventy percent of credit unions reported positive year-over-year loan growth, with the median loan growth at 4.9%.

CASE STUDY

PIONEER FEDERAL CREDIT UNION

Pioneer Federal Credit Union is adding members and loans by analyzing credit scores and inviting new members to join the cooperative.

The Idaho credit union began its Credit Score Analysis program in January 2015 and by mid-2017 completed more than 5,000 credit reviews, added 20,000 new members, and made $84 million in direct auto loans.

Pioneer offers credit score analysis to members and non-members alike in its 14 branches, on the credit union’s website, over the phone, or through email or chat.

The credit union focuses on raising credit scores members with a score of 720 or higher qualify for the 720 Club, which ensures the best loan rates Pioneer has to offer lowering monthly payments and eliminating high-interest credit card debt.

We didn’t set specific goals for the CSA program and 720 Club because we didn’t know what to expect, says Pioneer president and CEO Curt Perry. Anecdotally, though, we’ve realized much deeper relationships between our members and employees.

The deeper relationships result from helping borrowers get out of high-interest loans whenever possible, and through financial checkups that keep members on the right path, especially when times are tough.

Pioneer now is further building relationships by filling out its portfolio with new mortgage options.

Pioneer also plans to continue to expand the CSA program, emphasizing its value across the credit spectrum and building out the tracking process to keep tabs on how members are progressing through their partnership with their credit union.

Read The Whole Story

Strategy Performance 3Q 2017

Credit unions have made significant gains since the Great Recession started 10 years ago. Third quarter credit union growth trends surged past that of community banks and the overall banking industry. Measures such as loans, shares, capital, and membership have all reached new levels. These gains are all notable and meaningful; however, they are backward-looking. The important question to ask is: Where will credit unions be in the next 10 years? In this issue of Strategy Performance, learn why now is the time for credit unions to challenge themselves.

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 3Q 2017