Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: PRODUCTIVITY EFFICIENCY

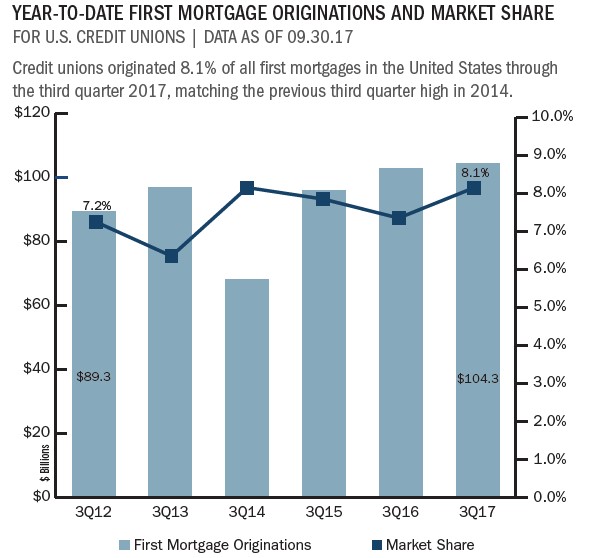

Total real estate loan balances increased 9.7% in the past year to reach $468.3 billion as of Sept. 30, 2017. At 82.5% of the real estate lending portfolio, first mortgage balances totaled $386.5 billion, up 10.6% year-over-year.

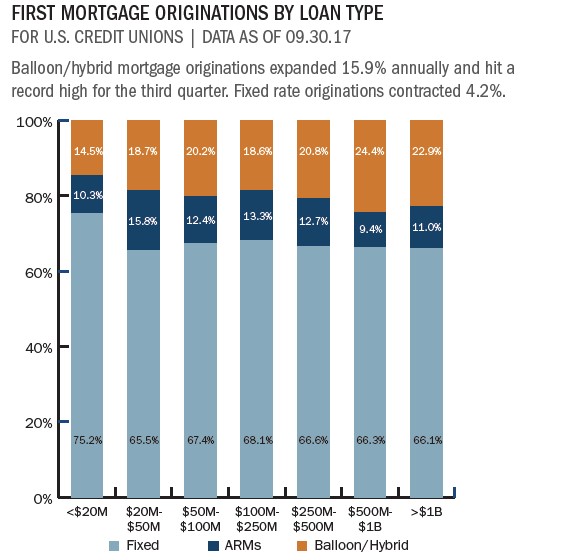

Credit unions reported positive year-over-year balance sheet growth for all first mortgage lending products in the third quarter of 2017. Balloon/hybrid loans represented the highest yearly expansion. Balances for these loans increased 14.6% and exceeded $100 billion for the first time ever. Fixed rate first mortgages made up the largest share of the first mortgage portfolio, 57.9%, with balances increasing 10.0% annually to $223.7 billion.

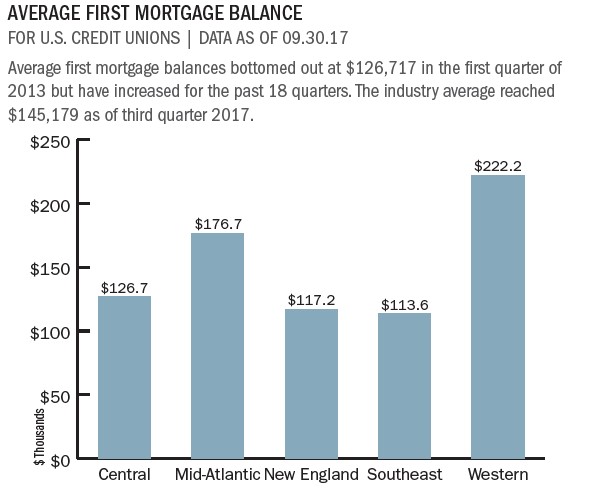

The average balance for first mortgage originations was up 3.9% year-over-year to $145,179. Credit unions have expanded this metric nearly $18,000, or 13.9%, since 2011. At $222,200, credit unions in the NCUA Western Region posted the highest average first mortgage origination balance. That’s more than $45,000 higher than the $176,673 average reported by credit unions in the Mid- Atlantic Region, which came in second.

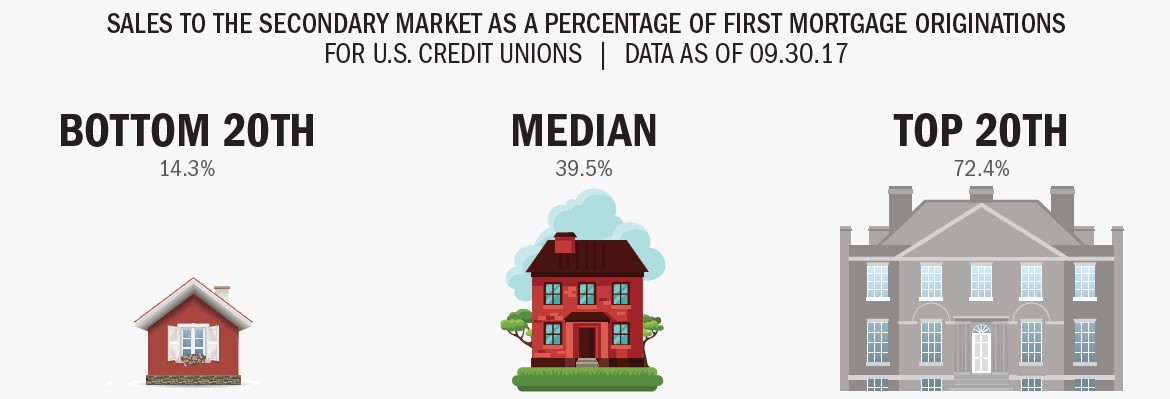

Year-to-date first mortgage sales to the secondary market decreased 8.9% annually to $37.9 billion. As a percentage of first mortgage originations, sales to the secondary decreased 4.1 percentage points.

Southeastern credit unions sold the smallest percentage, 19.7%, of their first mortgage originations. That’s 23.3 percentage points lower than Mid-Atlantic credit unions, which sold the largest percentage of their originations. Credit unions with assets of more than $1 billion sold 37.1% of their first mortgage originations. By comparison, the smallest peer group, credit unions with assets less than $20 million, sold just 20.1%.

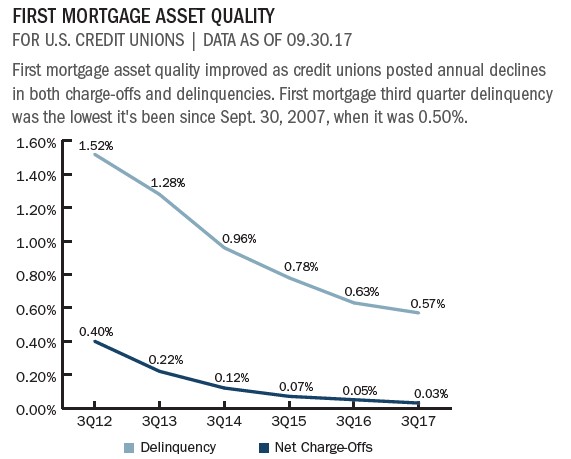

First mortgage delinquency has now decreased in the third quarter for seven consecutive years. Although first mortgage delinquency dropped 6 basis points year-over-year, it has improved 1.72 percentage points since its highest point on record, 2.29% as of Dec. 31, 2010. First mortgage net charge-off rates also improved. They decreased 2 basis points year-over-year to 0.03%.

Make The Most Of Mortgage Market Data

Leveraging HMDA data, MortgageAnalyzer helps credit unions identify market leaders and analyze their performance against other credit unions, banks, and mortgage lenders.

Click the graphs below to enlarge and then continue reading to see how a fledgling title insurance CUSO at California Credit Union saves dollars and makes sense.

Sales to the secondary market dropped 8.9% compared to the same period last year and fell from $41.6 billion to $37.9 billion. Credit unions with more than $1 billion in assets sold the largest portion of their first mortgage originations, 37.1%. By comparison, credit unions with $50 million to $100 million in assets sold 18.4%.

CASE STUDY

CALIFORNIA CREDIT UNION

California Credit Union has expanded its mortgage services to members through its own title insurance company, saving thousands of dollars for homebuyers and generating some revenue for itself.

California Credit Union created the CUSO, California Members Title Insurance Company (CMTIC), in response to member feedback.

We felt we could reduce members’ cost and provide the type of service they are accustomed to, says Frank Berriz, the owner of a title insurance company who had long done business with the credit union when he was asked to head up the CUSO.

CMTIC launched two years ago and offers full settlement services including title insurance and escrow for sale, refinance, commercial, and institutional transactions. The CUSO is licensed to operate throughout California but mainly serves California Credit Union and other credit unions in Southern California.

The CUSO offers cost savings in two ways. The first is through an owner’s policy that covers the borrower. The second is through a concurrent lender’s policy that covers the lender.

It’s difficult to quantify the savings as all title insurers have different posted rates, but Berriz estimates credit union members save up to nearly $500 per transaction compared to other major direct insurers.

The CUSO bases its rates on the purchase or refinance amount and can offer lower rates because it keeps expenses low. For example, the CUSO has no sales staff and relies on word-ofmouth to increase awareness.

The CUSO has processed more than 7,000 transactions since October 2015, mostly in refinances.

Read The Whole Story

Strategy Performance 3Q 2017

Credit unions have made significant gains since the Great Recession started 10 years ago. Third quarter credit union growth trends surged past that of community banks and the overall banking industry. Measures such as loans, shares, capital, and membership have all reached new levels. These gains are all notable and meaningful; however, they are backward-looking. The important question to ask is: Where will credit unions be in the next 10 years? In this issue of Strategy Performance, learn why now is the time for credit unions to challenge themselves.

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 3Q 2017