Public and member relations have merged under Grant Gallagher’s leadership at Affinity Federal Credit Union ($3.8B, Basking Ridge, NJ).

Gallagher joined the Garden State cooperative as a senior chat specialist in 2009 and is now entering his second year as Affinity’s head of financial wellbeing and brand communications. He also leads his credit union’s participation in the Callahan-Gallup Collaborative Financial Wellbeing and Member Engagement Program.

His responsibilities have grown over the past decade, and his new role is a culmination of the realization that financial wellbeing and external communications with the general public and public officials alike are part and parcel to helping ensure the credit union can maximize its ability to have a positive impact.

Here, he explains.

When and why did Affinity create the title of head of financial wellbeing and brand communications?

Grant Gallagher: Affinity created the title and role in the spring of 2021 to recognize financial wellbeing as a critical part of our brand identity and the value-add we deliver to our members. Financial wellbeing is at the forefront of our work with members and the support we provide them, so it must also be core to our public relations and communications efforts.

Your title was recently changed from financial wellbeing and external affairs manager. What’s the strategy here?

GG: This new role was created to consolidate functions that were previously managed independently. Before this, my primary focus was leading our financial wellbeing efforts and managing related relationships and programs. The progression happened organically over time. In 2019, I was tasked with leading our financial wellbeing initiative at Affinity. Soon after, brand communications were added to my role.

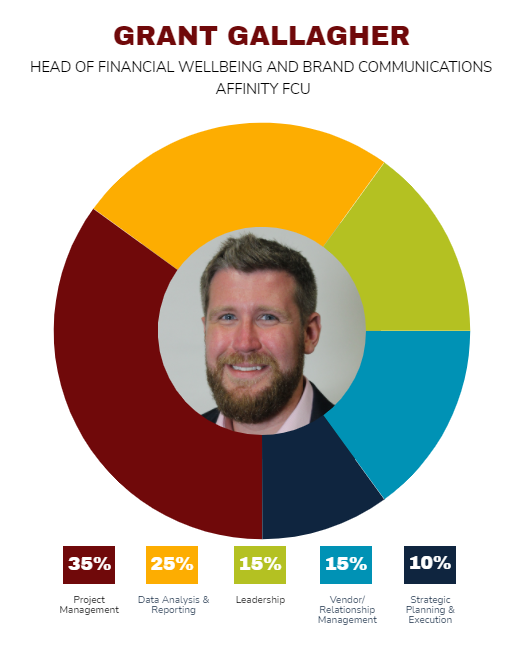

What are your areas of responsibility?

GG: Financial wellbeing and learning, brand communications, and external affairs.

I lead our financial wellbeing initiatives, including all member and employee-focused programs for all of Affinity’s business lines that are focused on financial health and wellbeing. This includes directing the surveying, data collection, and reporting, as well as relationship and vendor management related to the program, including the Gallup relationship. I am also involved in directing any financial wellbeing content creation, both internal and external.

The brand communications portion of my role includes public relations and corporate communications. This entails creating and implementing strategy and advocacy to complement our communications programs to build mutually beneficial relationships between Affinity and the public. This role also includes overseeing media relations, crisis communications, internal brand and marketing communications, and reputation management.

For the financial learning aspect of my position, I lead our educational programming and content. This includes managing online assets and vendors, content development, volunteer recruitment and management, and seminars and webinars.

In my role leading external affairs, I manage some of our partner programs and lead our political and regulatory advocacy efforts with our elected officials. This also includes serving as our PAC treasurer.

How do these pieces work together logistically?

GG: Affinity is at the forefront of all things related to financial wellbeing, and it allows us to be positioned as thought leaders in this space. We look for opportunities to share the importance of financial wellbeing with the media, and we see a similar alignment with our external affairs work.

Our elected officials hear similar themes from financial institutions, so having the ability to approach them with our unique value proposition and member-benefit focus gives us the ability to differentiate ourselves when advocating for credit unions.

How do they work together to help improve member service?

GG: One of the largest challenges we face is the general lack of understanding of financial wellbeing and its value within the marketplace. By being able to share this information more readily, it helps our members understand how we’re approaching member service differently. This synergy helps ensure that all of the educational resources available to both the membership and general public are visible and at the forefront of our communication efforts.

Describe Affinity’s work with Gallup. How does it help you do your job?

GG: There are multiple benefits to our partnership with Gallup, but the primary benefit is the understanding of member pain points and meaningful moments. This data is aggregated and analyzed as part of our Voice of the Member program and has helped us make impactful changes to our member experience in recent years. How our members regularly interact with us has comparatively changed, and the data from the Gallup program has given us meaningful insight into how to meet and exceed member expectations.

What makes you a great fit for the job?

GG: I have over a decade of experience working with credit unions, all of which have been dedicated to improving the financial lives of Affinity’s members. Knowing where we started as an organization makes it easier to anticipate what the future holds, and we want to continue sharing this vision with the public.

Even before our focus on financial wellbeing and relationship with Gallup, I had been involved in financial education and financial health efforts at Affinity for many years. These areas are prerequisites to be able to effectively support a member’s financial wellbeing and have prepared me to lead our efforts today.

Who do you report to? Who reports to you?

GG: My team, which is a part of our marketing team, consists of two full-time employees and an admin. I report to Maureen Byrne, our vice president of marketing and product. The external affairs specialist on my team focuses on financial learning and external affairs, and the communications manager focuses on public relations strategy and communications. We also have multiple committees that support many of the programs and initiatives we run.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What challenges and opportunities does your role address? How do you address them?

GG: One of the biggest challenges credit unions face today is that big banks have closed the service-level gap through personalization and automation, which is something credit unions have excelled at historically. This provides us a unique opportunity to differentiate and provide value to consumers through wellbeing.

One of the biggest challenges Affinity faces as a leader in the financial wellbeing space is that although many consumers recognize their finances as a source of stress, many are not comfortable expressing this outwardly or seeking a solution. Through our communications and educational programs, we’re able to help consumers understand and evaluate their relationship with money and learn how to make that relationship a positive one.

What’s your daily routine at your credit union?

GG: My team works fully remote, and I find it key to stay connected and keep an ongoing conversation throughout the day. I have a daily huddle with my team to talk about upcoming deliverables and identify potential roadblocks to hitting delivery dates. We’re all collaborative, so this approach helps keep everyone focused, and we’re usually able to identify and solve potential issues rapidly and internally.

Most of my workflow is project-driven, so my daily routine is dependent on project status. Often, it’s working toward the next project milestone or deliverable. During month- or quarter-end, I’m often focused on pulling together the latest financial wellbeing data to share with various leaders and committees.

How do you track success in your job?

GG: There are multiple KPIs that we use to define success. Through our financial wellbeing survey, we track our members’ emotional engagement, financial wellbeing, and rates of problem incidence. For financial learning, we track content engagement, webinar attendees, and lead opportunities generated. Our PR and communications efforts are dependent on media placements and audience size reached with our messaging.

At the end of the day, it all boils down to member impact. If all of these KPIs indicate we’re reaching members to positively impact their financial lives and help them achieve their dreams, then I’ve been successful in my role.

How do you stay current with topics that fall under your role?

GG: The main sources that help me stay current fall into a few broad categories: regular meetings and conversations with vendors/partners, industry newsletters and sites, our member surveys, and our trade associations. It’s hard to isolate any one of these areas as the most important because the areas I oversee continue to grow and evolve at a fairly rapid pace.

This interview has been edited and condensed.