In today’s digital age, providing a superior member experience that will keep members joining, staying, and engaging requires more than appealing products and services. It also requires knowing how appealing those products and services really are. That’s where Maura Ronayne comes in at one of the cooperative movement’s largest players, Alliant Credit Union ($14.0B, Chicago, IL).

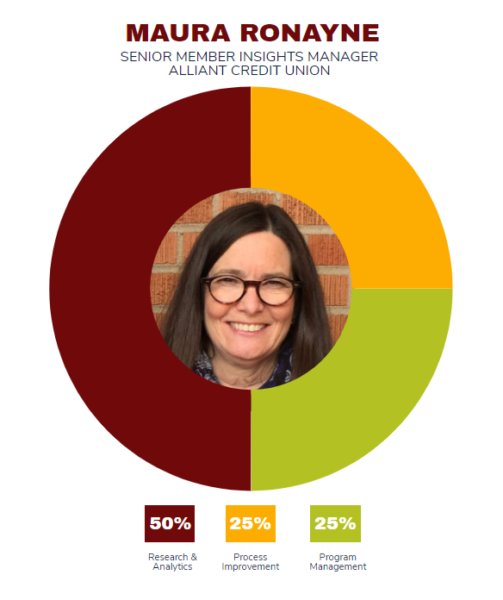

Ronayne joined Alliant in July 2013 as a senior market research analyst and for the past three years has been senior member insights manager. Among her responsibilities, Ronayne provides the decision-makers are her credit union the right business intelligence to enable them to make intelligent decisions.

Here she lays out the details of her role.

When and why did Alliant create the role of senior member insights manager? Was it specifically for you?

Maura Ronayne: A little more than three-and-a-half years ago, my title changed to better reflect my role. I am the only person in this role, and at the time of the change, I reported to the market research manager. That individual was focused on marketing list production, member demographics, and behavior profiling, whereas my focus was on our Net Promoter Score (NPS) program. I currently report to the manager of product and member experience analytics. I wouldn’t say the role is new role so much as it evolved after I moved from marketing to member experience after it was established in 2015.

What challenges does your role as senior member insights manager address?

MR: We’re becoming more member focused as an organization, which has resulted in more requests of our team. However, with enhanced tools and support from IT, we’re able to meet the challenges.

What opportunities does your role address?

MR: Alliant has a robust business intelligence initiative that empowers decision-makers to lead with data. Sourcing and reporting on member data falls to our team, providing us the opportunity to identify ways to enrich the member experience and incorporate the members’ voice in decision-making.

What makes you a great fit for this job?

MR: My prior experience at full-service market research firms managing people, projects, and data-capture solutions along with a bachelor’s degree in marketing provided me with the skill set required for a senior market research analyst.

I joined Alliant to be involved with decisions made based on data collected, something not often possible at a market research firm. Working with data-capture solutions and data processing has benefitted me greatly in the data-centric environment at Alliant.

How much has consumer data insight changed during the past few years? How does it help you and your credit union improve member impact?

MR: When I joined Alliant, most of the market research studies were ad hoc and many were conducted via mail. We obtained some general feedback, but much of it was not actionable. Since then, we’ve implemented a program that continuously surveys members and we’ve partnered with Member Loyalty Group to take advantage of its expertise, the network of participating credit unions, and the credit union benchmark data.

Internally, we also have developed a management system that aggregates all member feedback data, prioritizes it, and ensures the insights identified are acted upon.

What are your areas of responsibility? What software tools do you use?

MR: My primary role is NPS program administrator and analyst. I use Tableau, MS Access, MS Office including Excel and PowerPoint and Business Objects.

What’s your daily routine?

MR: I check e-mail to ensure scheduled data transfers did not fail. I also check the current relationship NPS and read through recent responses. And, I respond to data requests.

The first few weeks of each month are quite busy with monthly reporting. We analyze the data from surveys, operational metrics, and complaints to measure success of enhancements put in place as well as identify areas of opportunity. I also attend MX team meetings as well as those led by marketing and product and channel owners to lend MX insight.

How has the COVID-19 pandemic affected what you do at Alliant?

MR: Honestly, I think it’s made me more productive. There is less distraction at home and I have the ability to easily check on things during off-hours. Although I miss the social interaction, I make it a point to use MS Teams with video as much as possible.

How do you track success in your job?

MR: Feedback from management is key. We also establish goals and track them throughout the year. Improvements in member Net Promoter and Overall Satisfaction scores directly related to recommendations from our group are tied into these goals.

How do you stay current with topics that fall under your role?

MR: I attend the Member Loyalty Group user conference annually and participate in its online network. I receive a daily feed from CU Today and stay in touch with the market research community on LinkedIn.

This interview has been edited and condensed.