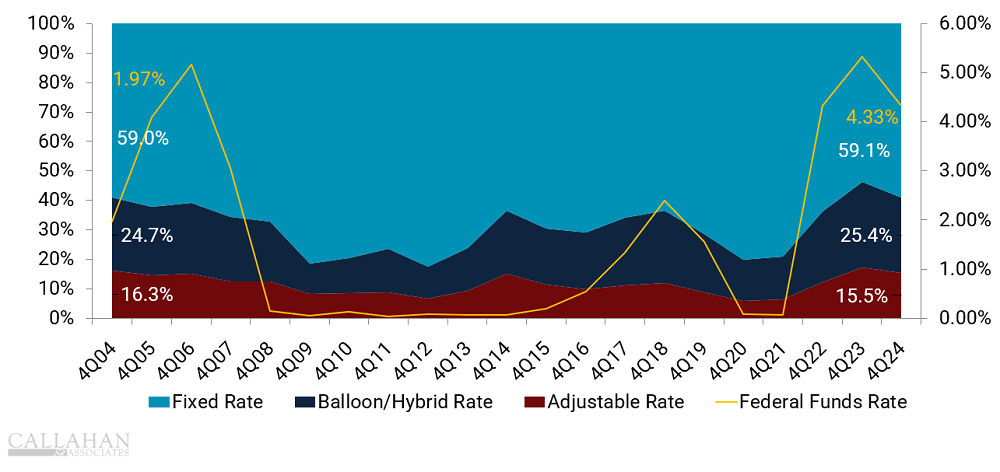

When interest rates started creeping up in 2022, higher borrowing costs made the traditionally popular fixed-rate mortgage a less desirable option. Rather than locking in a long-term mortgage at a higher rate, credit union members started to gravitate toward adjustable-rate mortgages and balloon/hybrid products. ARMs jumped from 6.7% of mortgage originations in the first quarter of 2022 — when rates started increasing — to 15.5% at year-end. Balloon/hybrids rose from 13.1% to 25.4% of originations.

FIRST MORTGAGE ORIGINATION BY TYPE

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

The NCUA defines a balloon/hybrid mortgage as a one-to-four-family residential property loan that has a balloon feature — i.e., the borrower makes lower monthly payments for a set period but then must make a large, lump sum “balloon” payment at the end of the term — or converts to an adjustable-rate loan after a predefined period. Therefore, many balloon/hybrid mortgages eventually turn into an ARM as well.

Strategic Insights

- With many market prognosticators expecting the Federal Reserve to cut interest rates in the near to medium term to spur economic activity, many borrowers are banking on their adjustable-rate mortgage to give them access to lower rates without incurring the fees associated with a refinance.

- The increased popularity of adjustable-rate mortgages has shifted the composition of the industry as a whole. As of Dec. 31, 2024, 65.5% of outstanding first mortgages were fixed rate, 11.0% were adjustable, and 23.5% were balloon/hybrid. By comparison, in the first quarter of 2022, when interest rates started to increase, 76.2% of outstanding first mortgages were fixed rate, 8.6% were adjustable, and 15.3% were balloon/hybrid.

- Despite the current popularity of products that offer adjustable rates, many borrowers misunderstand the potential advantages and drawbacks of such loan options. In response, credit unions are working to educate their members on the ins and outs that come alongside these loan types. Learn more about these efforts in “Embracing ARMs And Battling Members’ Misconceptions” on CreditUnions.com.