Inflation, slowing loan growth, rising interest rates — what a year. Now that 2023 is firmly in the rearview mirror, credit union leaders can take a look back to assess the impact of the past year and what it might mean for 2024.

SHARE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

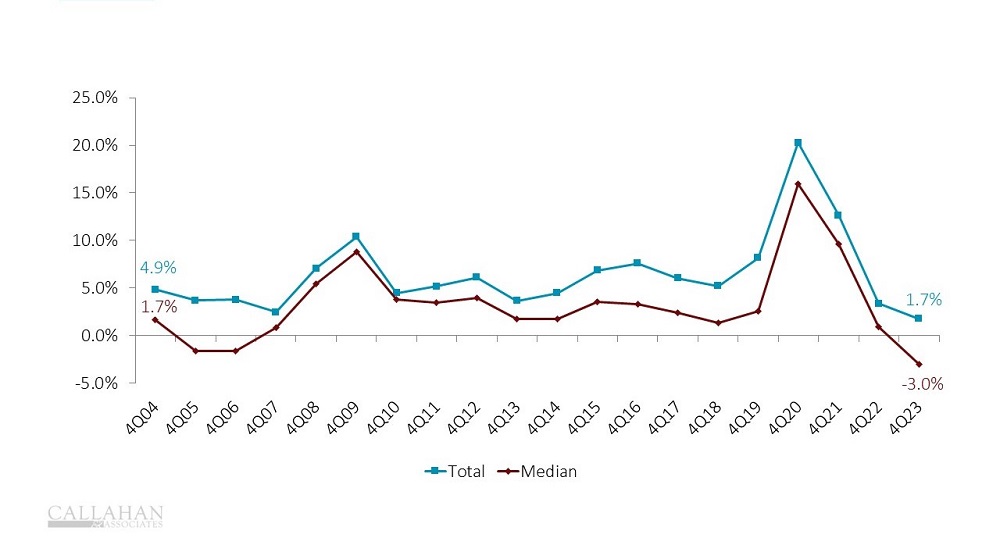

- Share growth has stalled in recent quarters and inched forward just 1.7% at year-end. However, comparing total industry growth to that of the median reveals a more startling trend: Share balances fell 3.0% year-over-year at the median credit union. Overall, share balances decreased at two-thirds of credit unions.

- Liquidity remains a top concern for credit unions moving into 2024, particularly considering half of all institutions reported higher share departures than this median value. Amid growing loan balances and shrinking shares, the industry’s loan-to-share ratio rose to 85.1%.

DELINQUENCY BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

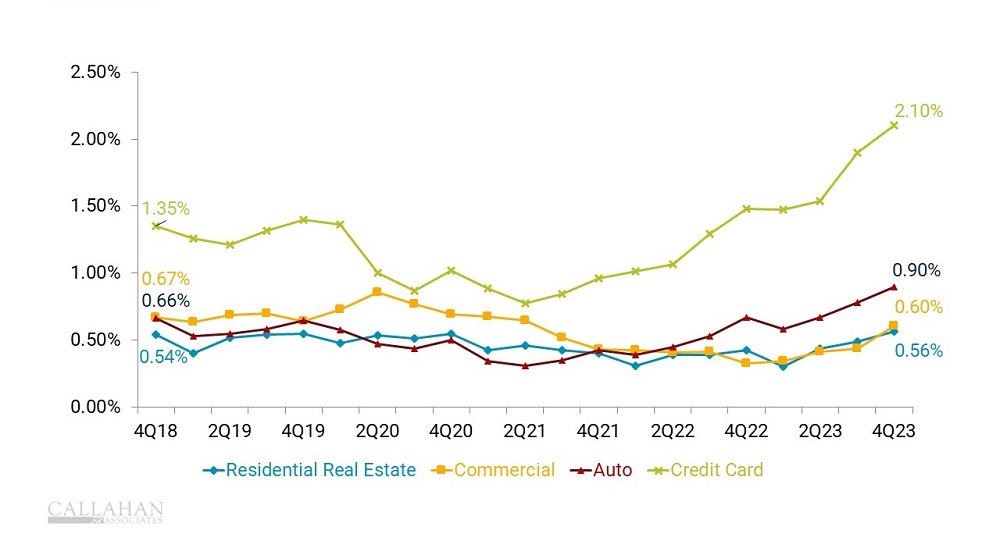

- Asset quality has been worsening at credit unions; however, the bulk of that decline has come from credit cards. Credit card delinquency continued to rise sharply in 2023 and hit 2.1% as of Dec. 31. Delinquency for other loan types has grown modestly or even shrunk compared to five years ago.

- Rising prices swiftly pushed up credit card balances in the past few years. When households get behind on payments, many prioritize staying current with mortgages and autos. As such, delinquency often hits credit cards first.

QUARTERLY PROVISIONS FOR LOAN AND LEASE LOSSES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

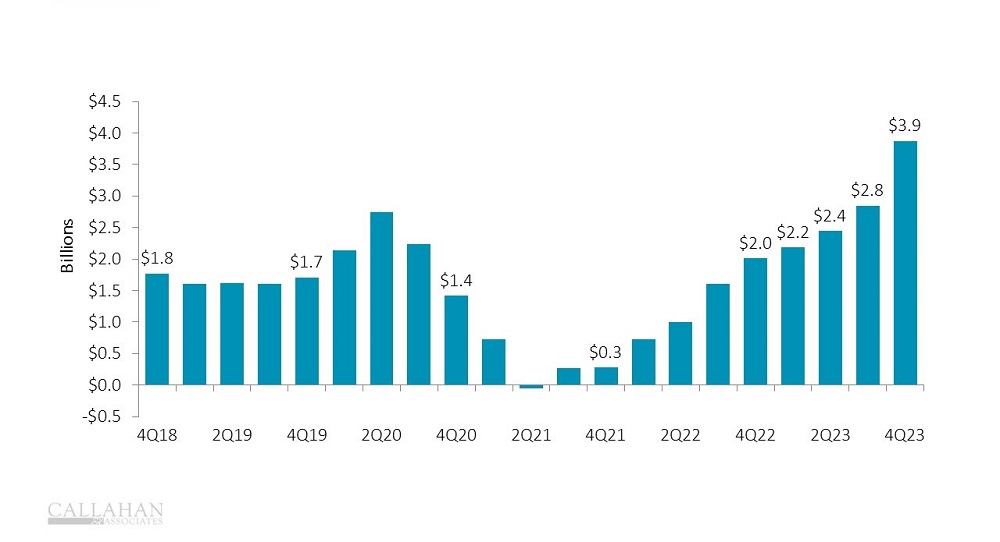

- In anticipation of a rise in delinquency, credit unions have started to reserve more to cover future losses. In the fourth quarter, credit unions added $3.9 billion in provisions, an increase of $1.1 billion from the past quarter and much higher than the $2.0 billion they set aside at year-end 2022.

- Industrywide, provisions accounted for 0.51% of average assets, up from 0.25% the year prior. As provisions account for a greater percentage of assets, credit unions must be aware of the earnings impact. Despite rising delinquency rates, credit unions are still well covered, with 152.9% coverage on delinquent loans, higher than before the pandemic.

RETURN ON ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

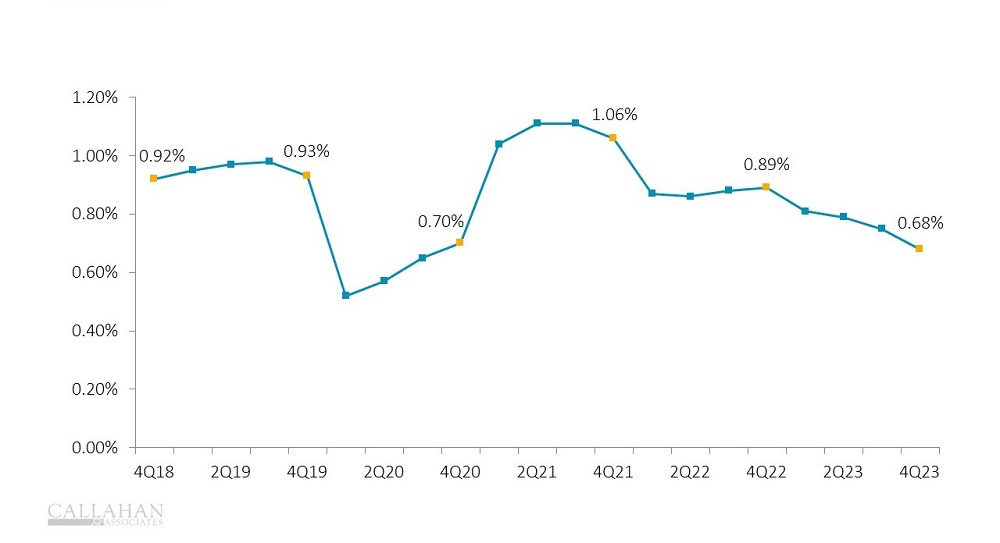

- ROA declined for the fourth consecutive quarter in the fourth quarter of 2023. While interest rates climbed, credit unions were able to lend at greater rates and boost margins. However, that was short-lived.

- Compared with 2022, credit unions in 2023 had to contend with both the need for more provisions and a higher interest expense. A rise in interest expense, provisions, and operating expenses put pressure on income and suppressed ROA, which dropped to 0.68% at year-end.

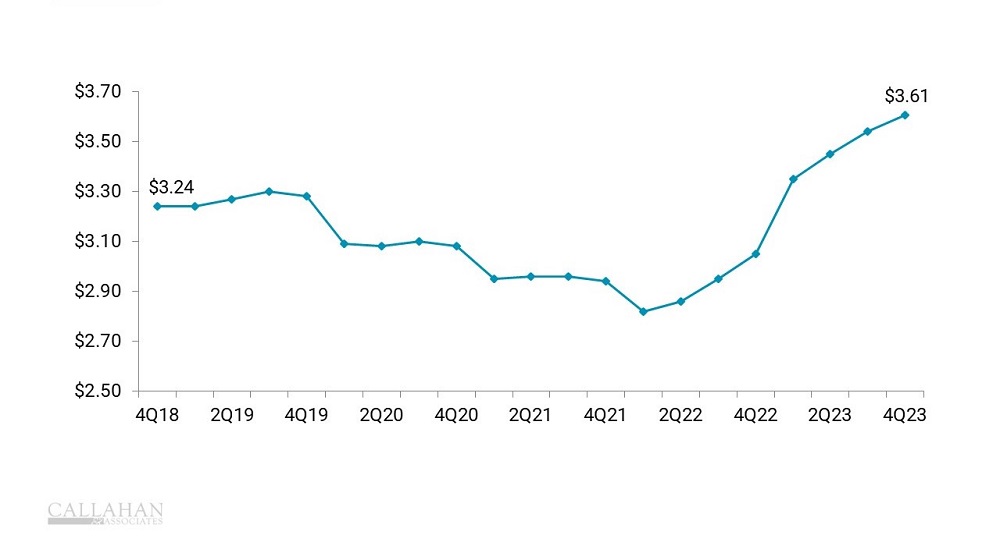

REVENUE PER $ OF SALARY AND BENEFITS EXPENSE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- Although ROA decreased, revenue per salary and benefits reached $3.61 in the fourth quarter. Credit unions are paying more for top talent, and revenue is climbing alongside that. The average salary and benefits at U.S. credit unions was $96,962 in the fourth quarter, near the all-time high set early in 2023.

- Total revenue grew 28.7% year-over-year as credit unions capitalized on higher yields on loans and investments. Yield on loans stood at 5.25% in the fourth quarter, whereas yield on investments increased to 3.06%. Both represent a marked difference from their pandemic-era bottoms.

Benchmark Your 4Q 2023 Performance With Ease

Learn how your institution’s 4Q 2023 performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

REQUEST YOUR FREE SCORECARD