The credit union industry finished the second quarter of 2022 in a very different position compared to where things stood one year ago. Macroeconomic shifts drove changes in member demand, which impacted top-level credit union metrics. Last year, members were flush with cash, fueled by various economic-relief programs. Alongside this, low-interest rates drove record lending as Americans took advantage of low mortgage rates to purchase homes.

This year, with consumers now fully removed from pandemic-era assistance, credit union liquidity is being put to use more rapidly. Inflation surged to 9.1%, according to CPI inflation data, driving up members’ cost of living and leading to increased demand for financing. The Federal Reserve is taking a hawkish stance on interest rates, with the main goal being to ease inflation. Despite rising rates, elevated asset prices remain for the time being, and consumer loan balances are correspondingly booming at record rates.

Callahan’s quarterly Trendwatch webinar covered all this and more, highlighting key financial performance trends in the credit union industry, as well as the overall state of the marketplace. Red on for five takeaways from the data.

No.1: Market share rising in key loan categories

MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

Callahan Associates |CreditUnions.com

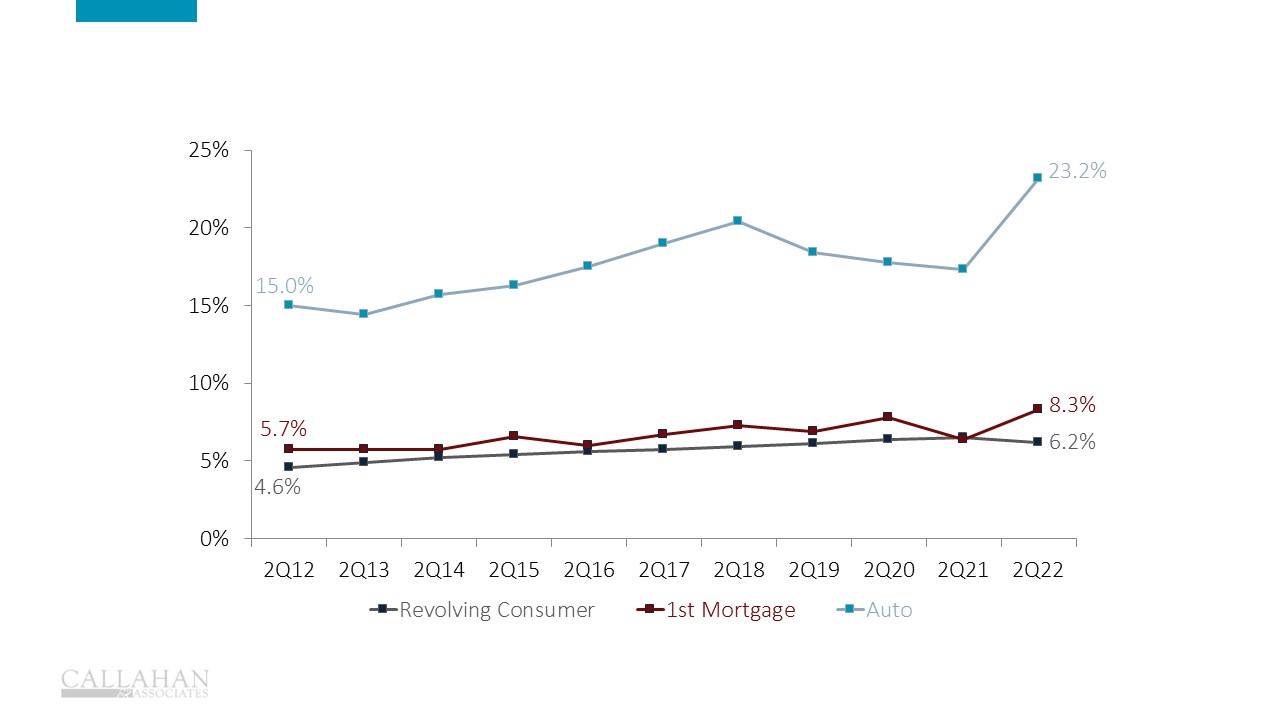

- The credit union industry made significant headway in gaining market share year-over-year in both the auto loan and first mortgage markets.

- Indirect loans are a major factor of why market share increased nearly 5.0 percentage points from last year’s first half. Consumers are more likely to search for car loan originations through fintech companies, and credit unions are making a concerted effort to build those partnerships.

- With home prices at record highs and rates rising, nationwide home financing has fallen from its 2021 record pace. However, credit unions have maintained member demand better than banks and online lenders, leading to a record high origination market share above 8%.

No.2: Annual loan growth reaches record highs

LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

Callahan Associates |CreditUnions.com

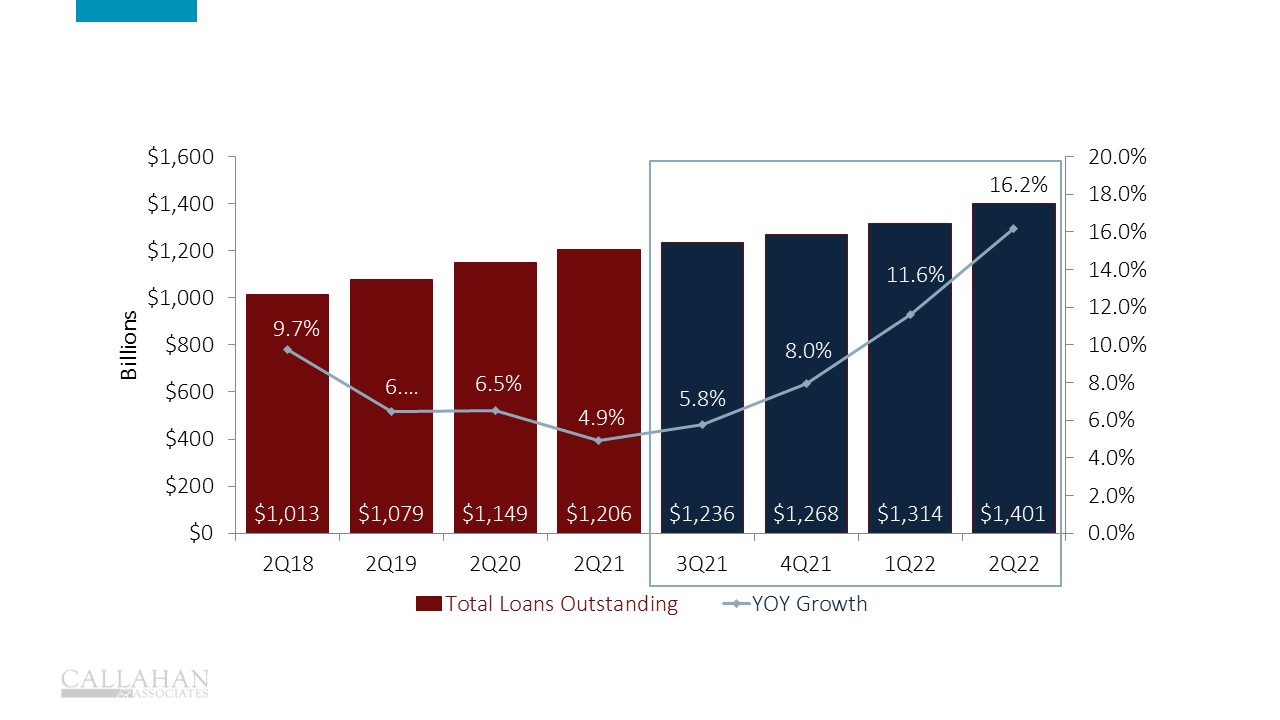

- Loans reported their best year-over-year growth on record as members repurposed excess cash balances to purchase and subsequently finance higher-priced homes and vehicles.

- Rising asset prices are a factor behind loan growth, as consumers take on a larger balance with each new loan now than they did a year ago. Rising asset prices have also allowed borrowers to dip into their home’s equity, as quarterly growth for other real estate surpassed quarterly first mortgage quarterly by a margin of 11.2% to 5.4%, respectively.

- All major loan products experienced double-digit growth year-over-year. Commercial loans and new autos reported the largest percentage increase on the consumer side at 23.6% and 17.4% each.

No.3: Loan-to-share ratio creeping back up

LOAN -TO- SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

Callahan Associates | CreditUnions.com

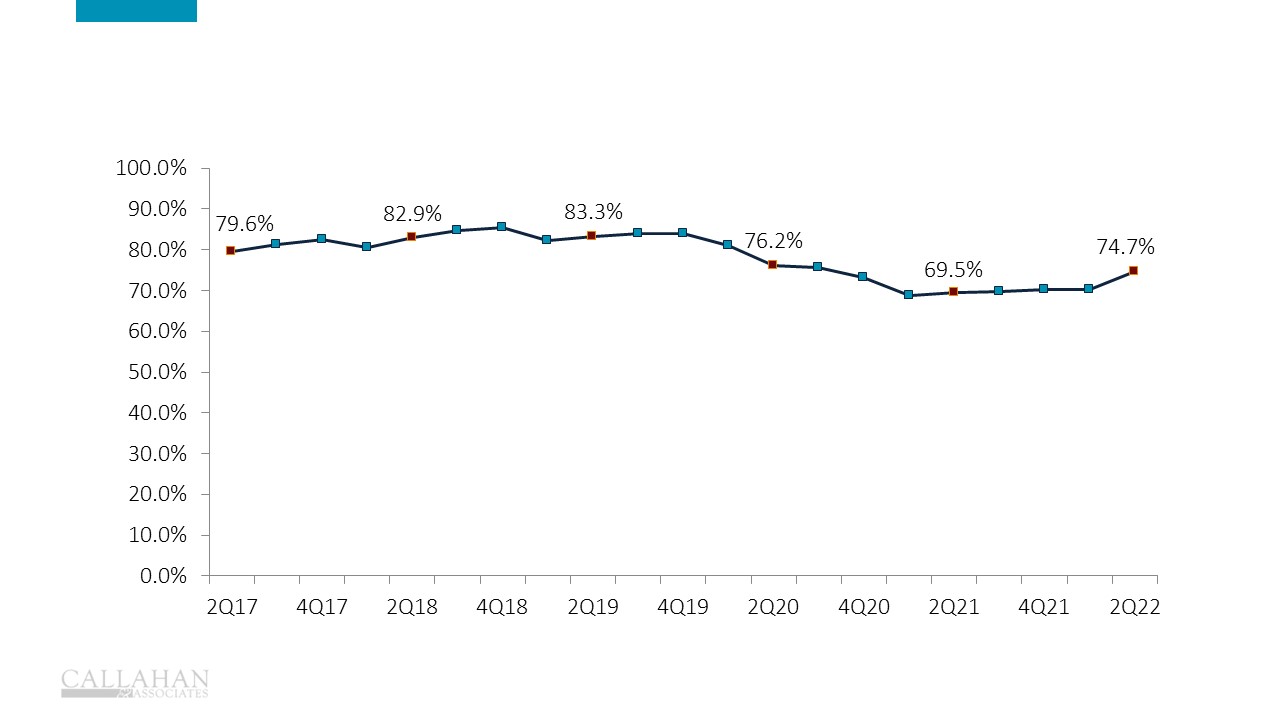

- The loan-to-share ratio surpassed 70.0% for the first time since December 2020, as credit unions lent funds to their community members.

- Credit unions are holding fewer funds in cash, repurposing these low-yielding balances into loans as consumer demand for financing surged in June 2022. The industry experienced the biggest quarterly decline in cash on record, at 28.6%.

- The loan-to-share ratio saw the biggest quarterly increase in history at 4.5 percentage points quarter-over-quarter. Credit unions are deploying their deposits more effectively than they have been able to in recent years, serving more members and generating higher yields because of it.

Share growth slows across all products

SHARE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

Callahan Associates | CreditUnions.com

- With the federal relief from COVID-19 coming to a halt last year, total share growth has decelerated since peaking in March 2021. In the second quarter of 2022, the industry experienced an 8.2% year-over-year increase in total shares, down from 15.0% last year.

- Current interest rates on historically high-paying accounts continue to be unattractive to members. Only core accounts experienced year-over-year growth this quarter, as share certificates and IRAs declined by 7.3% and 1.2%, respectively.

- The average share balance per member grew by 4.4% annually, compared to 11.0% last year. Members are saving at a slower rate than a year ago, with no more federal assistance and an increase in the cost of living.

Total revenue surges thanks to loan and investment income

REVENUE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.22

Callahan Associates |CreditUnions.com

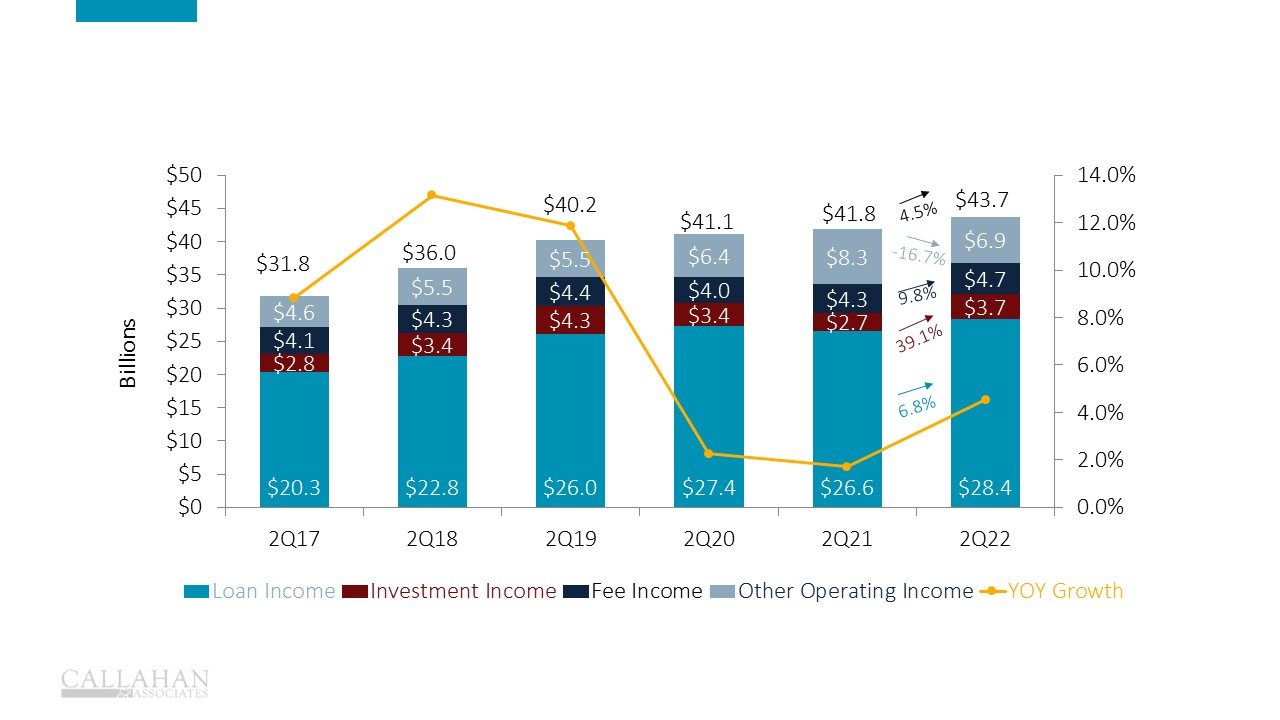

- Loan and investment income, being tied to the most rate-sensitive products, played a key role in total revenue growth. These key categories grew by 6.8% and 39.1% on an annual basis, respectively. Net interest margins were also bolstered by the rising loan-to-share ratio, as more assets were earning the higher loan yields versus the lower investment yields. All told, industry revenues grew 4.5% year-over-year.

- Other operating income declined 16.7% year-over-year, as cooperatives kept more first mortgage loans on their balance sheets rather than selling them to the secondary market.

- Net income declined by 15.4% as annual expense growth of 9.5% outpaced revenue growth. Even so, ROA remains a healthy 0.86%. Part of the increase in costs went toward investment in operational improvements that are expected to be beneficial for member service.