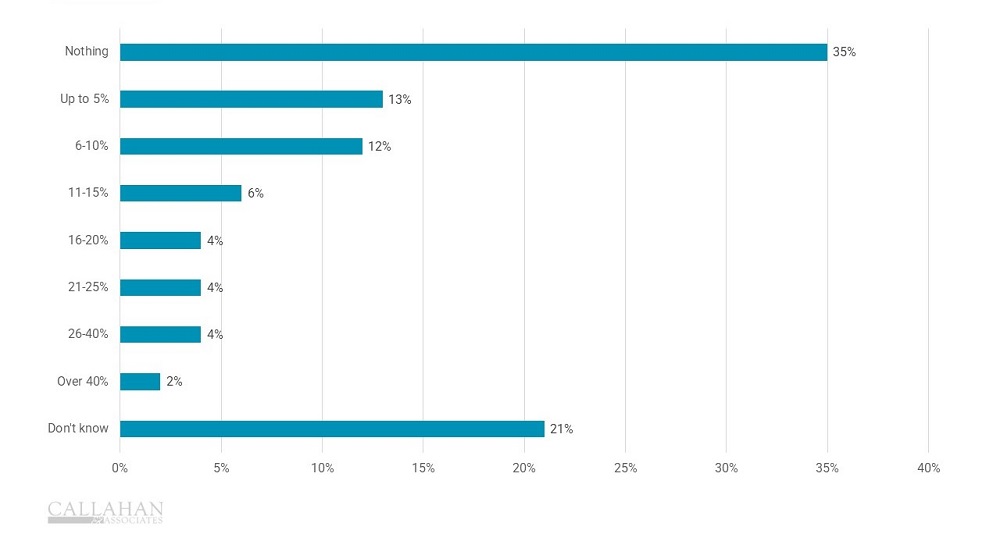

PERCENTAGE OF AMERICANS’ ANNUAL INCOME SAVED FOR RETIREMENT

FOR U.S. CONSUMERS

© Callahan & Associates | CreditUnions.com

Americans want to retire by age 65 — if not sooner. Unfortunately, a majority lack the savings to do so, and a substantial percentage aren’t confident about their financial security once they stop working, according to a 2024 report from YouGov. The average credit union member age has hovered in the mid-40s for decades, and the study’s findings indicate an opportunity for credit unions to lean into retirement-planning services.

Strategic Insights

Baby Boomers

Born 1946-1964.

Gen X

Born 1965-1980.

Millennials

Born 1981-1996

- Low savings rates: Roughly one-third of Americans believe they’ll be able to retire at age 65, but only 36% believe they’ll have enough independent savings to do so, according to YouGov’s 2024 retirement report. Forty percent of those surveyed reported they aren’t confident about financial security for retirement.

- Lack of confidence: The youngest members of the baby boom generation are rapidly approaching retirement age, but 33% aren’t confident they’ll be ready. That figure jumps to approximately 48% for Gen X and millennials.

- Education counts: Regardless of age, those with post-graduate degrees are most confident about their retirement finances, but at 49%, even that doesn’t represent a majority. Respondents with a two-year degree were least confident, though high school graduates and those with some college experience had similar responses.

- Taking risks: A majority of those younger than 55 are more likely to take risks with their retirement planning, including riskier ventures with the stock market and cryptocurrencies.

- An opportunity for credit unions: Roughly 20% of the general population is currently working with a retirement planner or financial advisor.