CREDIT UNION MARKET SHARE BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

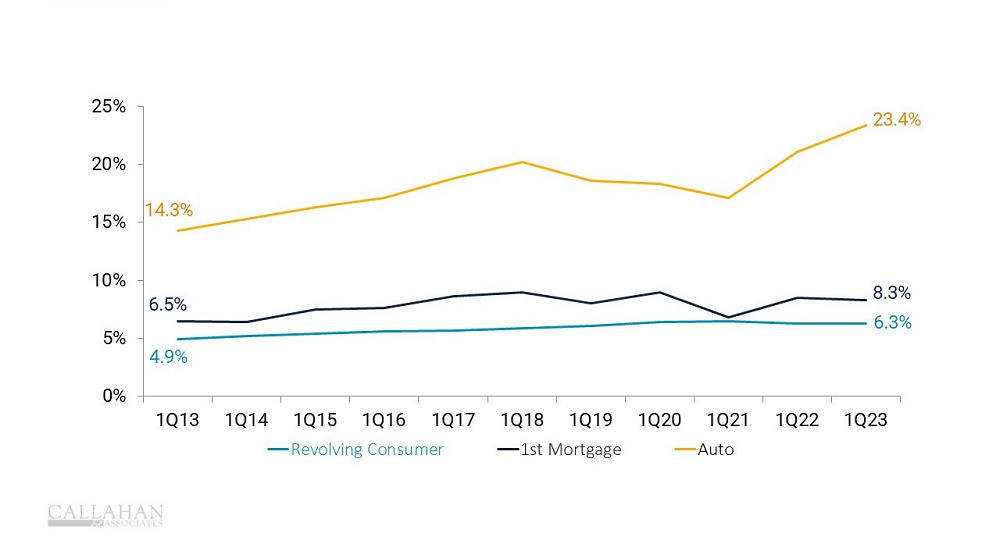

- Auto origination market share for credit unions increased to 23.4% in the first quarter of 2023. This is an annual increase of 2.3 percentage points — a jump that could cause credit unions to consider whether they are underpricing auto loans.

- The increase in market share comes with corresponding strong growth in auto loans outstanding. New auto balances grew 21.7% year-over-year while used auto expanded 16.9%. The performance puts auto among the fastest-growing loan products at U.S. credit unions.

- Market share of revolving consumer loans, such as credit cards, was flat year-over-year. In fact, it hasn’t changed much during the past five years.

- Despite reporting a decline in first mortgage originations, credit unions conceded only 2 basis points of mortgage market share as all financial institutions fell victim to a slowing mortgage market.

How Do You Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo Today

Schedule Your Peer Demo Today