LOAN PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

- The NCUA can designate a credit union as “low income” when a majority of its members meet certain low-income criteria. This is important because member income impacts borrowing — analyzing loan portfolios based on whether a credit union caters to low-income or high-income Americans illustrates the degree of this influence.

- Balances in the loan portfolio at U.S. credit unions have recently increased thanks to both the COVID-era boom in originations as well as the increase in interest rates that has encouraged credit unions to hold loans rather than sell to the secondary market.

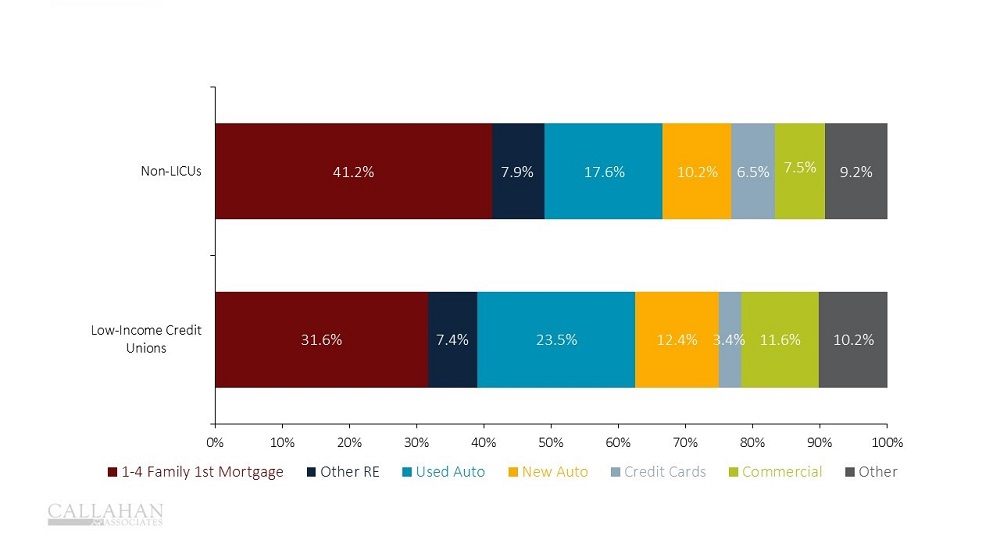

- Credit union members with higher incomes tend to take out more mortgages. Unsurprisingly, rising home prices have skewed homeownership even more toward the wealthy. Credit unions without the low-income designation hold 41.2% of their loan portfolio in mortgages versus 31.6% for low-income credit unions.

- On the other hand, low-income credit unions hold a higher percentage of auto loans — 35.9% versus 27.8% for those without a low-income designation. Considering the rising cost of vehicles, credit union members of modest means increasingly need financing to afford transportation.

- The asset quality of these loans has moved in tandem during the past five years, with credit unions that don’t hold a low-income designation consistently reporting delinquency rates a few basis points higher than institutions that do. In the second quarter, credit unions without a low-income designation reported a delinquency rate of 0.67%; low-income credit unions reported a delinquency of just 0.59%.

- These delinquency numbers might seem counterintuitive; however, it is possible that credit unions with a low-income designation decrease their risk through prudent lending practices, tighter lending standards, and more tailored products.

Is Member Income Affecting Your Loan Quality?

Develop a clear picture of your credit union’s performance with a complimentary scorecard from Callahan & Associates. Armed with your desired KPIs plus a few we might suggest, you’ll be in a better position to benchmark against desired peer groups, share findings with your board, and help members reach new levels of financial stability.

Request Your Scorecard Today

Request Your Scorecard Today