After struggling with harsh increases in the cost of living for the past two years, Americans are finally adapting to life with high inflation. In Primerica’s Middle-Income Financial Security Monitor survey, middle-class Americans reported health rather than inflation as their top financial concern for the first time since 2021.

Adaptation, however, does not equate to comfort.

In the same survey, 72% of survey respondents reported their income growth lagged their costs of living.

In a survey from the Achieve Center for Consumer Insights, young consumers — especially Gen Z — are most susceptible to falling behind financially and more likely to consider risky financial choices — such as borrowing from retirement savings — to cope with higher costs. Only 8% of all respondents reported contacting their financial institution for help, highlighting how worried consumers might not be prudently addressing their situation.

Credit Union Key Points

- The average member relationship — the average share balance plus loan balance — grew 3.0% annually to $23,804. The average share balance declined as members struggled to save, but the average non-commercial loan balance expanded 12.1% during the past 12 months. That’s an annual increase of $1,096.

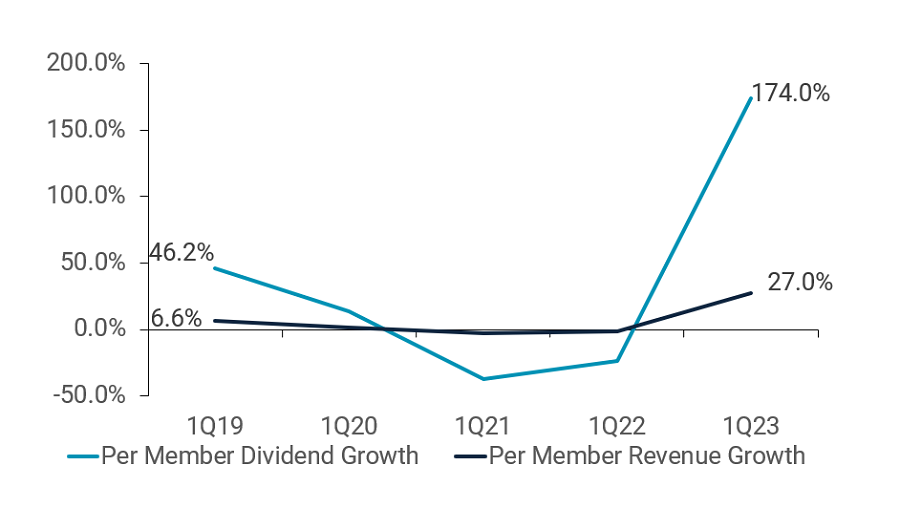

- Annualized dividends per member reached $135, the highest give-back value since 2009.

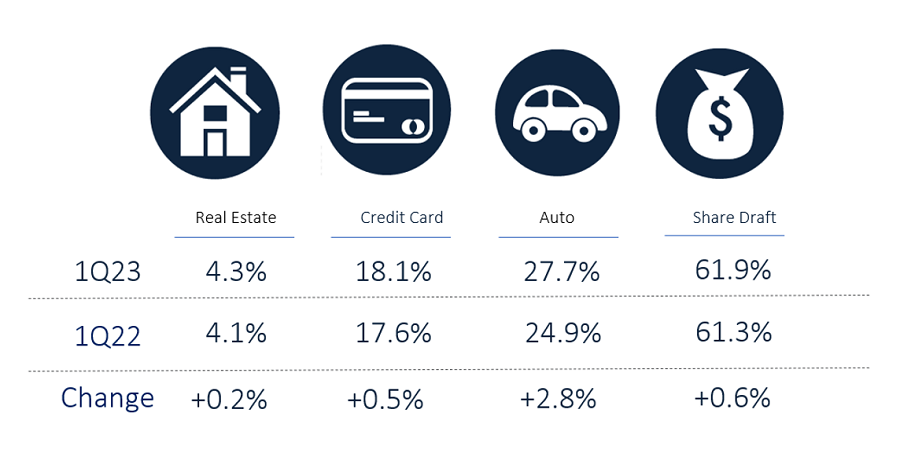

- Credit card penetration was up 44 basis points year-over-year to 18.1%, the highest rate on record. The average balance per card also increased $215 annually to $2,998 as members contended with higher costs of living.

How Do You Perform Against Peers?

CLAIM YOUR CUSTOM SCORECARD TODAY

Performance At-A-Glance

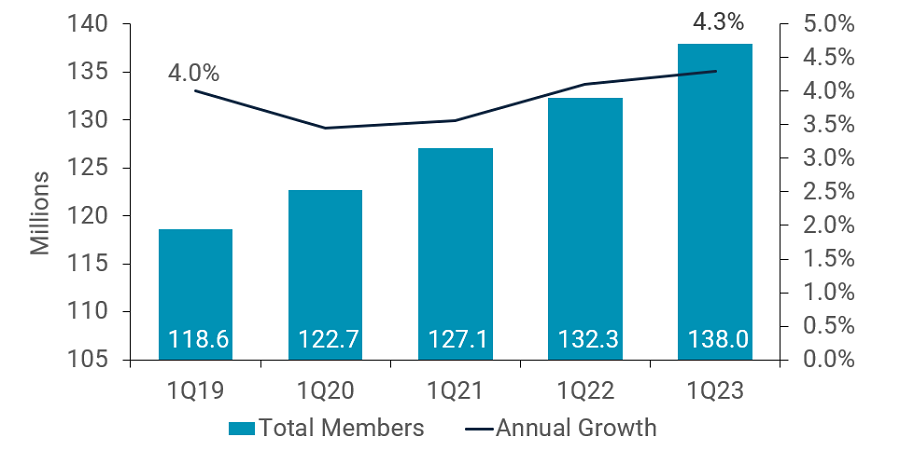

MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

PENETRATION RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

REVENUE AND DIVIDEND GROWTH PER MEMBER

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

The Bottom Line

Thanks in part to rate hikes and a rise in higher-yielding share certificate balances, cooperatives are returning more money in dividends per member than at any point in the prior decade. Member relationships are also deepening on the lending side as they seek out loan products to cover costly expenses.

However, loan portfolios will face challenges if members under financial duress are unable to make payments. Younger generations in particular are more likely to be struggling financially and disenchanted with the state of the economy. Credit unions have an opportunity to extend a guiding hand and cultivate these fledgling member relationships.

This blog originally appeared in Credit Union Strategy & Performance. Contact Callahan & Associates to learn how you can gain access today.