- There are nearly four times the number of bank branches nationwide (75,390) as there are credit union branches (20,290). Still, credit unions’ 21.2% branch market share exceeds their asset market share. Collectively, credit unions hold $2.3 trillion in assets compared to $23.4 trillion held by banks. The relative dominance of the credit union branch footprint compared to assets served underscores the core philosophy of credit unions — people over profit.

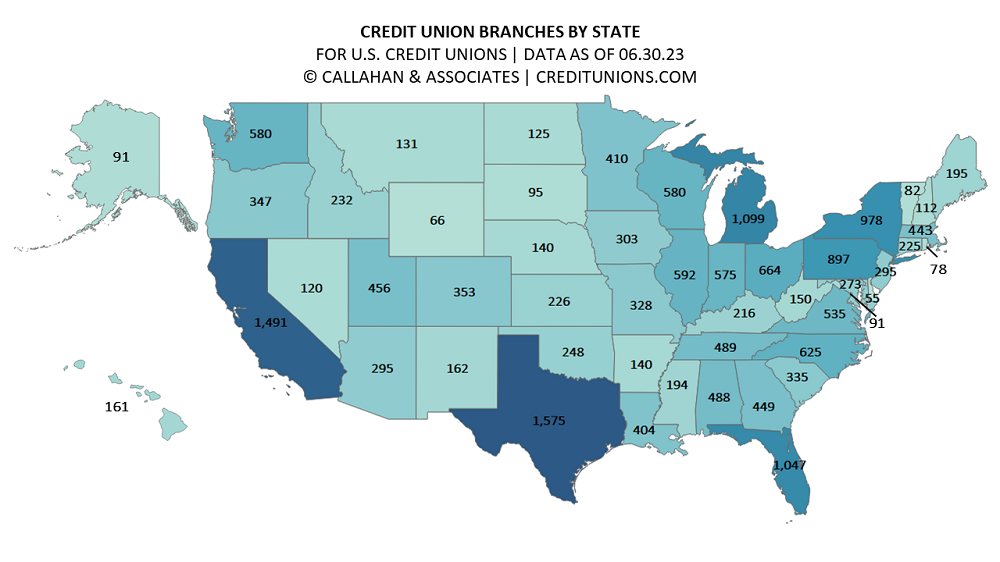

- Branch footprints by state generally align with state populations; however, credit union branches are more prevalent in some areas and less so in others. There are more bank than credit union locations in every state, but Alaska and Utah are the closest to even, at 1.2 and 1.1, respectively. On the contrary, New Jersey has more than eight times as many bank branches as credit union branches and Arkansas has nearly 10 times as many.

- Year-over-year income growth at credit unions was 30.9% as of Sept. 30, 2023. Banks reported 62.4% growth during the same period. In addition to higher income growth, banks enjoy economies of scale that credit unions do not have; as such, credit unions’ average operating expense ratio was 40 basis points higher than banks. But, again, these ratios reflect a credit union focus on service versus profit.

- Although credit unions’ physical footprint is smaller than their banking peers, cooperatives prioritize serving members of modest means. Credit unions manage far fewer assets on a per-branch basis than banks, allowing for better service, albeit often at the expense of stronger operational efficiency. Despite generating less income and having fewer assets, credit unions are committed to maximizing their branch presence in the name of member service.

Are You Using Data To Fuel Strategic Decisions?

Callahan’s Peer Suite empowers credit union leaders to make informed, data-back decisions without wrestling with complex, manual processes. Benchmark against the peer groups your choose, automate your KPIs every quarter, and kickstart your journey to success.

Request A Demo