Credit unions historically were formed to serve a distinct, narrow field of membership. That started to change in the late 1990s and early 2000s as credit unions adapted to competitive pressures.

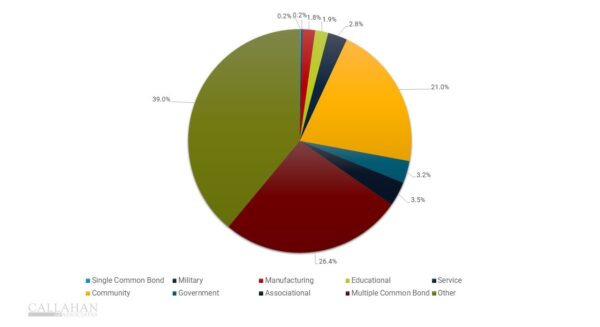

CREDIT UNION INDUSTRY BY CHARTER TYPE

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

Such flexibility has proven essential to the survival of the industry. Yet even institutions that serve narrowly defined communities have found ways to increase their accessibility and expand their rosters while staying true to their core base.

Today, regulatory scrutiny combined with member loyalty is pushing credit unions to reconsider the value of select employee groups and multiple common bonds. As credit unions look to the future, strategies that blend the best of different models and incorporate underserved communities — true to the roots of the movement — will be crucial to navigating economic challenges and shifts in consumer behavior.

Strategic Insights

- Single common bond fields of membership comprise a small number of total credit unions. For example, by number, military credit unions comprise 0.2% of the industry, education 1.9%, and associations 3.5%. However, many of the nation’s largest credit unions by asset size fall into those categories. Navy Federal Credit Union ($178.0B, Vienna, VA), State Employees’ Credit Union ($56.5B, Raleigh, NC), and SchoolsFirst Federal Credit Union ($30.9B, Tustin, CA) all offer specialized financial services tailored to the distinct needs of the members they serve, contributing to a loyal membership base.

- Community charters comprised one-fifth — 20.9% — of the industry. The digitization of products and services has allowed these institutions to expand beyond their physical communities and meet their members wherever they are. The challenge they face is in striking a balance between local relevance and wider reach.

- In response to regulatory changes in the 1990s, many credit unions moved away from multiple common bond charters based on occupation or association toward community charters. That trend, however, has started to shift, possibly because multiple common bond charters present an easier avenue for expansion and allow credit unions to serve an infinite number of membership groups. As of the second quarter of 2024, multiple common bond charters made up slightly more than one-quarter — 26.3% — of the industry.

- The “other” category comprises a full 38.8% of the industry. That refers to mostly state-chartered credit unions. They don’t report their field of membership to the NCUA, so it is difficult to categorize their data by what kind of field of membership they might be serving.