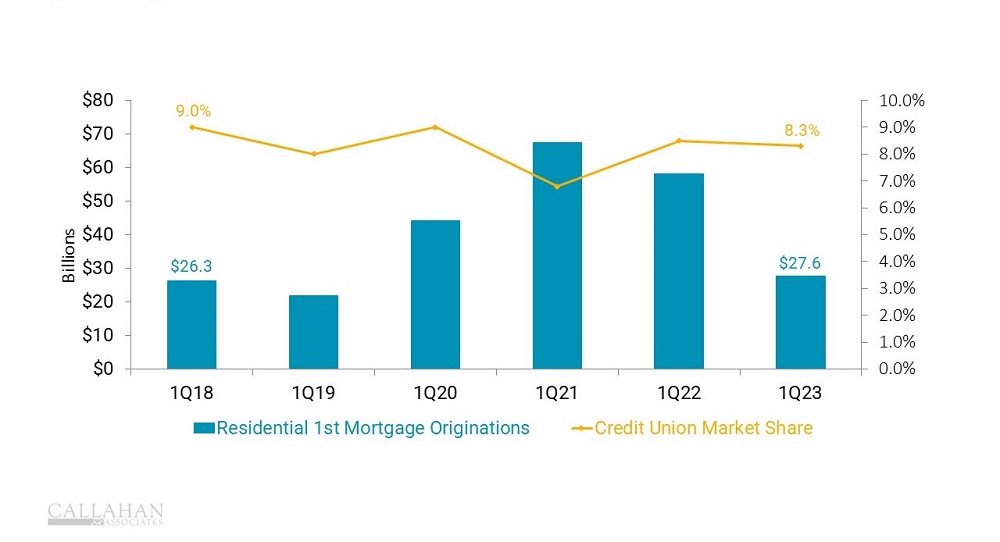

RESIDENTIAL FIRST MORTGAGE ORIGINATIONS AND MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

- First quarter originations of residential mortgages at U.S. credit unions dropped 52.2% compared to the same quarter last year. Total dollars originated in the first three months of 2023 reached only $27.6 billion, a clear sign the pandemic-era origination frenzy is over.

- Despite the slowdown, the credit union market share of originations remained relatively flat at 8.3%.

- A remarkable 55.7% of first mortgage originations were adjustable rate or balloon/hybrid, a stark contrast to the first quarter of 2022 when only 19.8% were non-fixed rate.

How Do You Compare?

Learn how your institution’s mortgage performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

LEARN MORE TODAY

LEARN MORE TODAY