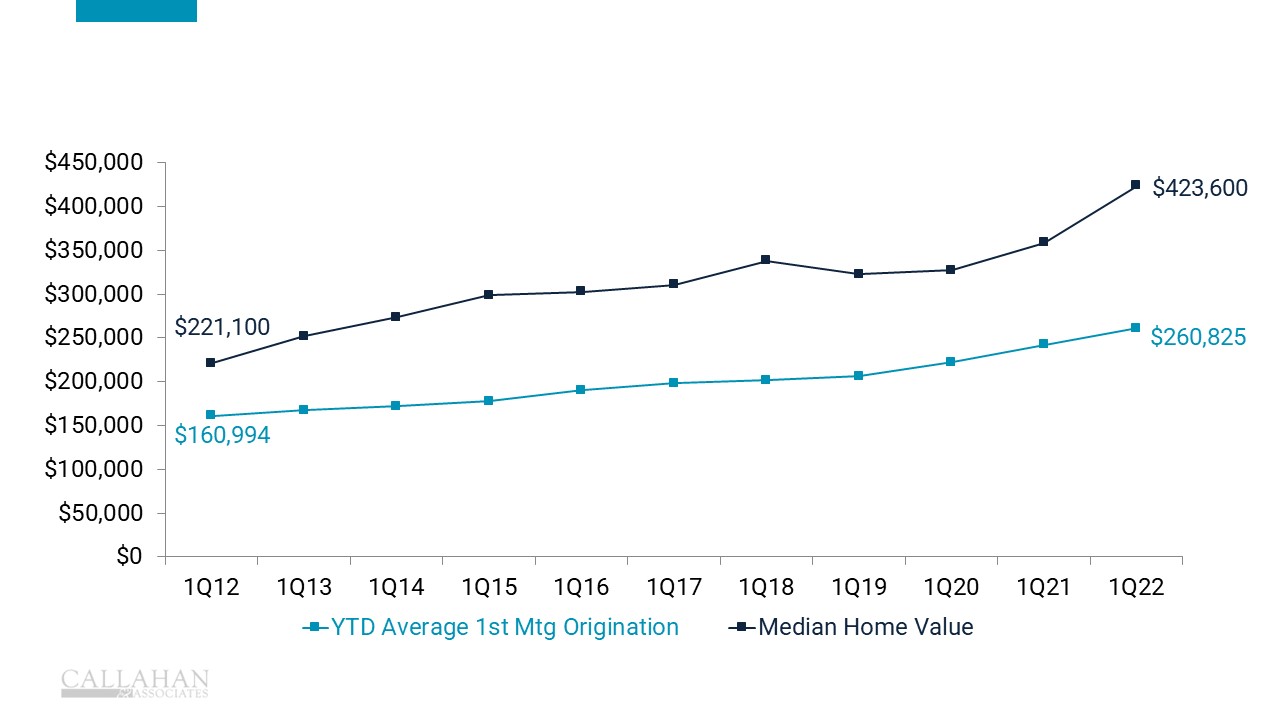

Median home values have nearly doubled in the last decade, according to recent data from the Federal Reserve Bank of St. Louis. That figure stood at more than $423,000 at the close of March a 91% increase from a decade ago. Credit union mortgage volumes have also seen substantial gains in that same period, with year-to-date average first mortgage originations up nearly 62%. The average difference between median home values and credit union first mortgages has been 35.6 percentage points over the past decade.

So what accounts for the difference between the two figures? For one, credit union members typically buy homes with lower listing prices not surprising, given the industry’s historic focus on serving consumers of modest means. Beyond that, loan amounts are different from home prices, and reflect down payments. Still, the originations grew at an annual average rate of 4.3% during the last 10 years, indicating that even as home prices rise, the industry is keeping up.

AVERAGE FIRST MORTGAGE ORIGINATIONS TO MEDIAN HOME VALUES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

CALLAHAN ASSOCIATES|CREDITUNIONS.COM

Source: Callahan Associates, Federal Reserve Bank of St. Louis.