Noninterest income at credit unions is up slightly over the past year, but that doesn’t change the fact that fee income industrywide has been on the decline for years. And the Biden administration’s war on so-called “junk fees” could depress those margins even further.

Here’s what credit unions need to know.

Why Does This Matter Now?

New reporting rules from the National Credit Union Administration that took effect during the first quarter have made it easier than ever before to understand exactly how much institutions earn from fee income. The new rules only apply to credit unions with assets exceeding $1 billion. That leaves out a substantial portion of the industry but means this information will be available for some of the nation’s highest-profile credit unions.

“Media and policymakers across the country have jumped on instances of NSF and overdraft fees they deem to be unfair or predatory,” explains William Hunt, director of industry analytics at Callahan & Associates. “This is an emotional topic, given that the members who are most likely to be hit by these [fees] are often the least likely to afford them. There’s a reason they get a lot of attention by regulators, policymakers, and media outlets.”

The NCUA’s focus, adds Hunt, is the result of concerns around reputational and financial risk for the industry. And credit unions could eventually be expected to defend their fee policies to examiners using this data as a starting point.

What Does The Data Say?

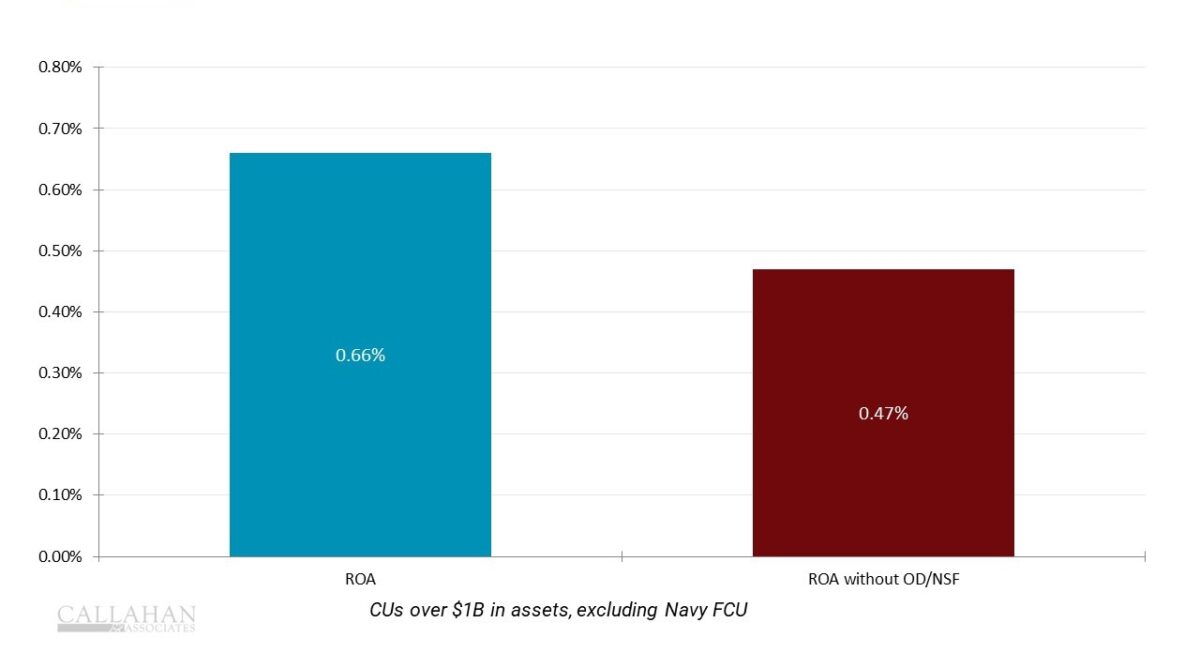

Revenue from NSF and overdraft fees plays a big part in the balance sheet. For credit unions with more than $1 billion in assets, ROA in the first quarter could drop nearly 20 basis points — to 0.47% — if those fees were eliminated. Those fees represent more than a quarter — 28.66% — of total net income and slightly more than 50% of fee income.

HOW NSF/OVERDRAFTS IMPACT ROA

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

The issue is compounded by the fact that net interest margins have tightened and credit unions are barely covering their operating costs, which are rising faster than assets.

One note: The figures above only apply to credit unions with assets more than $1 billion, but do not include Navy Federal Credit Union because its size makes it an outlier.

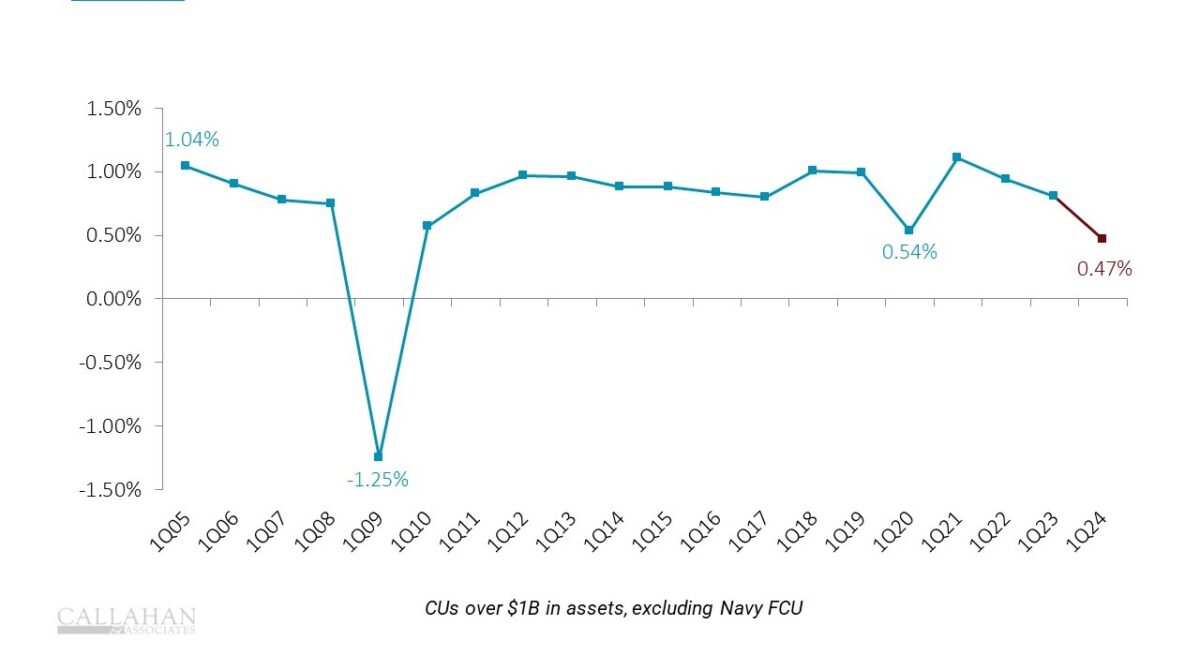

Will Fee Income Eventually Disappear Entirely?

Probably not, but it’s important to note that the future of NSF and overdraft fees is cloudy at best. Industry leaders and trade groups are working with regulators to determine the best way to proceed, and it’s unlikely these fees will be eliminated — at least in the short term.

FEE INCOME OVER TIME

FOR U.S. CREDIT UNIONS >$1 BILLION IN ASSETS

© Callahan & Associates | CreditUnions.com

For shops concerned about possible reductions in fee income, Hunt outlined two options. Improving operational efficiency by reducing costs but maintaining service levels can have a significant impact. Additionally, other noninterest income channels outside of NSF/overdraft fees can provide value to members while also bringing in vital revenue streams.

Banks have been moving in that direction for years, Hunt says, and credit unions are still playing catch up.

Learn More About New NSF/OD Fee Reporting

Join William Hunt, director of industry analytics at Callahan & Associates, for an examination of the latest data from the NCUA to shed light on what the data says — and what it doesn’t!