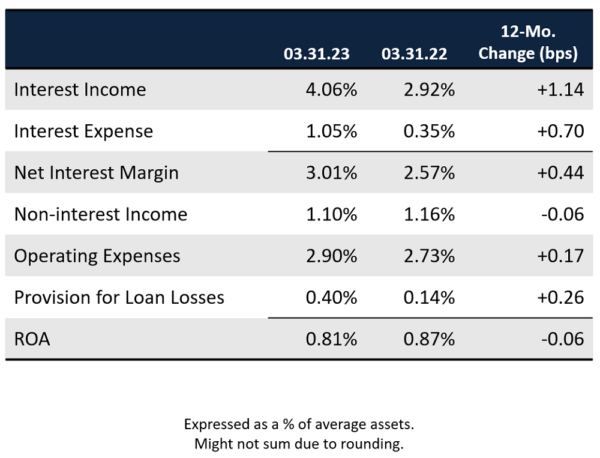

The Federal Reserve’s ongoing push to fight inflation by raising interest rates has had a dramatic impact on credit union earnings.

On the revenue side, higher interest rates pushed credit unions to reprice asset portfolios, leading to higher loan and investment yields that bolstered margins and revenue. At the same time, slowing deposit growth left credit unions with limited liquid funds available for lending, leading many to run certificate promotions or borrow money to fund lending. This competition for liquidity increased the cost of funds.

Although financial institutions generally aim to make loans — especially in high-rate environments — funding and operational constraints forced many to make difficult operational decisions that ultimately impacted earnings, and the industry’s return on assets fell slightly year-over-year to 0.81%.

Higher Rates And Revenue

Interest income from loans and investments at credit unions reached $22.5 billion in the first quarter. That’s a 45.8% increase from the first quarter of 2022. Interest income comprised 79.6% of total revenue, the largest portion since March 2009. Rising benchmark rates drove income growth in both categories, with income from loans leading the way. That increased $4.9 billion, or 35.5%, compared to the year prior.

Interest income from investments increased $2.1 billion, or 133.9%, year-over-year as credit unions reinvested maturing securities at higher yields during the past 12 months. Additionally, with few new shares available to lend, credit unions repurposed much of their cash balances into higher yielding loan or securities products, helping to drive up average asset yields and total revenue.

Historically, it takes credit unions a few quarters after a Fed hike to price in higher rates. The end of the first quarter marked one year since the first benchmark rate increase, and industry yields were significantly higher, although this is partially skewed by year-to-date metrics resetting on January 1. The yield on investments was 2.68% as of March 31, an increase of 177 basis points from a year ago. The yield on loans increased 63 basis points to 4.88%.

The composition of the loan portfolio also plays a sizeable role in credit union earnings. Although there will be low-yielding pandemic-era loans on balance sheets for years to come, there are also newer, higher-priced loans that help build yield. As of the first quarter, 30.3% of real estate loans outstanding were set to reprice or mature in the next five years, up 3.1 percentage points from one year ago. As borrowers repay these loans, credit unions will be able to lend it back out at higher interest rates, given rates stay high in 2023.

EARNINGS MODEL

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

Higher Rates And Expenses

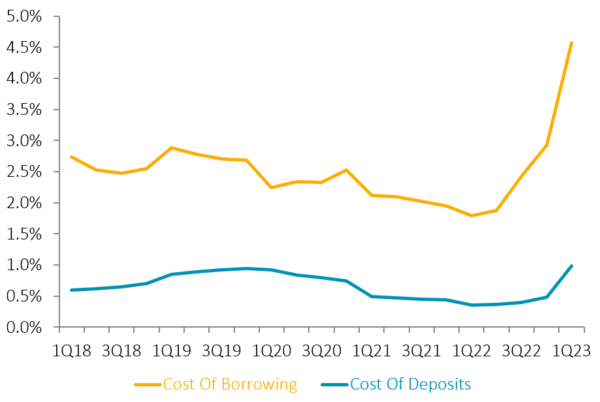

Most major operating costs held steady at U.S. credit unions. One exception is the 11.7% year-over-year increase in employee compensation as institutions fought inflation to retain talent. The more pronounced expense increase came from the cost of funds, which tripled from one year ago to 1.17% as of March 31.

Many credit unions launched share certificate rate promotions to attract liquidity, which drove up the cost of deposits 63 basis points annually to 0.98%. The cost of borrowing increased 278 basis points year-over-year as benchmark increases made borrowing funds expensive. Although borrowing balances have grown, they still comprise only 4.7% of assets at credit unions nationwide, meaning most of the rise in the cost of funds was from interest paid on deposits.

COST OF BORROWING VS. COST OF DEPOSITS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

The last time the federal funds effective rate reached the current level was in July 2006, when it held steady at 5.25% for about a year. During that period, credit union revenue was also elevated. Interest income as a percentage of average assets finished June 2007 at an annualized pace of 5.80%.

At the same time, interest expense was 2.61%, much lower than the 1.05% in the first quarter of 2023. Credit union borrowing was just as expensive in 2007 as it is today, but the difference in the funding costs comes mainly from credit unions using more certificates in the mid-2000s. Certificates comprised 32.3% of the share portfolio by midyear 2007, compared with 19.1% in the first quarter of 2023. That means approximately one-third of 2007 shares were costing around 5%, a huge headwind for interest margins.

It is impossible to understate the role of liquidity in credit union earnings. For credit unions with sufficient liquidity, 2023 could be a year of opportunity for both lending and earnings. If the benchmark rate holds steady, credit unions will have time to lock in more of their assets at higher rates, assuming they have the funds available to do so.

For those without funds to lend, borrowing or attracting deposits through share certificates are the popular paths forward. However, relying on these channels is costly and suppresses interest margin expansion. Additionally, they are less closely tied to strong member relationships compared with core draft and savings account types.

Of course, the credit union mission does not focus on earnings; however, having sufficient net income is important for building the capital needed to invest in the credit union and its members and foster long-term success. For credit unions that are able to participate in the higher rate environment, 2023 could set the stage for strong earnings for years to come.

What Does Your Earnings Model Look Like?

Learn how your institution’s performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.