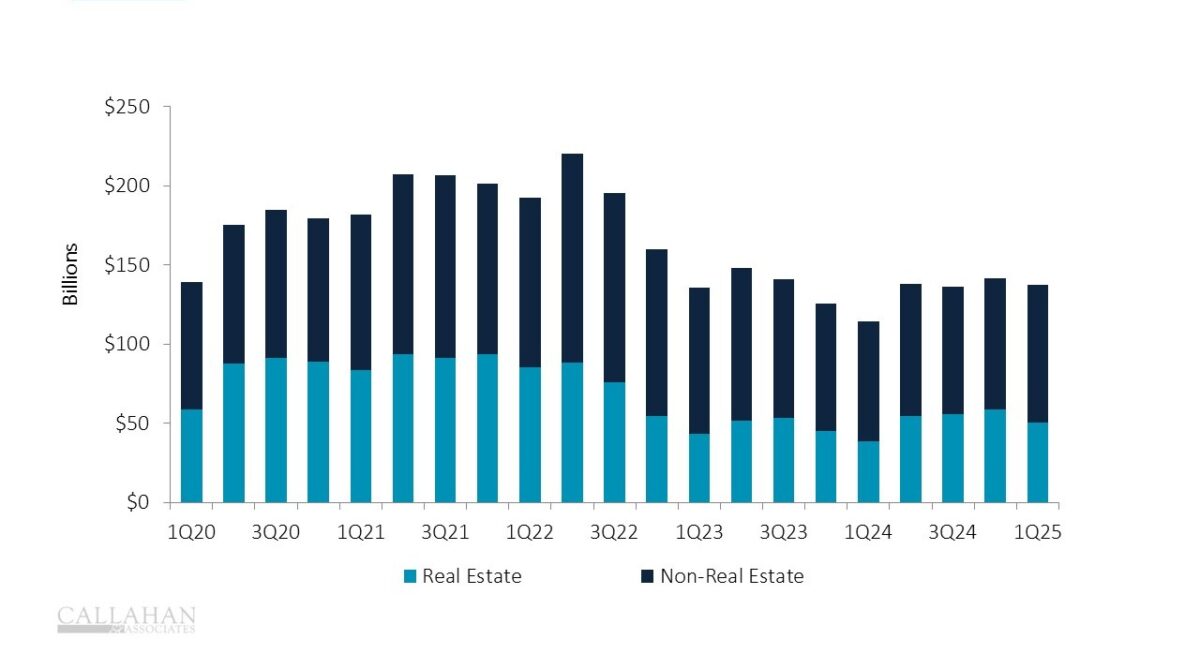

In recent quarters, members’ borrowing habits evolved alongside the economy. While real estate originations — both residential and commercial — increased in 2024, in the first quarter of 2025 it was consumer originations that shined, growing 4.4% quarter-over-quarter.

While real estate originations rose 30.8% compared to 1Q24, a seemingly impressive year-over-year gain, they dropped by 13.6% compared to the final three months of 2024. That decline was largely due to first mortgage and commercial originations, as other real estate originations — mainly HELOCs — grew 2.1%.

What drove these shifts in lending? First quarter data suggests it may be the result of changing member behaviors in the face of new market dynamics and economic headwinds.

Quarterly Loan Originations

For U.S. Credit Unions | Data as of 3.31.2025

1. Consumer Lending Gets A Boost

Consumer loan originations jumped 4.4% quarter-over-quarter, reflecting the needs of members and their relationship with their credit union.

While members increased total credit card balances by 3.7% year-over-year, utilization declined by almost a full percentage point since the fourth quarter of 2024. However, this is somewhat typical of the first quarter, as spending is usually lower after the frenzy of the holiday season, and more members spend cash as tax returns are deposited into their accounts.

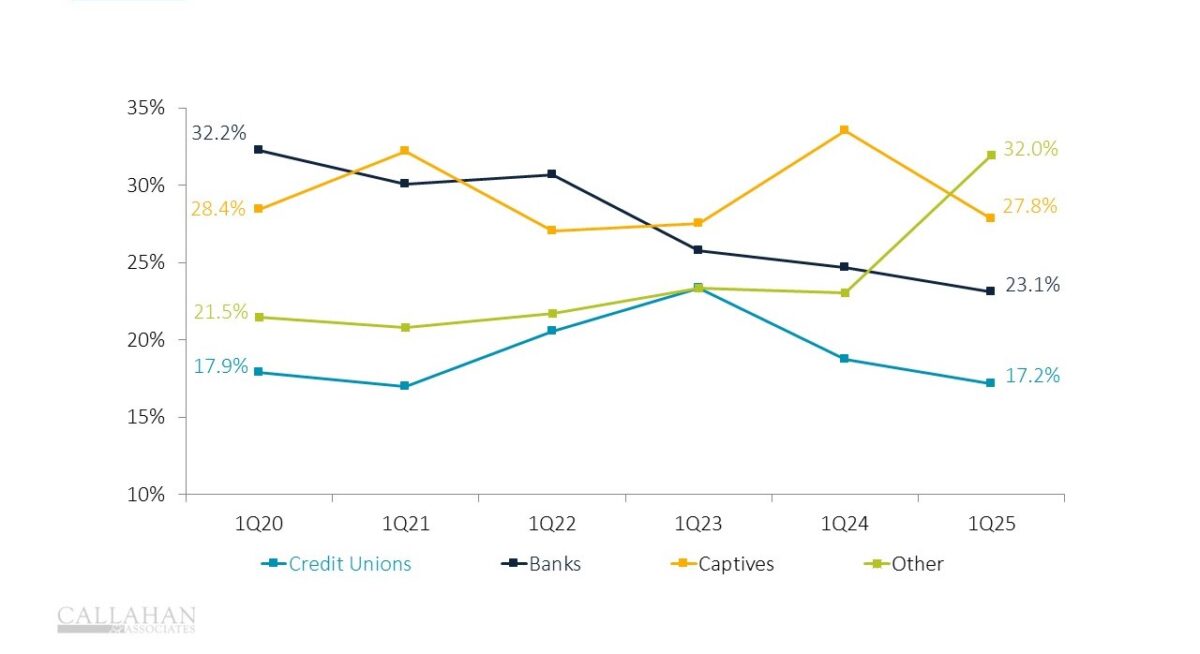

Vehicle purchases also played a role boosting consumer loan originations. U.S. car sales saw a bump in March from consumers rushing to dealerships to get ahead of tariffs, but credit unions were not the only lender to benefit. Auto manufacturers’ lending departments and other finance companies linked to the dealership gained market share in the first quarter. These companies — eager to move inventory quickly — offer low-cost financing that many consumers can’t pass up.

Auto loan balances held by credit unions declined slightly year-over-year, meaning the industry is not quite originating enough auto loans to replace the amount of paydowns on existing loans.

YTD Auto Origination Market Share by Lender Type

Data as of 3.31.2025 | Source: Experian

2.Real Estate Loans Reflect Changing Market Dynamics

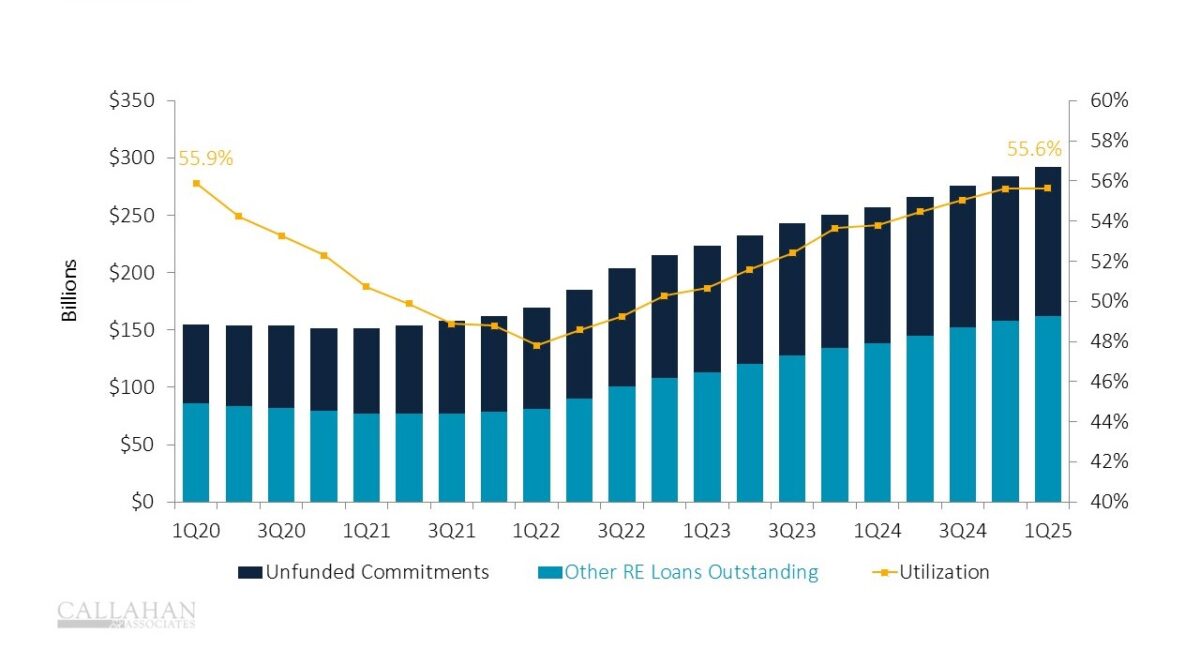

In the first quarter, credit unions increased HELOC balances, while first mortgages were stagnant. On the commercial side, real estate lending is up significantly year-over-year, driven by new approaches to commercial lending.

Members continued to pursue more HELOCs, as they’ve come to rely on recent increases in home equity to take out credit. The home purchase market remained quiet in the first quarter, and refinances were rare, due in part to the Federal Reserve’s “higher for longer” approach to interest rates. In light of this, credit unions originated more adjustable rate and balloon/hybrid mortgages compared to the first quarter of 2024, as more members might be expecting mortgage rates to drop.

On the commercial side, real estate loans are still a specialized loan product for credit unions. Commercial originations cooled off in the first quarter after an active end to 2024, but are still up 62.4% year-over-year.

Members are increasingly considering credit unions when looking for a lender for a large commercial loan. This growth reflects how credit unions are building out their commercial lending teams, and some are acquiring banks to capture the talent and expertise of proven commercial lenders.

Total HELOC Balances and Utilization

For U.S. Credit Unions | Data as of 3.31.2025

3.Earnings On The Upswing

How do these changes influence the income statement? Advantageously, it appears.

The 30-year fixed rate mortgage averaged 6.83% during the first quarter, 20 basis points higher than the fourth quarter. More pandemic-era loans are being paid down and replaced by higher-yielding loans on credit union balance sheets. This caused the average loan yield for credit unions to reach 5.97% in 1Q25, up 14 basis points from year-end.

Further, consumer loans typically carry a higher interest rate than those backed by real estate, and consumer originations reported the most growth in 1Q25.

Member borrowing behavior is in transition, shaped by economic constraints and shifting priorities. The modest rebound in real estate originations — driven primarily by home equity loans — signals that members are still leveraging their homes, but not necessarily moving or refinancing. Meanwhile, consumer loan originations have taken the spotlight despite credit unions struggling to maintain market share in auto lending. The growth in commercial lending suggests new opportunities to meet members’ needs but also increased complexity. For credit unions, understanding and adapting to these changing borrowing patterns will be essential for staying relevant in a shifting economic environment.