There’s a new kind of energy at TAPCO Credit Union ($653.8M, Fircrest, WA), but you’d be hard-pressed to find a lot of folks who will say the words out loud.

That’s thanks to a successful 2022 home equity loan campaign that put a spin on a popular — but NSFW — expression and helped boost loan volumes while bringing in young new members, too.

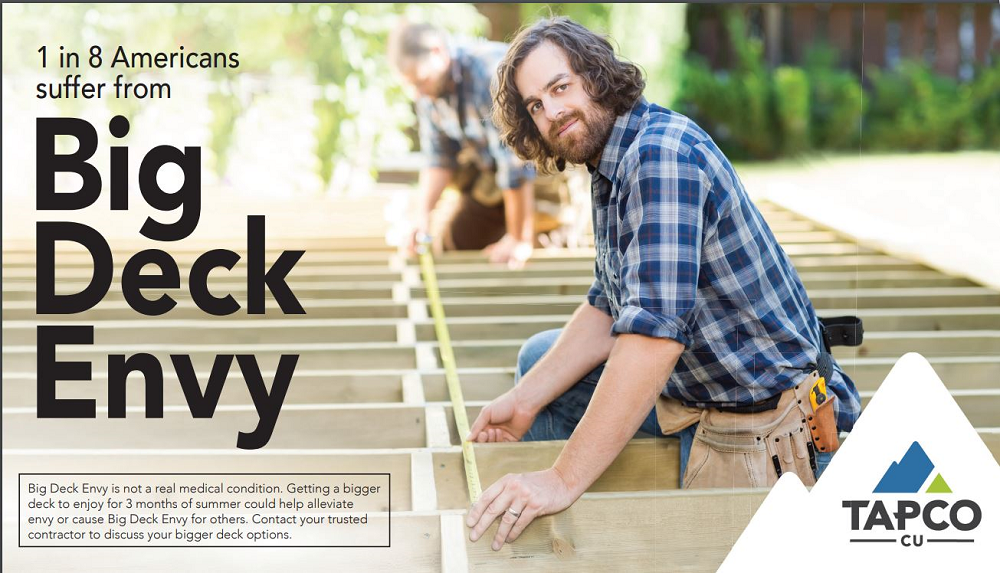

“We knew we wanted to be edgy; we know edgy gets noticed,” says Jacob Rose, marketing specialist at the Washington state cooperative. “We were brainstorming and looking at things with a home equity line and home improvement. The ‘BDE’ phrase came to mind. We tamed it down and got to ‘Big Deck Envy’ — you’re going to be envious of your neighbor’s big deck.”

To take things a step further, the marketing team paired the tagline with an action shot of a contractor building a deck. The campaign used billboards, social media postings, post cards, and radio ads with a popular Seattle-area on-air personality to help boost awareness.

HELOCs, Autos, And Diamonds

The results speak for themselves. In the two months the campaign ran — April and May of 2022 — TAPCO estimated it would reach nearly $1.6 million in total HELOC volume. Instead, the campaign helped bring in more than $5 million for that product. Similarly, the credit union estimated it would make around $565,000 in second mortgages but reached nearly $2.2 million by the time the campaign ended.

All that work had an impact beyond just home loans. According to Bill Peters, chief operating officer, Big Deck Envy also helped bring in a handful of new members along with two new auto loans and 10 new checking accounts. Even better, it helped flip member demographics to better attract consumers between the credit union’s target ages of 24 and 40.

Aside from the impact on the balance sheet, Big Deck Envy also earned multiple Diamond Awards from the Credit Union National Association.

Small But Mighty

Peters is quick to note the success of Big Deck Envy wasn’t solely from clever marketing. Although the COO offers effusive praise of his “small but mighty” marketing team, he also admits the credit union targeted nearly 1,000 members who either had the ability to take on a mortgage product or had inactive accounts. It also mailed postcards to 10,200 households located within a 1.5-mile radius of its six branches.

CU QUICK FACTS

TAPCO CREDIT UNION

DATA AS OF 03.31.23

HQ: Fircrest, WA

ASSETS: $653.8

MEMBERS: 29,855

BRANCHES: 6

EMPLOYEES: 105

NET WORTH RATIO: 8.1%

ROA: 0.53%

Since that campaign launched, second mortgages and HELOCs have risen to more than 16% of total loans, an increase of 4 percentage points in just one year. Mortgage lending of all types now makes up slightly more than 30% of TAPCO’s total loan volumes, and overall loan growth in the first quarter of 2023 was more than 18%. Real estate loans at TAPCO made up more than 36% of total assets at the close of the first quarter.

Despite the success of Big Deck Envy, TAPCO officials have no regrets giving the campaign such a brief run. Peters says it launched just in time for home equity season at a time when the credit union was trying to attract loans. TAPCO generally doesn’t recycle campaigns year after year, and this one “was never meant to be evergreen,” Rose says.

One-Two Punch

Although TAPCO is still focusing on home equity loans, the one-two punch of rising rates and higher home prices have resulted in a slowdown.

“These are my words, not Wall Street, but this rolling recession we’re in has a lot of people holding off and struggling to buy because of where rates and prices are,” Peters says. “We’re off target a little in terms of goals. This campaign helped us get a lot of loans on the books so we could continue getting some of that interest income year-over-year.”

Peters and Rose are tight-lipped about the future, but the pair indicates more edgy campaigns are just around the corner. One of the biggest lessons from last year is that turned heads can build brand awareness.

“If you can put out an ad that has some humor, people remember it more,” Peters says. “We had a few people in the community that thought we were a little too edgy, but it was a very small number who were upset about it. The overarching opinion was it was an incredible ad campaign and a lot of fun.”

Another lesson from the experience, according to Peters, came from simply allowing the marketing team the freedom to put the campaign in the right light to attract those 24- to 40-year-olds.

“Just showing up the way we need to show up in an area where they are helps drive in those young members,” the COO says.

Sticking with the “small but mighty” metaphor, Peters notes the total cost for the campaign was approximately $35,000. Interest income in the first year alone exceeded $60,000.

“We’re going to gain back twice our investment just by running our campaign,” he says. “But more than that, we’re creating brand awareness in our community.”

What’s Your Marketing Strategy?

Learn More