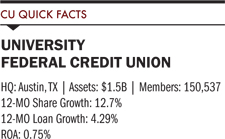

University Federal Credit Union serves the higher education community in Austin, TX, which includes the flagship campus of the University of Texas. With more than $1.5 billion inassets, UFCU is the eighth-largest credit union in Texas. The credit union boasts more than 150 SEGs, and most of its 150,000 members live within the Greater Austin area.

In2003, the credit union and its CEO, Tony Budet, helped underwrite and launch Opportunity Austin, a five-county initiative of local businesses and the Austin Chamber of Commerce that attracts companies and jobs to the region. (For more on OpportunityAustin, pick up the February 2012 issue of The Callahan Report or visit austinchamber.com.) Budet also participates in credit union organizations such as CUNA, the Texas League, and Catalyst CorporateCredit Union as well as locally focused organizations in Austin’s non-profit, civic, and medical sectors. In addition, he has restructured his formal job description to reflect the credit union’s increased focus on community participation and development.

What Are You Trying To Do At UFCU?

Tony Budet: We are positioningourselves to gain more influence in Austin and Central Texas to grow our business, impact local and state political affairs, strengthen higher education, and improve quality of life. Influence is gained through relationships, which requires investment,attention, and resources.

Why don’t credit unions reach out and become larger players in their communities?

TB: Generally speaking, we are a self-absorbed industry. This has somethingto do with our history. We all began small and tended to work within self-contained fields of membership, such as workers in a factory or teachers in a district. Even today, most credit unions, including those of $1 billion and more in size, are smallrelative to others in the financial services industry. Many credit unions do not have the scale and human resources necessary for the CEO to devote time to the community while many choose not to leverage those opportunities.

Influence is gained through relationships, which requires investment, attention, and resources.

How have you developed relationships with people of influence in the community?

TB: I recently reinvented my job for the second time in my 12 years here as CEO. I renegotiated my job description with my board, positioning myself to be more outward-facing. I passed many of my former responsibilities to our executive vice president, who now leads daily operations ofthe credit union. I retain interest in some internal responsibilities, such as organizational and leadership development, but basically the EVP is internally focused and I am externally focused. The role is allowing me, forcing me, to reach outwardand make the credit union a greater presence in Austin.

At the moment, I participate in more than a dozen organizations: CUNA, the Texas League, and Catalyst Corporate Credit Union as well as University Federal Credit Union is a moverand shaker in Central Texas.local organizations such as the Austin Chamber of Commerce and others in Austin’s non-profit sector, civic life, medical centers and so forth.

Do you believe this approach has helped the credit union?

TB: UFCU has doubled in size over the past five years, and I attribute most of that growth to the power of meaningful relationships under the umbrellaof a strong brand.

You seem to be putting most of your effort into local or regional work. Do you feel this is more productive than work in Washington?

TB: Right now, I do. We can gain a great deal by becoming major players in our own areas. I agree with those who say all politics are local. Our federal senators and representatives have offices in DC, but they’refrom here. Through relationships with people who are influential in this area folks who personally know me, trust me and my colleagues, and are familiar with UFCU’s commitment to our community it’s possible to more effectivelyconnect with influential decision makers, in Austin and in DC, to effect change. CUNA and the Texas League are integral to that effort, but we CEOs need to also step up to the plate.

How do you build these relationships?

TB: In some ways you would not expect. For example, our Chamber of Commerce each year sponsors a trip to another city to glean ideas and best practices. This year that city was San Jose. Approximately 120 of Austin’sleaders from all walks of life went. Four people from our credit union went. UFCU sponsored three education sessions, which enabled me to explain a bit about what UFCU is. The upshot was that I and UFCU presented ourselves to 120 of Austin’smost influential leaders. In addition, we ate breakfast, lunch, and dinner with these people over three days. You come back from a trip like that with relationships you did not have before. Leaders get to see us and know us, permitting UFCU to increasinglyweave itself into the leadership fabric of the Austin region. We get a seat at the table. Participating in that annual Chamber event is a huge investment in the future of our credit union.

I should add this is not solely my or a few directors’effort. Everyone on our leadership team is outward-facing in some respect. UFCU has so integrated itself into the life of the campuses we serve that it not uncommon during campus visits for faculty, staff, or students to stop and tell us how UFCUhas helped them, their club, or section of the university. We have built trust among these people. Sometimes we have helped build relationships by donating monetary support, sometimes with just a lot of personal service including, for example, helpingarriving students move into their dorm rooms as each fall semester begins. So, when times get a little tough, they think about us for a place to safeguard money or do business or take out a loan.

Do you get involved in politics?

TB: This year we did. The Texas League endorsed a candidate for the Republican U.S. Senate seat. Only about 18 of Texas’ hundreds of credit unions supportedthis effort, but we were one of them. We made a substantial monetary contribution and allowed the League to cross-reference our membership list to identify registered Republicans, to whom it sent eight post cards promoting the candidate as League-endorsed.

Our choice David Dewhurst, a proven friend to credit unions lost the primary but remains Lt. Governor. At a post-election Capitol luncheon with representatives of several Texas credit unions, Dewhurst expressed gratitudefor our support. He will remain the Lt. Governor of Texas for the next two years. We now have strong ties with him. We’ve placed the things we would like done by the Texas Legislature in front of him and he has said he will be supportive. Interestingly,Dewhurst’s opponent, who is likely to be elected to the U.S. Senate, has reached out via his staff to the Texas League and other associations who backed Dewhurst. Our board wants to do more of this kind of thing. I haven’t seen credit unions do it very much, perhaps because of anxiety over offending somebody, but I understand the credit unions that participated in this initiative heard no complaints about the politicalactivity.

How does the community feel about UFCU’s activism?

TB: The only form of community expression I’ve seen is growth in business opportunities, so I know the community reacts positively to our activism. Certainly Austin is getting to know us better. I seldom go anywhere in the Austin region where people have not heard of us and don’t say something positiveabout our employees when I mention who I am and what I do. We get stories all the time about how someone at UFCU has helped. The visibility is strong, the brand is strong.

How does the membership react to your or the credit union’s activism?

TB: I am not sure the members are particularly aware of it. I think they sense we are becoming more visible Wherever I go I see you guys but I’m not sure they see what we are doing as activism or that I have a new role that is somehow extraordinary as a credit union CEO.

Banks, by the way, are far ahead ofus in this kind of activism and participation. When there are city events, banks tend to be well represented while credit unions are not. Credit union people tend to go to credit union events but not so much to community events. We should correctthat. We should be a part of the life of our communities, not solely a part of the lives of our SEGs.

Can other credit unions duplicate what you have been doing?

TB: Sure. It’sprobably easier for a credit union concentrated in a single geographic area, as we are in Austin, to succeed in this effort, and certainly an organization’s scale and commitment to execute play a part. There is no doubt in my mind that the ever-changinglegislative, regulatory, and economic landscapes demand credit union CEOs redefine how they accrue value for their credit unions and not outsource critical responsibilitiesto CUNA or their respective leagues.

This article appeared originally in the November 2012 issue of The Callahan Report. Click here to read the main article: The Election Is Over. It’s Time To Come Out Swinging.

This article originally appeared in the October 2012 issue of The Callahan Report. Click here to read a Q&A with Tom Dorety, CEO of Suncoast Schools Federal CreditUnion ($$5.2B, Tampa, FL).

Read more:

This article originally appeared in the October 2012 issue of The Callahan Report. Click here to read a Q&A with Tom Dorety, CEO of Suncoast Schools Federal CreditUnion ($$5.2B, Tampa, FL).

Read more:

This article originally appeared in the October 2012 issue of The Callahan Report. Click here to read a Q & A with Tom Dorety, CEO of Suncoast Schools Federal CreditUnion ($$5.2B, Tampa, FL).

Read more: