Bob Dempsey, CEO, Cascade Community Credit Union

The high delinquency rates of loans made to poorly vetted borrowers then packaged into bonds and sold to investors have raised fears of a bubble.

Sound familiar?

It does to Bob Dempsey, president and CEO of Cascade Community Credit Union ($193.0 million, Roseburg, OR), who sees unsettling parallels between what’s happening now in auto lending and the U.S. mortgage boom that ended in 2008 with the worst recession since the Great Depression.

Today’s auto lending looks much to me like what we saw in real estate from 2004 to 2007, says Dempsey, whose more than 40 years in financial services includes 18 years with the FDIC, where he worked on liquidations during the savings and loan crisis in the 1980s that saw approximately one-third of the nation’s thrifts go bust.

CU QUICK FACTS

Cascade Community Credit Union

Data as of 03.31.16

HQ: Roseburg, OR

ASSETS: $193.0M

MEMBERS: 13,246

BRANCHES: 3

12-MO SHARE GROWTH: 11.9%

12-MO LOAN GROWTH: 5.5%

ROA: 0.93%

A large number of people who cannot and should not be able to afford these loans are being put on the books, regardless of risk, he says.

There’s no bubble at Cascade Community, however. Dempsey’s credit union is one of only 10 nationally holding auto loan portfolios of more than $35 million that had auto delinquencies so low in the first quarter of 2016 that their reportable delinquency rates round out to zero, according to performance data reported by Callahan Associates.

LEADERS IN LOWEST AUTO DELINQUENCY

FOR US CREDIT UNIONS | DATA AS OF 03.31.16

Callahan Associates | www.creditunions.com

| State | Credit Union | Auto Delinquency |

|---|---|---|

| SC | South Carolina | 0.00% |

| MA | Metro | 0.00% |

| CA | Pacific Service | 0.00% |

| NM | White Sands | 0.00% |

| TX | Plus4 | 0.00% |

| AZ | Canyon State | 0.00% |

| TX | LibertyOne | 0.00% |

| VA | Signature | 0.00% |

| KS | White Eagle | 0.00% |

| OR | Cascade Community | 0.00% |

*For credit unions with more than $35 million in auto loans on which NCUA is reporting first quarter 5300 Call Report data.

Source: Callahan Associates.

We have long-tenured lenders, the best I’ve ever seen, and they lend based on years of relationships with members, Dempsey says. They’re not order-takers. They’re going to do what’s best for the member and for the credit union.

Cascade’s first quarter loan-to-share ratio of 52% was notably lower than asset-based peers (68.7%), state peers (78.0%), and credit unions nationally (76.1%), but Dempsey admits there is room to grow.

When, not if, the economy goes south, we’ll be able to increase to a more reasonable 65% because there’ll be so many bad players out of the market, he says.

How Do You Compare?

Check out Cascade Community Credit Union’s performance profile on Search Analyze. Then build your own peer group and browse performance reports for more insightful comparisons.

There’s Those Collateralized Bonds Again

Media reports about a subprime lending auto bubble tend to focus on bond issues such as those issued by Dallas-based subprime lender Skopos Auto Receivables Trust. According to a Wall Street Journal report titled Subprime Flashback: Early Defaults Are A Warning Sign For Auto Sales, Skopos sold $154 million of the bonds in November, backed by more than 10,000 loans averaging 5.6 years and about 20% interest.

According to Market Watch, approximately 12% of the underlying loans packaged into the Skopos bonds were at least 30 days past due and one-third of those were more than 60 days delinquent through February 2016.

In another 2.6% of loans, borrowers had filed for bankruptcy or the vehicles had been repossessed, MarketWatch reports.

Fitch Ratings reports, meanwhile, that the 60-day delinquency rate for subprime car loans nationally hit 5.16% in February, the highest in nearly 20 years. A Bloomberg News report titled This Is What’s Going On Beneath The Subprime Auto-Loan Turmoil says newer entrants seeking quick returns are pushing the envelope.

It’s worth noting that the same dynamics that have drawn a host of new entrants into the business of subprime auto lending have been at play across CMBS (collateralized mortgage-backed securities) and CLO (collateralized loan obligation) markets, too, with many new entrants jumping into their respective markets in recent years, the Bloomberg report says. It seems business interests, like business cycles, never really go away.

Nick Clements, founder of MagnifyMoney, also sees similarities to the mortgage crisis. Clements surveyed 673 auto buyers through Google Consumer and found 52.1% never had their income verified when applying for the loan.

Clements says 20% of today’s auto loan volume of close to $1 trillion is going to subprime borrowers. He also says $27 billion in bonds backed by subprime loans were sold by various issuers in 2015, compared to less than $9 billion in 2010. Meanwhile, Clements says, in 2011, 12% of securitized loans went to borrowers with credit scores below 550. In 2015, that number was 30%.

Auto dealers resemble the mortgage brokers, making money on the sale of the cars and the dealer discount from lenders, Clements told Credit Union Journal in an article titled Road Hazard: Subprime Loan Delinquencies On The Rise. Verification requirements are minimal.

Meanwhile, the head man at one of of the biggest of the big banks shares some of that view. According to the Wall Street Journal, JPMorgan Chase CEO Jamie Dimon said at a June 2 financial industry conference that the auto lending market is a little stretched and that someone is going to get hurt, but it won’t be us.

The WSJ piece notes that, according to the Federal Reserve Bank of New York, the $1 trillion auto loan market is currently only about one-eighth the size of $8.4 trillion mortgage market. The article says in the first quarter, Chase had $62.9 billion of auto assets reported a drop in its auto-related net charge-offs from 0.5% in the fourth quarter to 0.44%, up from 0.38%.

Dimon says his company does very little subprime lending and that although he does not believe an auto market downturn is imminent, he does see risk growing due to higher default rates from that sector, as well as from longer repayment periods for borrowers, and the potential for used-car prices to decline in the coming years, putting a damper on the value of lenders’ collateral when borrowers default.

Although auto lending isn’t on the same scale as mortgage lending, if there is indeed a subprime auto lending bubble that bursts on Wall Street, what would that mean on Main Street, where most credit unions live?

Financial crisis-induced impairments frame many perfectly creditworthy, low-risk, high-merit folks as subprime’ under standards that have not been updated or recently validated.

Credit Union Exposure Smaller Than Rest

There are some indications it could be similar to the housing collapse, in that credit unions as an industry suffered less than many big banks and investment houses.

Toxic investments in sliced-and-diced mortgage securities caused the corporate credit union crisis. NCUA has recovered money, but nothing has made it to the credit unions themselves. Read more on CreditUnions.com.

Although credit unions’ auto market share has been hitting new highs, much like in mortgages, credit unions have minimal exposure in the subprime auto lending space. A recent report from Experian Automotive, for example, says only 14.1% of credit union used auto financing is to borrowers with credit scores of less than 600. That falls to 6.9% for new cars.

Banks are slightly more exposed in that segment, but both credit unions and banks pale in comparison to the finance companies, which have 70% and 39.2% out to used and new subprime, respectively. For buy-here-pay-here lots, 68.4% of financing goes to subprime borrowers.

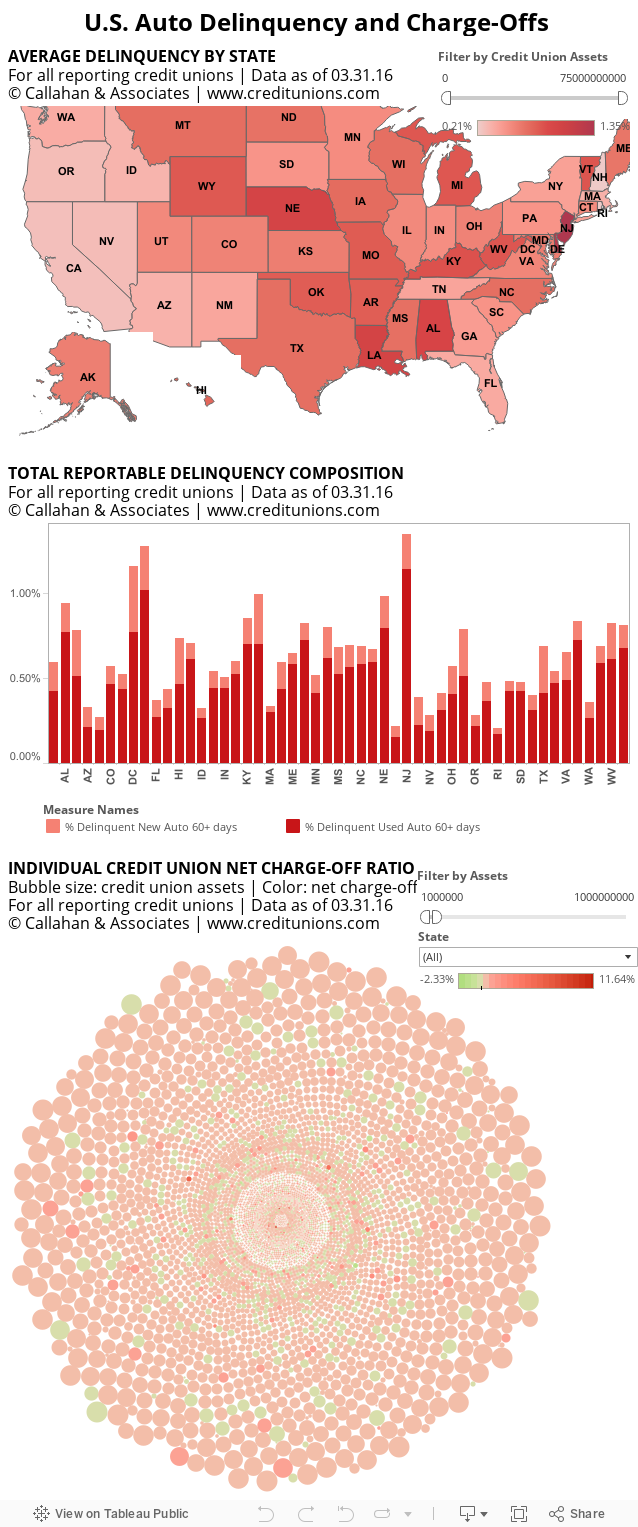

Although subprime delinquency rates are reportedly soaring, in the first quarter of 2016, credit unions reported an overall 60+ day delinquency rate of 0.54%, up only three basis points from first quarter of 2015.

The most current data for banks is from fourth quarter 2015, and numbers show a 90+ day delinquency rate of 0.04%. The chart below shows the trends over the past few years among credit unions and banks.

Click through the tabs below for a deeper dive into credit union and bank auto delinquency and net charge-offs.

$(‘.collapse’).collapse()

1. CREDIT UNION AUTO DELINQUENCY AND NET CHARGE-OFFS (TOTALS)

CREDIT UNION AUTO DELINQUENCY AND NET CHARGE-OFFS

FOR US CREDIT UNIONS* | DATA AS OF 03.31.16

Callahan Associates | www.creditunions.com

| Year | Auto Delinquency 60+ Days (In Millions) | % Auto Delinquency 60+ Days | Auto Net Charge-Offs (In Millions) | % Auto Net Charge-Offs | Total Auto Loans (In Millions) |

|---|---|---|---|---|---|

| 2013 | $1,015.2 | 0.55% | $398.5 | 0.22% | $183,227.6 |

| 2014 | $1,099.8 | 0.53% | $263.4 | 0.13% | $205,719.3 |

| 2015 | $1,207.1 | 0.51% | $314.0 | 0.13% | $238,773.5 |

| 2016 | $1,482.8 | 0.54% | $418.2 | 0.15% | $272,630.1 |

*For all credit unions on which NCUA is reporting first quarter 5300 Call Report data.

Source: Callahan Associates.

2. CREDIT UNION AUTO DELINQUENCY AND NET CHARGE-OFFS (YOY GROWTH)

CREDIT UNION AUTO DELINQUENCY AND NET CHARGE-OFF GROWTH (OR PERCENT CHANGE)

FOR US CREDIT UNIONS* | DATA AS OF 03.31.16

Callahan Associates | www.creditunions.com

| Year | Auto Delinquency 60+ Days (Percent Change) | % Auto Delinquency 60+ Days (Percent Change) | Auto Net Charge-Offs (Percent Change) | % Auto Net Charge-Offs (Percent Change) | Total Auto Loans (Percent Change) |

|---|---|---|---|---|---|

| 2014 | 8.34% | -0.02% | -33.90% | -0.09% | 12.28% |

| 2015 | 9.75% | -0.03% | 19.22% | 0.00% | 16.07% |

| 2016 | 22.84% | 0.04% | 33.11% | 0.02% | 14.18% |

*For all credit unions on which NCUA is reporting first quarter 5300 Call Report data.

Source: Callahan Associates.

3. BANK AUTO DELINQUENCY AND NET CHARGE-OFFS (TOTALS)

BANK AUTO DELINQUENCY AND NET CHARGE-OFFS

FOR US BANKS* | DATA AS OF 12.31.15

Callahan Associates | www.creditunions.com

| Year | Auto Delinquency 60+ Days (In Millions) | % Auto Delinquency 60+ Days | Auto Net Charge-Offs (In Millions) | % Auto Net Charge-Offs | Total Auto Loans (In Millions) |

|---|---|---|---|---|---|

| 2012 | $208.7 | 0.07% | $339.9 | 0.11% | $298,827.7 |

| 2013 | $172.8 | 0.05% | $411.0 | 0.13% | $321,513.6 |

| 2014 | $122.2 | 0.03% | $477.0 | 0.13% | $355,391.9 |

| 2015 | $124.2 | 0.03% | $520.3 | 0.13% | $387,218.7 |

*Credit unions report accounts as delinquent after 60 days in arrears while banks report after 90 days. This combined with charge-offs and/or borrowers simply catching up make it difficult to determine the true differences between 60 days and 90 days delinquent.

Source: Callahan Associates.

4. BANK AUTO DELINQUENCY AND NET CHARGE-OFFS (YOY GROWTH)

BANK AUTO DELINQUENCY AND NET CHARGE-OFF GROWTH (OR PERCENT CHANGE)

FOR US BANKS* | DATA AS OF 12.31.15

Callahan Associates | www.creditunions.com

| Year | Auto Delinquency 60+ Days (Percent Change) | % Auto Delinquency 60+ Days (Percent Change) | Auto Net Charge-Offs (Percent Change) | % Auto Net Charge-Offs (Percent Change) | Total Auto Loans (Percent Change) |

|---|---|---|---|---|---|

| 2013 | -17.18% | -0.02% | 20.89% | 0.01% | 7.59% |

| 2014 | 11.28% | -0.02% | 16.07% | 0.01% | 10.54% |

| 2015 | 15.62% | 0.00% | 9.07% | 0.00% | 8.96% |

*Credit unions report accounts as delinquent after 60 days in arrears while banks report after 90 days. This combined with charge-offs and/or borrowers simply catching up make it difficult to determine the true differences between 60 days and 90 days delinquent.

Source: Callahan Associates.

Is Subprime In The Eye Of The Beholder?

Amid the debate of the existence and severity of a subprime auto loan bubble, Chris Howard, senior vice president at Callahan Associates, says the very definition of subprime might be obsolete.

Financial crisis-induced impairments frame many perfectly creditworthy, low-risk, high-merit folks as subprime’ under standards that have not been updated or recently validated, Howard says.

That framing, he says, is a problem for middle-class consumers and for credit unions, but not for the high-end lenders who’d rather not serve that middle market nor for the more aggressive folks who make a lot of money serving the bottom of the market.

Those are competitors, Howard says, whose political agenda includes limiting the activity of credit unions.

The bubble meme is very useful to them, Howard says.

So is the increasing length of the loans, a traditional indicator of potential future problems, Howard says. But that factor is mitigated, at least somewhat, by the increasing quality and longevity of new cars.

Loan terms are extending to never before contemplated timeframes 72, 84, and even 96 months while 100,000 miles for even the cheapest, lowest-quality new car is no big deal, the Callahan SVP says.

Also, the current age of the fleet is still high in historical terms though less so when considering greater quality and longevity so the market still has the ability to absorb a higher than normal volume for a while and to see a rollover in the used car market that will extend a little longer, Howard says.

Balanced against that, however, is this fact: No one I know including me argues that longer-term loans are a good thing, beyond, perhaps, giving more access to more people, Howard says.

To the contrary, longer terms are generally viewed as a risk factor and their growth as a warning sign of impending doom. It does seem, however, that the better quality and longevity of the collateral fleet mitigates that risk and undermines the arguments of fear-mongers, the Callahan research chief says.

As for the data, Callahan figures show credit unions have noted slightly more reportable delinquencies, 60+ days, among indirect loans than direct loans in the past two years. In first quarter 2016, it was 0.57% for indirect loans compared with 0.54% for direct loans. But that spread is narrowing, down from 5bps in first quarter 2015 and 6bps in first quarter 2014. Both are still a far cry from the 60-day delinquency rate of 5.16% among all lenders reported among that risk category by Fitch Ratings in February.

Save Time. Improve Performance.

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics.

Oil And Statewide Economies

Delinquency rates are not uniform across the country, just as the economy isn’t, either.

For example, the sharp drop in oil prices has had a much-chronicled impactin numerous states that have seen the boom sparked by fracking. But North Dakota, a kind of ground zero for this latest boom and bust, is not among the 10 states with the highest auto lending delinquency rates in the first quarter of 2016. Louisiana is but Texas isn’t.

Who jumped nine spots to claim the number two spot? Delaware, at 1.28%, according to Callahan data. Why Delaware? It’s a small state with 21 credit unions, so a struggle here and a boom there can swing the stats.

I can only speak in generalities, but I think our members are still struggling with economic hardships, including unemployment and under-employment, says Carole Langui, CEO of the Delaware Credit Union League.

According to Langui, downsizings and closings by many of the small state’s large corporations has had a spillover effect on suppliers and service providers as well as to the businesses those furloughed employees patronize: restaurants, dry cleaners, salons, corner groceries, and more.

Although our credit unions try to work with these members and help them during these rough times, not all will turn to their credit union for help, Langui says.

Hover over data for more information and use filters to make interactive displays by filtering by assets.