Top-Level Takeaways

-

Oregon State Credit Union created its first full-time educator in 2003 after the state dropped financial education as a high school graduation requirement.

-

The credit union now offers financial education online and in person at schools, prisons, and other community settings.

In 1997, state lawmakers in Oregon removed financial education as a requirement for high school graduation. The move created what Oregon State Credit Union ($1.2B, Corvallis, OR) identified as an opportunity, and mandate, to step up its financial education efforts. The credit union has had a full-time community education director since 2003, and its offerings have changed with the times. Likewise, its responsibility has spread to K-12 classrooms, adult education, and prison work as its FOM has expanded to now include 24 of the Beaver State’s 36 counties.

ContentMiddleAd

Amanda Brenneman-Brown, a Certified Credit Union Financial Counselor, became community education director in 2015. Here, she and Laurie Roe, the credit union’s vice president of organizational development, share their experiences in meeting that fifth of the Seven Cooperative Principles for Credit Unions: Education, Training, And Information.

Tax preparation was among the life lessons that Oregon State Credit Union community education director Amanda Brenneman-Brown taught in this visit to West Albany High School last fall.

Describe the organizational structure of Oregon State Credit Union’s financial education efforts.

Laurie Roe: Community Education is a department under Employee Development and consists of one full-time employee dedicated to serving members and non-members alike. The Employee Development department is housed underneath the chief operating officer.

What is the credit union’s commitment to financial education?

LR: Education is a core value of Oregon State Credit Union. We employ a full-time representative, our community education director, to teach personal finance to people of all ages and walks of life as well as lead the educational outreach of our departments that provide business, investments, and real estate expertise. In addition to classroom-based teaching, the director also oversees our online financial education program that provides valuable, just-in-time information 24/7 at no charge without step foot into a class.

CU QUICK FACTS

Oregon State Credit Union

Data as of 12.31.17

HQ: Corvallis, OR

ASSETS: $1.2B

MEMBERS: 108,199

BRANCHES: 14

12-MO SHARE GROWTH: 8.1%

12-MO LOAN GROWTH: 24.4%

ROA: 0.92%

Amanda also manages a five-school sponsorship that makes online education modules available to students K-12 at sponsored schools. We know stronger personal finances can lead to stronger local and global economies.

The credit union also sponsors Junior Achievement, financial reality fairs, teacher grants, and college scholarships. Approximately 65% of our public relations philanthropic budget is directed to youth and education.

With Callahan online seminars, 30 minutes is all you need to learn from the tried-and-true practices of industry peers. Check out Callahan’s upcoming webinars.

What happened 20 years ago? And how did you respond?

LR: In 1997, the Oregon legislature voted to remove personal finance as a graduation requirement for seniors in high school. Oregon State Credit Union identified a new role we could fill by giving access to this information at no cost to schools, non-profits, community groups, and other parties.

We created the position of community educator because we saw the need for someone to provide financial literacy tools to youth and adults in our communities. The position directly supports the fulfillment of our vision and demonstrates our core values in action.

Meanwhile, we use the data we collect regarding the positive impact of our programs to educate our state and congressional leaders in pursuit of reinstating financial education requirements in our schools.

Who else provides financial education at your credit union?

LR: Although it looks different from Amanda’s role, all credit union employees who interact with our members provide financial education as they create financial solutions. Through the consultative service process, employees educate individuals on opportunities to improve their credit and products and services that can help them achieve their financial goals.

What do you do in schools and prisons?

Amanda Brenneman-Brown: I teach a variety of topics at schools through lectures, games, Q&A sessions, and special events like financial reality fairs. For prisons, I trained all of the Department of Corrections transition coordinators to work with individuals who are about to be released. Their intake staff also works with individuals coming in, so inmates are getting education as they arrive and depart from incarceration.

How do the materials differ between schools and prisons, and what level schools are you working in?

AB: We teach in all grades K-12 and we use a lot of Junior Achievement as well as some in-house created curriculum that depends on what the teacher requests. The prison curriculum combines our in-house materials with what the Oregon Department of Corrections already had in place. We enhanced the department’s curriculum and created additional classes based on its needs.

I also teach at homeless shelters, housing authorities, drug courts, and other non-profit or community groups. Many of these groups request an eight-week series, which is a combination of curriculum from credit.org and in-house development.

It’s important to stay on top of your pop culture game. Now, that’s not to say binge watch MTV, but know a little about the lives of your audience.

What kind of education does Oregon State Credit Union provide for women?

AB: I’ve taught a group of women who wanted more information on how to best budget with an irregular income. I also get calls requesting financial counseling by women who are taking on financial responsibility for the first time whether through divorce, death, or just starting out on their own. The education for women in this stage of life is no different from the education I offer to others.

What does the schedule, and setting, for your program look like?

AB: Most of our classes are by request, and the schedule stays full. The setting is typically a K-12 classroom or meeting room at a community organization. Also, our Investment Services team offers a variety of seminars ? including some geared to women ? and educates members and prospective members. We promote these via social media, the branches, and newsletters.

How do you measure the impact of what you’re doing?

AB: We don’t measure most of the classes by a specific business-related metric, such as memberships opened or loans generated. But, for the prison education and the eight-week series classes we do measure the amount of information learned and feeling of confidence with a nine-question pre- and post-event survey.

How do you plan to get the most return?

AB: The credit union does not expect or track any stated return on this investment; however, we do report the number of adults and youth served as well as the number of presentations delivered to our board of directors as a measure of outreach and those numbers have been recognized nationally several times over. Presentation counts include in-class instruction, financial reality fairs, Department of Correction classes, online financial education offerings, and one-on-one financial counseling.

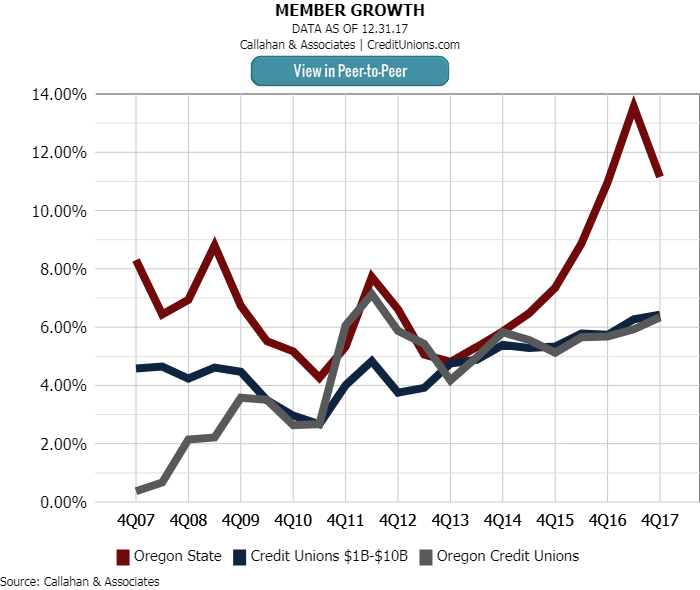

Oregon State Credit Union’s membership growth has exceeded Oregon credit unions and similarly sized ones. To what do you attribute that success?

LR: We are a sustaining resource with member service as our strategic driver. Community education is one of many other factors that have contributed to our solid reputation in the state of Oregon and our market position in our field of membership.

This interview has been edited and condensed.

10 Tips To Succeed In Financial Education

Oregon State Credit Union’s community education director Amanda Brenneman-Brown and vice president of organizational development Laurie Roe offers best practices to provide financial education in a classroom setting.

- Evaluate need. Identify who the credit union wants to serve, assess their financial education needs and gaps, and decide where the credit union’s efforts can provide sustaining support. Don’t duplicate efforts that already exist in the community.

- Evaluate capacity. Can the credit union support a full-time educator or team, or will someone add education efforts to their plate? Even if an employee enjoys teaching financial education, if it competes with other duties, it’s not sustainable long-term.

- Start with the end in mind. Build the role or department with sustainability and scalability in mind. New requests will come from people who have attended other classes word of mouth is great, just be prepared to manage growth.

- Don’t burn out. Set the program’s scope and determine whether the credit union will customize on request. Also, set expectations for evening and weekend hours and travel. Note, for school programs, be mindful in scheduling other strategic projects or time allocation during the school year.

- There’s no need to re-create the wheel. There are a lot of curriculum resources out there, so don’t start from scratch to get things up and running.

- Protect desk time. This is an out of the office job, so set aside desk time for phone calls, emails, and meetings as well as paperwork and other office tasks. Desk time also helps maintain credit union connections and relationships.

- Know the audience. It’s important to stay on top of your pop culture game. Hashtag jokes are going out of style and Star Wars is more popular with adults. Now, that’s not to say to binge watch MTV, but know a little about the lives of your audience.

- Make it real. Personal finance comes to life when people meet others in the same boat, so share crazy personal finance stories. Make sure students know the classroom is a no-shame, no-judgment zone and that there’s no shame in asking for help.

- Invest in the program. Provide educators with their own resources for education, training, and conferences, and more.

- Choose wisely. Make sure the program staff is right for the job. Not everyone is well suited to be an effective educator, community ambassador, or public speaker.