There’s no question the C-suite is growing. In recent years, specialized roles such a chief risk officer, chief experience officer, chief digital officer, chief strategy officer, chief growth officer, and more have joined the ranks of CEO, COO, and CFO.

At a high level, organizational charts at today’s credit union reflect the key responsibilities of the management team: serving members, controlling risk, and managing operations. But what do variations at the top of the org structure say about business strategy, compliance goals, availability of talent, and CEO preference?

To be sure, size matters. The larger the organization, the more crucial the lines of responsibility leading to the top. CEOs are more distant from front- and back-office activities and must balance the need for visibility and control with strategy and delegation. Organizational flexibility is important, too, as market conditions are changing at an increasingly faster pace.

Strategy and organization are two sides of the same coin now, former McKinsey Co. senior partner Lowell Bryan has observed. And they both adapt to each other.

Here, five CEOs from credit unions with assets that top $1 billion talk about their institutions’ senior leadership roles, the strategy behind these roles, and how these structures will serve their credit unions into the future.

A few takeaways of note:

- Less is more. The larger the executive leadership team, the greater the chance of decision-paralysis and siloed business units. The CEOs interviewed have between four and eight direct reports, for an average of six executives, although nearly all indicated those teams are likely to grow in the future to align with credit union objectives.

- Risk is king. Most of these credit unions have elevated or plan to create top leadership roles for risk, recognizing the importance of risk and compliance when they reach $10 billion in total assets, which will trigger more regulatory scrutiny.

- Experience is chief. The role of chief experience officer, or chief member experience officer, is gaining steam throughout the credit union industry. This leader oversees projects that often cut across multiple divisions of the organization, from member services to technology.

- Growth in focus. A relatively new role, chief growth officer, is responsible for expanding membership and member reach. Like the chief experience officer, this executive’s responsibilities typically cut across sales, marketing, lending, and analytics.

- The EVP decision. Although many credit unions today operate with a flat executive leadership team, most of the CEOs acknowledge executive vice president roles might be needed to manage internal- and external-facing areas of the business as the organization grows. Two of the five large credit unions already have EVP roles. One also includes a chief of staff role to facilitate decisions between the leadership team and the CEO.

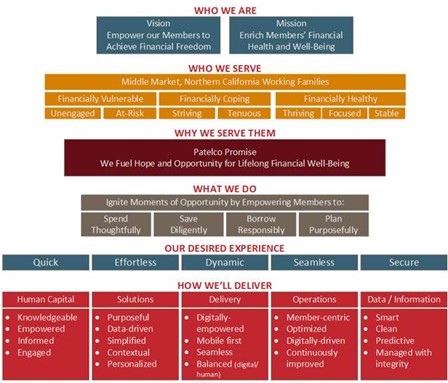

Patelco Credit Union: Business And Strategy Alignment

Since Erin Mendez took the helm at Patelco Credit Union ($9.0B, Dublin, CA) in 2013, the credit union has more than doubled in size. More than a few organizational changes have accompanied that growth.

“Size and complexity matter — they change and evolve continually,” Mendez says. “The organizational structure, likewise, needs to change and evolve.”

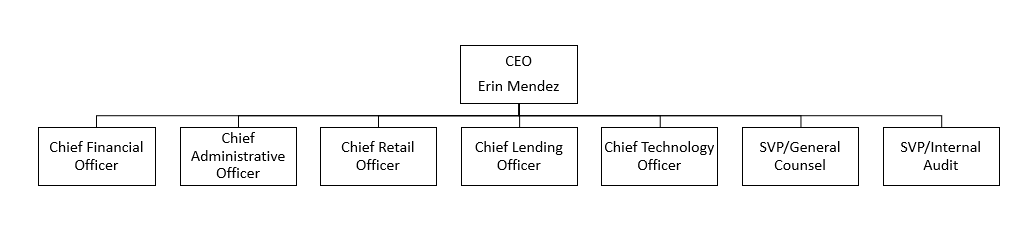

Mendez currently has seven direct reports: chief financial officer, chief administrative officer, chief retail officer, chief lending officer, chief technology officer, SVP/general counsel, and SVP/internal audit.

“When we redefined our mission to build our members’ financial health and wellbeing, we created a group to focus on our members’ financial wellness and improve the member experience,” Mendez says. “We also created dedicated resources to focus on member communication regarding financial wellness, inclusive of fraud prevention. And we’ve created data and analytical teams to meet the growing demands of knowing and understanding our members.”

According to Mendez, there’s no magic number for the ideal size of a senior leadership team.

“This depends on your areas of focus, to what degree you want direct versus indirect influence over these areas, to the degree your organization and leadership team has matured or not, and the level of complexities, just to name a few,” she says. “All these items are moving with time and with people. How an organization works, shifts, and moves over time impacts how you organize.”

Mendez says Patelco focuses on four pillars of strategic importance: members’ financial wellness, making it easy to do business with Patelco, risk management, and financial performance. Multiple areas support these strategies, so various teams have primary and secondary oversight and must collaborate to meet key performance objectives around product and portfolio, delivery and distribution, operational performance and effectiveness, and business agility.

Patelco is nearing $10 billion in total assets, which will trigger additional oversight by federal and state regulators. When it does, risk performance will play a key role in the organization.

“In the future, a chief risk officer most likely will be added due to size and complexity and changing regulatory environment,” Mendez adds.

PSECU: Focusing On Enterprise Leadership

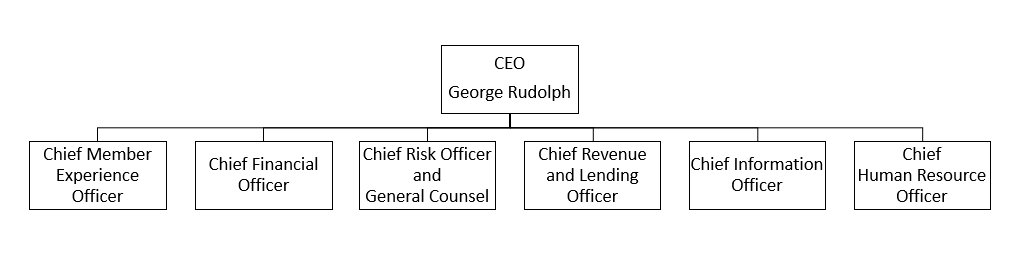

George Rudolph joined Pennsylvania State Employees Credit Union ($8.2B, Harrisburg, PA) in 2019 to replace a retiring CEO. At that time, PSECU had 10 executives on the leadership team. In mid-2020, after developing a five-year strategic plan, Rudolph announced a new organization structure that consisted of six direct reports: chief member experience, chief financial officer, chief risk officer and general counsel, chief revenue and lending officer, chief information officer, and chief human resource officer.

“I think the ideal number of direct reports to the CEO is three to five,” Rudolph says. “However, given the complexity of larger credit unions and increasing emphasis on areas like talent optimization and risk management, it becomes more difficult to manage to a smaller number.”

Some new CEOs aim to reorganize within the first 100 days, but Rudolph said he wanted to observe PSECU first. The primary reason he moved from a 10-member to a six-member executive team was to ensure clear lines of accountability and broader oversight over the business. According to Rudolph, more leaders make it more difficult to achieve enterprise leadership, cohesiveness, and collaboration.

“We insisted the executive team have not only functional expertise but also — and perhaps more importantly — strong capability as enterprise leaders,” the CEO says. “You can imagine, with 10 people giving their opinions, how long it could take to make a decision. This led to a siloed approach to running the business as opposed to an enterprise approach.”

A key role in the new structure is the chief experience officer, which oversees sales and marketing, strategic growth and product development, and marketing analytics. Elevating that role to the executive team was crucial to supporting business strategy, Rudolph says.

“When I came into the organization, everybody was responsible for the member experience and nobody was responsible for the member experience,” he says. “We want everyone to do their part for the member experience, but at the end of the day it’s important we bring that together under one person, like the conductor of an orchestra.”

The reorganization also moved all technology projects under the CIO rather than distributed throughout the credit union, ensuring the technology team focuses on what it does best — processes and system implementation.

“I’d like to make sure we’re optimizing the experience through technology, not optimizing technology through the experience,” Rudolph says.

Coastal Credit Union: Moving To Digital Everything

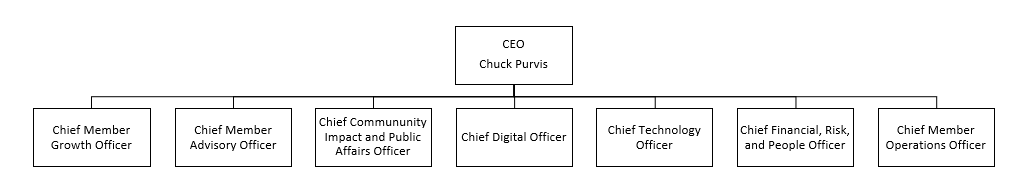

Coastal Credit Union ($4.6B, Raleigh, NC) had $900 million in assets in 2001 when Chuck Purvis joined the organization. Purvis served as executive vice president and chief operating officer until he was named president and CEO in 2012. Today, Purvis says he wants to keep the organization as flat as possible and even eliminated a layer of supervisors between managers and front-line employees several years ago.

More recently, and after working to update the credit union’s strategic plan, Purvis announced a new organizational structure in December 2021. Around the same time, Coastal’s chief lending officer left to take a CEO job at another institution; also, the leader in strategy and talent announced his retirement. The vacancies created new options for restructuring.

“There are times when you have capable people and you try to put square pegs into round holes, so it’s nice to have some flexibility,” Purvis says. “Every time I’ve got a senior-level vacancy, I should be asking how to revisit the structure and what is the most important work for this vacancy?”

Coastal’s senior leadership team now consists of eight positions, including Purvis. Most of these leaders have been with Coastal for four years or longer. The team has three members supporting the back office: chief technology officer; chief financial, risk, and people officer; and chief member operations officer.

The member-facing side of the organization previously fell under four executives: chief lending officer, chief retail officer, chief culture and impact officer, and chief member service officer. Today, those fall into the broader categories of chief member growth officer, chief member advisory officer, chief community impact and public affairs officer, and chief digital officer, a new role that is yet to be filled.

The digital banking channel is a key priority for the credit union in the near term. Four years ago, Coastal was one of 13 credit unions that invested in Constellation Digital Partners, which offers an open platform and a network of fintech partners designed to free credit unions from depending upon a single technology provider. The first phase of implementation at Coastal will introduce a number of new digital services to members. The credit union will spilt IT responsibilities, normally handled by the CIO, between the chief digital officer and chief technology officer.

“Our vision is to enable digital delivery of everything we do for a member,” Purvis says. “I needed an executive that was exclusively focused on digital channels and rolling out our vision for apps for members without the burden of worrying about our infrastructure.”

Recognizing that the best opportunity for growth is among existing members, Coastal now has a chief member growth officer, which includes marketing, product development, member experience, and analytics — all of which is aimed at increasing retention. The chief member advisory officer role includes branch advice and sales, digital sales, wealth management, loan origination, and overall member financial wellbeing.

“On the operations side, the chief member operations officer functions in a role similar to a COO,” Purvis says.

Pockets of operations that were previously located throughout the enterprise now report to one executive, who can focus on increasing efficiencies through robotic process automation and adopting a common set of tools throughout the enterprise.

“It’s about consistency, efficiency, and flexibility in staffing,” the CEO says. “Being able to move folks around based on where demand or volumes are.”

According to Purvis, one advantage of the new structure it that it exposes leadership team members to a broader set of disciplines and offers the opportunity for professional growth in the future, potentially with EVPs leading the two sides of the organization.

“There’s an element of succession planning underlying all of this,” Purvis says. “I am a firm believer in pushing my executives to take on functions or roles that might not be natural to them. You might be an expert in one of these areas, but if you’re going to be a CEO, you’ve got to be able to lead them all.”

Meritrust FCU: Driving Growth And Technology

Meritrust Federal Credit Union ($1.6B, Wichita, KS) is at a major inflection point. Although Meritrust is the largest credit union in Kansas, until recently its growth has been restricted by charter to three large communities. In 2019, the credit union converted to a federal charter, but its growth plans were hit by a double whammy — COVID-19 and the grounding of the Boeing 737 Max, which is manufactured in Wichita.

“We’re coming out of that,” says James Nastars, who joined Meritrust nine years ago as president and CEO. “The city is going through a bit of a renaissance, so we’re looking at how we can be good community stewards. How can we plug into the community to help make that happen? How can we leverage community growth to help grow the credit union?”

Rather than focusing on a three-year strategic plan, Meritrust’s board developed a 10-year plan for the credit union’s future, with a focus on creating financially healthy members, and Nastars’ leadership team is organized around delivering on that plan.

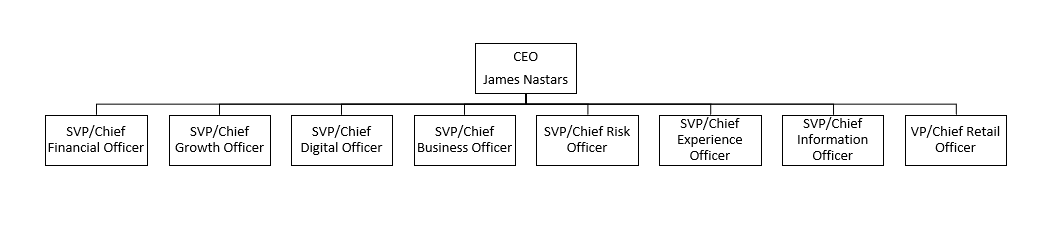

Seven senior vice presidents and one vice president report directly to Nastars. Those roles are: chief financial officer, chief growth officer, chief digital officer, chief business officer, chief risk officer, chief experience officer, chief information officer, and chief retail officer.

“I probably have more direct reports than most CEOs of credit unions my size, but that’s by design,” Nastars says. “I’ve got good folks in these roles. They’re not high maintenance, and they’re smart people. It doesn’t keep me from spending time on strategy. That will likely change as we get bigger, but for right now it’s working well.”

Like Coastal Credit Union, Meritrust is an investor in Constellation Digital Partners and is planning to rollout a new digital banking platform as well as adopt emerging technologies such as blockchain, artificial intelligence, and robotic process automation. Meritrust is also part owner of Bonifii (formerly CULedger) and will be implementing the CUSO’s member path solution.

Under the leadership structure, the chief digital officer oversees all digital channels, including digital payments. The CIO manages IT infrastructure services, emerging technologies, and data analytics.

“Those things are big in and of themselves, so we need to split them between two people,” Nastars says. “We’re trying to leverage other credit unions and other fintechs to solve some of these things because we know it would be difficult for us to do on our own.”

The credit union created the chief experience officer role in 2015. That role includes both member and employee experience.

“It’s everything to do with the employee experience and the member experience under the philosophy that if we have happy and engaged employees, in turn, we’ll create happy and engaged members,” Nastars says.

Meritrust’s chief growth officer oversees lending, CRM, community engagement, and sales. Some sales activities overlap with the chief retail officer, chief business officer, and chief digital officer, so the chief growth officer ensures the credit union’s sales efforts are coming from the same place and everybody is moving in the same direction, Nastars says.

“The risk of having a large leadership team is that they can get siloed,” Nastars says. “But that’s not the case right now. They work well together.”

TDECU: Managing Risk And Compliance

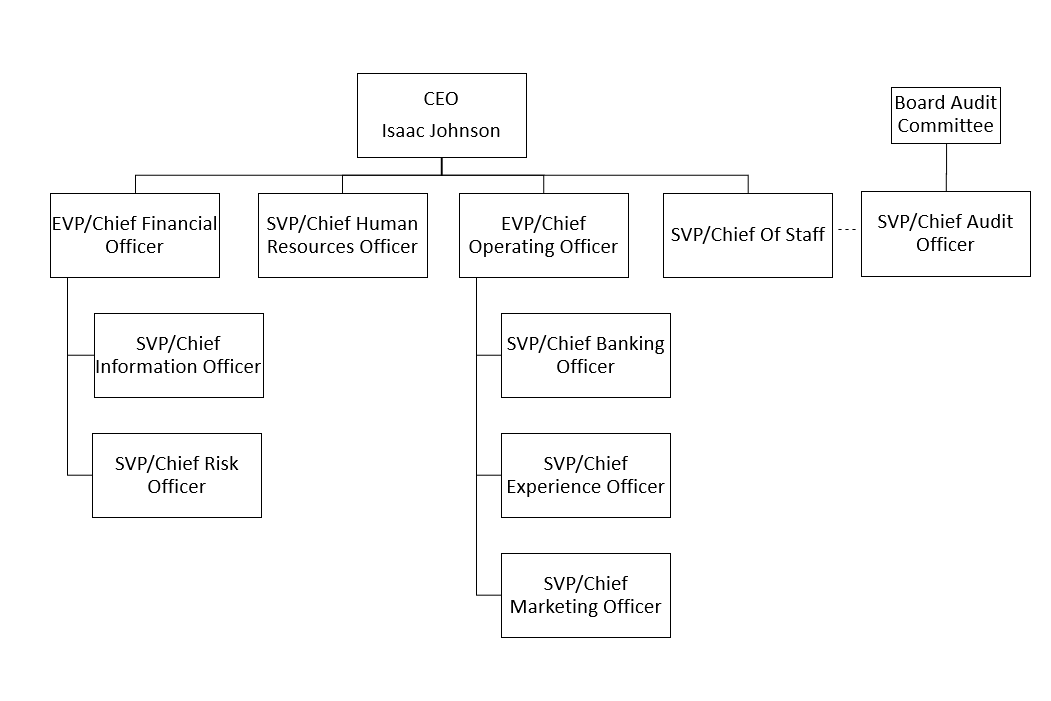

Isaac Johnson has had two careers at TDECU ($4.5B, Lake Jackson, TX). He first joined in 2014 as the organization’s first general counsel and later chief risk officer. In 2018, Johnson, a commanding general serving in the U.S. Army Reserve (351st Civil Affairs Command), was called to active duty and stationed in South Korea.

Back in the states two years later, Johnson took a job as corporate secretary for the board of directors of USAA. In 2020, however, he rejoined TDECU as chief administrative, legal, and diversity officer. A year later, he moved into the role of president and CEO.

With such a firm foundation in risk and compliance, it’s no surprise those functions are key pillars in TDECU’s organizational structure. In fact, Johnson says he has seen other organizations struggle with compliance and operational challenges and is applying their lessons learned to TDECU.

Johnson has four direct reports. An EVP/chief financial officer manages the back-office side of the credit union, while an EVP/chief operating officer manages the front-office side. In the middle is the SVP/human resources officer, which Johnson describes as the glue to keeps both sides together. His fourth direct report is an SVP/chief of staff, who oversees strategy, program management, and communications, plus has a dotted line relationship with the SVP/chief audit officer, who reports directly to the board’s audit committee.

“We were looking for clarity of functions,” Johnson says. “We were looking to be a compliant company, and we were looking to streamline systems and processes. We were looking for very clean lines.”

He adds that as TDECU grows and eventually reaches $10 billion in assets, the right structure to address increased regulatory scrutiny will already be in place.

Johnson says his decision to appoint a chief of staff was influenced by seeing the value of that role in the military. The chief of staff consolidates day-to-day status updates and helps keep priorities on track. When he was traveling, for example, Johnson says he would have to make up to six calls to find out what’s going on at the credit union.

“Our chief of staff is constantly interacting with senior leaders, including the EVPs,” Johnson says. “In that role, he’s influencing, not directing, them to ensure they’re aligned to our goals, objectives, and purpose. On a side note, he takes care of some issues before they reach me. He is also a problem-solver behind the scenes.”

After returning to TDECU, Johnson also focused on clarity of purpose for the organization. Instead of a standard mission, values, and purpose statements, TDECU now has a concise purpose statement: helping people navigate their financial journey. The business is organized around three strategic pillars: banking excellence, member experience excellence, and operational excellence. This provides goals for each side of the organization with member experience sprinkled across both.

“Our structure is helping to support our strategic pillars over multiple years those don’t change,” Johnson says. “We have programs and projects we implement yearly to drive excellence in those pillars. This a journey, and I don’t think we ever get to an end state of improving that experience and reaching those goals for excellence.”

Ideally, Johnson says, he can manage up to six executives and have an impact on each one’s professional development.

“I take a personal interest in the development of my leaders,” the CEO says. “Beyond six direct reports, what value am I able to bring to help grow these individual executives?”

Credit Union Policies At Your Fingertips

The Policy Exchange from Callahan & Associates is the best resource available to share and download credit union policies. View an array of workable templates, documents, and policies, and learn how they can help your credit union.