The National Retail Federation projects consumers will spend a record $730 million in November and December 2019, up by as much as 4.2% over last year. At the same time, Americans are expected to take on an average of $1,100 in holiday debt through credit cards, retail charge cards, and personal loans.

National banks have all but abandoned traditional Christmas Club savings and loan specials, but credit unions across the country are standing behind these time-tested offerings, adding new products to the mix such as pre-approved loan offers, skip-a-payment, credit card deals, and post-holiday debt consolidation.

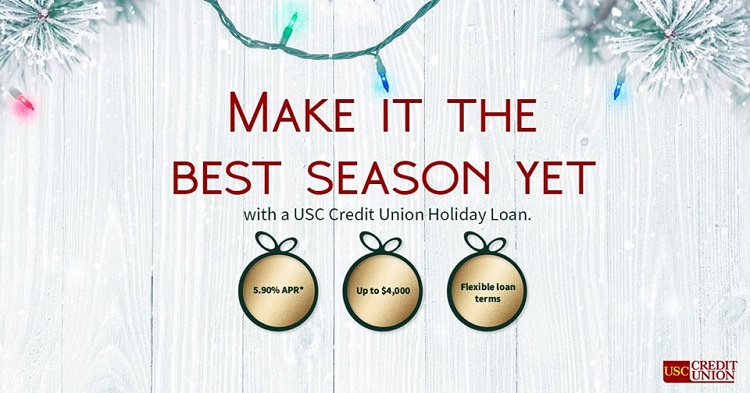

We’ve had the Holiday Loan for more than 30 years, says Valerie Ives, vice president of digital experience at USC Credit Union ($580.4M, Los Angeles, CA). It’s one of our most popular products. Members start asking for it in the early fall or late summer. Many have taken out the loan every year for a decade or more.

USC Credit Union has offered its Holiday Loan for more than 30 years, and it continues to be one of the California cooperative’s most popular products.

Here’s a dusting of the holiday products offered this year in credit union land.

Holiday Loans

Members at ClassAct Federal Credit Union ($227.1M, Louisville, KY) can take out a holiday loan with an interest rate as low as 5.75% 2% lower than the credit union’s standard personal loan. The loan caps at $3,000, which members can take up to 24 months to repay with no payments for 60 days.

Many members each year take advantage of this holiday promotion, says Kimberly Cyrus, marketing director at ClassAct FCU. This year we decided to sweeten the deal.

ClassAct Federal Credit Union’s holiday loan program offers a cheerful interest rate as low as 5.75%. The loan caps out at $3,000, which members can take up to 24 months to repay.

That sweetener comes in the form of a February drawing that will pay off one member’s holiday loan.

According to Cyrus, the holiday loans contribute approximately $1.5 million every year to the credit union’s $123.5 million loan portfolio. Delinquency has run 2% over the past two years but has been as low as 1% in the past.

The holiday season can be tough financially, whether it be finding cash for food and presents, paying medical bills, fixing a car, or preparing your automobile or home for winter, Cyrus says. We strive to be a resource to the community. The Holiday Loan is one of the many ways we do that.

Further north, CoVantage Credit Union ($1.9B, Antigo, WI) offers a Holiday Bucks loan that members can use for a variety of reasons, including debt consolidation, vacations, home furnishings, and more. The loan offers three tiers of interest rates ranging from 2.99% APR for loans of $20,000 or more to 4.99% APR for $9,999 or less. Members can pay back the loan over 48 to 60 months but must take out the loan by Christmas Eve.

The Holiday Bucks program from CoVantage Credit Union offers tight budgets some feliz flexibility. Members can put the money toward a variety of expenses, including debt consolidation, vacations, home furnishings, and more. Interest rates start at 2.99%.

Pre-Approved Loans

In addition to its Holiday Loan with a 6% APR and no application fee, HOPE Credit Union ($302.7, Jackson, MS) offers pre-approved personal loans of $1,000 for 12-month terms, a 10% APR, and no application fee.

Many people go into debt during the holidays trying to take care of their families, says Sandra Patterson, senior vice president for lending at HOPE. We want to make sure they can stay on the correct financial journey.

A $1,000 pre-approved personal loan that offers 10% APR and no application fee helps HOPE Credit Union members steer clear of expensive credit card debt during the holidays.

In 2018, the credit union pre-approved approximately 3,000 loans and closed 763. And to make the loan more broadly available, it has loosened some pre-approval criteria. For example, an overdraft no longer disqualifies applicants.

We wanted to make sure we were not too harsh on our requirement, Patterson says. Making this loan to our existing membership is low risk. And, it’s a great way to help during this time of year.

Pre-approved loans for $1,000 have been so popular at nearby Navigator Credit Union ($329.5M, Pascagoula, MS), marketing has increased direct mailers during the holidays. In the past, the credit union sent mailers with a loan voucher in time for Black Friday but has backed up the launch to earlier in November to accommodate an earlier shopping season. According to marketing director Cheryl Cooper, approximately 20% of the offer’s recipients return a signed voucher by Dec. 31.

We make it as easy as possible for members, Cooper says. They can deposit the voucher. They can call and give us the unique code to activate it. They can stop by a branch or an ATM and deposit it into their savings account.

Credit Card Rewards

Although personal loans are popular, a 2018 consumer survey indicates that 68% of new holiday debt is charged to credit cards. And that debt doesn’t come cheap 55% of respondents reported paying between 10% and 29% in interest. Credit unions are responding with holiday credit card offers of lower rates, no transfer fees, and special incentives.

Members that hold the Navigator Platinum Rewards Card can take advantage of triple rewards through Dec. 31. The card includes no annual fee, no balance transfer fee, and no cash advance fee. Cardholders also earn unlimited uChoose Rewards, including cash back.

Navigator Credit Union offers triple rewards on its credit card during the holidays. Members can redeem for event tickets, electroics, spa treatments, apparel, travel, and cash any time of the year.

We encourage members to have a card like ours with fewer fees and a lower interest rate, Cooper says.

In addition to a 5.99% APR Holiday Loan, MassMutual Federal Credit Union ($252.0M, Springfield, MA) is offering double rewards through Dec. 31 on its Visa Rewards Credit Card.

Members swipe and save at Mass Muutal Federal Credit Union, which offers double rewards on its credit card through the end of the year.

Our members like both of the credit cards we offer, says Jackie Lopez, marketing manager at MassMutual. We have a low-balance, plain vanilla credit card that offers low interest rates for members who carry balances. Those who pay it off like to take advantage of the rewards points.

Extra Credit Union ($231.9M, Warren, MI) combines loan and card promotions for the holidays with a special credit card APR offer of 4.99% for 12 months on balance transfers and no balance transfer fee. Members can also take out a holiday loan of $500 to $2,000 through Jan. 8.

Naughty or nice, members at Extra Credit Union can take advantage of loan and credit card promotions during the holidays. Members don’t have to pay a balance transfer fee on their credit cards, or they can take out a holiday loan up to $2,000.

The holidays are wonderful, crazy, amazing, and, sometimes, stressful, says Ruthann Varosi, marketing manager at Extra. The holiday loan helps eliminate some of that stress and gives people a little extra jingle in their pockets for holiday expenses.

Skip-A-Payment And Debt Consolidation

Skip-a-payment programs and debt consolidation loans are growing in popularity in the holiday special arsenal. Skip-a-payments are typically limited to auto or personal loans, but that extra money can still be beneficial for members during the holidays.

Last year, White Eagle Credit Union ($108.4M, Augusta, KS) helped members access $22,425 through skipped payments.

This year we are surpassing this number with double in Skip-a-Pay, and our number of Holiday Loans is up too, says Debi Devor, marketing director at White Eagle CU.

Skip-a-payment programs and debt consolidation loans are growing in popularity for holiday promotions at credit unions. Whate Eagle Credit Union has helped members access more than $20,000 through skipped payments.

What about the debt hangover that comes after the holidays? Advantis Credit Union ($1.5B, Clackamas, OR) prefers to forgo the holiday specials in favor of a 1% APR discount on personal loans beginning in January.

We will likely do about $9 million in unsecured loans in the first quarter, says Kyleigh Gill, communications and community engagement manager at Advantis. Most of which are debt consolidation loans to pay off credit card debt.