Have you ever considered implementing a shiny new service innovation or an efficiency-laden delivery channel but held off because of worries that the option wouldn’t fly with your membership? As it turns out, credit unions can paint a much clearerpicture of potential adoption rates as well as the resulting impact on efficiency membership growth,and even return on assets by proactively identifying, segmenting, and growing their early adopter membership segments.

Although these groups may look very different on paper, each has certain tendencies including independence and mobility, an appreciation for convenience over interaction with employees, or a familiarity with next-generation consumer technology that makes them more open to new services and delivery channels than the average member.

Building A Profile Of Early Adopters

According to a 2012 BAI Research study, current channel preferences particularly for high-tech, self-service options such as mobile banking, mobile payments,and remote deposit capture (RDC) can indicate how open individuals will be to adopting next-generation technology.

Young members are one prime target, but be careful not to clump all of these individuals together. One segment to pay closer attention to is low-income individuals under the age of 44 who earn less than $50,000 annually. This group represents roughly21% of the banking customer population and, according to the survey, tends to favor ATMsas its primary channel, followed by mobile and telephone banking.This group also happens to be the most open to alternative payment options (for instance, anything not considered cash, check, debit, credit, online bill pay, or PayPal.)

A related subset is the emerging affluent, who constitute approximately 7% of the banking population. These individuals are classified as age 29 or younger and earning more than $50,000 annually. Although they too prefer ATM, mobile, and phone bankingover other options, they are far more inclined to use these self-service channels (and subsequently disinclined toward traditional ones) than any other demographic group. They are also the second-most inclined toward using alternative payments of any other group.

There’s certainly plenty of opportunity in Gen Y segments, but don’t discount your older members just yet, particularly if they’re wealthy. The final group that stood out in the BAI study was consumers age 30 or older who earned $125,000 or more annually. These individuals account for 11% of bank customers and, though they are most inclined towards the online channel, they are also more open to using mobile or telephone bankingthan any others in that age bracket. Affluent groups of any age, along with boomers, tend to show a much stronger affinity for RDC than any other consumer segment.

Younger member aren’t apathetic to RDC; it’s just that they already expect it, says Tony Rasmussen, senior vice president of payments and business services for Mountain America Credit Union ($3.4B, West Jordan, UT). Older members tend to be more delighted with the option because they remember having to do deposits in much less convenient ways over the span of their lifetimes.

With 16% of its membership consistently using some form of mobile banking, Mountain America has also seen its mobile deposit activity increase nearly a million dollars a month over the past year, driven by adopters of all ages.

According to BAI’s research, when viewed holistically, the pool of early adopters is anything but shallow, representing up to 40% of all financial consumers.

Why They Matter

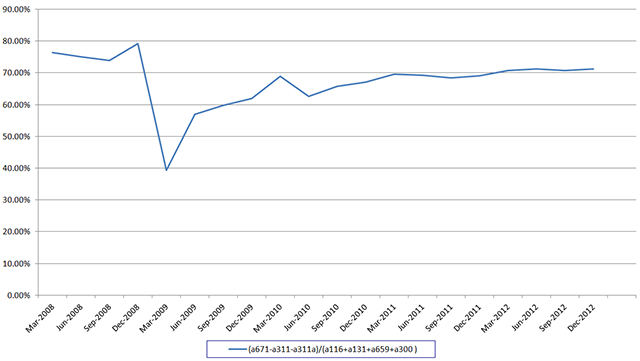

According to Callahan & Associates Peer-to-Peer Software, the average efficiency ratiofor credit unions nationwide has risen 2.1 percentagepoints year-over-year to 71.3%, and even small increases in adoption of self-service options can help keep these expenses in check.

EFFICIENCY RATIO (MINUS PROVISION FOR LOAN LOSS)

All Credit Unions In US | DATA AS OF DECEMBER 31, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’ Peer-to-Peer Software

On the surface, early adopters may not seem as profitable as other segments particularly the younger segment. However, financial institutions that do a good job of attracting and developing early adopter segments are seeing quite the opposite.

According to a recent press release,Desert Schools Federal Credit Union($3.1B, Phoenix, AZ) discovered that early adopters of its mobile banking technology were two times as profitableas the members who didn’t use that channel.

Early adopters can also be powerful assets for generating referrals to the institution, or convincing others to try a particular product or service, says Rasmussen.

We had one member in his 50s who is responsible for not only bringing over 80 people to the credit union since he joined in his 20s, but who has also demoed our mobile banking service to over 25 people, Rasmussen says. He told usthe people he talked with were a little hesitant about the technology until he showed them how it works then they were sold.

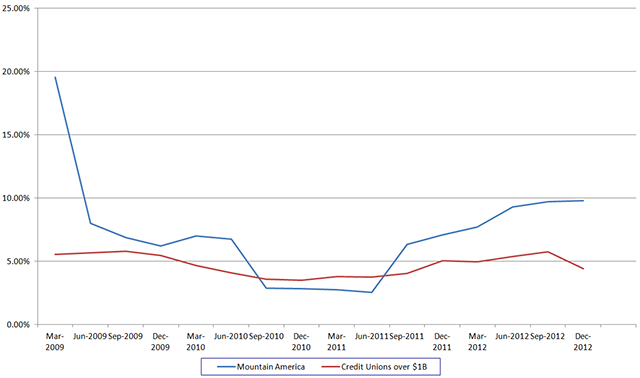

MEMBERSHIP GROWTH

DATA AS OF DECEMBER 31, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’ Peer-to-Peer Software

Indentifying And Converting The Holdouts

Although there is certainly potential in any marketplace, the intensely local focus of many credit unions means that their early adopter populations may be much larger or smaller than national averages, based on the particular region or even the typeof accounts served.

For example, although small business owners have a high propensity for using mobile products to track various components of their operation, they also tend to lag behind ordinary consumers when it comes to adoptingfinancial technology, says James Hughes, research analyst for BAI. In all, a bank’s small business customers still choose to conduct roughly two-thirds of their financial businessin a branch.

Yet, many small businesses may shun remote service simply because they were never informed such alternatives were available, or because their institution failed to highlight the potential benefits of these options.

Small businesses are one of our biggest users of mobile deposits, as they are highly motivated by time and cost savings, Rasmussen says. Within the first few months of offering mobile deposit, we had several small businesses rangingfrom dentists to truck drivers who were power users of this technology, with some depositing as many as 20 checks a day.

Likewise, nearly every institution has a segment of members who still want to conduct transactions in the branch, but that doesn’t mean that these individuals can’t be early adopters as well. Emerging options such as kiosks and remote tellersare having a significant effect in modifying branch visitor behavior, blending the benefits of self-service without eliminating the human interaction or service standards these members hold dear.

Today, 48% of loan volume at Element Federal Credit Union($26.6M, Charleston, WV) is generated by online, kiosk, mobile or other self-service interaction, yet the remaining 52% ofloan interactions are also being streamlined by new technology. Not all members fell in love with these options at first sight, but a series of strategic pushes in consumer awareness complemented by employee assistance when necessary has helped encouragemembers to accept and use these options.

Whether it’s iPads, Skype, or another new remote service, we are constantly introducing our members to new technology, says Kristin Miller, a member services representative for the credit union. We have oldermembers come in who haven’t ever used these things, and we’ll go over it with them one-on-one so they can see how easy it really is.

By not only generating new service options but also strategically cultivating a captive audience willing to use them, Element has been able to maintain an efficiency ratio that is more than 20% lower than its comparable peers (69.2% versus 92.7%).

Whether our members consider themselves techies or not, they are because of the services they use to connect and do business with us, says Samantha Painter, assistant manager for Element.