Since its founding in the 1960s, WEOKIE Federal Credit Union ($1.4B, Oklahoma City, OK) has grown to be one of the largest financial institutions in Oklahoma, serving more than 63,000 members in the capital city and surrounding counties.

“Our mission is to change lives in our communities one person at a time by being the best place our employees have ever worked and our members have ever banked,” says CEO Jeff Carpenter, who took the helm in early 2021. “We’ve been somewhat stagnant, so we revamped the entire organization.”

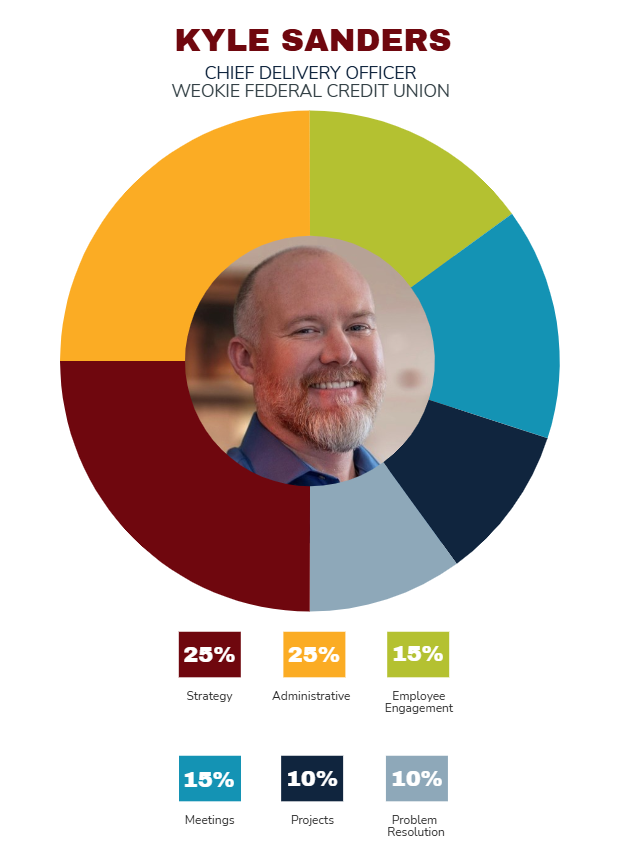

That renovation included adding a new member to its executive team. Kyle Sanders joined the Oklahoma cooperative on Jan. 6 as its chief delivery officer. Here, Sanders and Carpenter offer thoughts on the new title and how it reflects WEOKIE’s strategic direction.

What led WEOKIE to create this role? What are the responsibilities of the chief delivery officer?

Jeff Carpenter: The role was created after our former COO retired in February. Kyle took over a significant portion of their responsibilities under a new title, which focuses on how we deliver products and services to members. This includes our 14 branches, our digital contact center, which has about 17 employees, and our ATM solutions. Other areas he oversees include facilities, operational support, and our CUSO, WEOKIE Financial Group, which provides investment services. The goal is to modernize every delivery channel and stay focused on how members access our services.

Kyle, talk a bit about your professional journey and what brought you to WEOKIE.

DID YOU KNOW?

WEOKIE FCU gets its name from its original SEG at Western Electric, a utilities company. The employee association was called The Okies. So, we + Okie = WEOKIE.

Kyle Sanders: Before WEOKIE, I was with Launch Credit Union ($1.4B, Merritt Island, FL) as an VP. I led our branch experience area, overseeing 10 branches and our wealth management program. Before that, I did a short stint as a branch manager at a community bank, and prior to that, I was a branch manager with Navy Federal Credit Union ($180.8B, Vienna, VA). So, I’ve worked at a couple of credit unions and worked my way up with a focus on retail, branch experience, and member service.

JC: I think it’s important Kyle also spent 12 years at Sam’s Club.

KS: Yes! I started when I was 16 and worked through high school and college. After graduating, I went into retail management there for six years. I honestly think everyone should work in retail or food service. You learn how to work with people, handle challenges, and build perspective.

JC: That retail experience is valuable. Kyle stood out in the interview process because of his passion. His growth mindset, alignment with our values, and ideas about WEOKIE Financial Group really resonated. He wants members to build wealth. He also noticed we were built for transactions, not relationships, and he’s now leading an evolution to change that.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What does the shift from transaction-focused to relationship-focused look like? How do you balance quality digital offerings with face-to-face personalized care?

KS: Credit unions have to evolve to keep up with fintechs and banks. Our differentiation will be through relationships and service. COVID really shifted things. A lot of people were forced to try digital. Since then, branch transaction volume has dropped. So, we’re changing the language from “branches” to “member relationship centers” and reframing our culture. In the branches, a lot of our focus is helping members learn to use digital tools. The contact center side is adding AI service tools, too. So, to me, digital is about combining the human touch with digital accessibility.

JC: Kyle’s work is helping reduce transaction volume so our staff can focus on those deeper relationships. We have 30 certified financial counselors, and now we’re going to use that expertise.

CU QUICK FACTS

WEOKIE FCU

HQ: Oklahoma City, OK

ASSETS: $ 1.4B

MEMBERS: 63,143

BRANCHES: 13

EMPLOYEES: 228

NET WORTH: 13.3%

ROA: 0.55%

What’s in the pipeline right now that is exciting?

Kyle Sanders: We’re working to introduce deposit-taking ATMS as a new delivery channel. They’ll be 24/7 access. We’re looking into adjusting our hours, too.

Jeff Carpenter: We’re also looking to fix the disconnect we have between branches and lending. We removed lending from branches three years ago but never built a strong referral bridge. Kyle is now helping us rebuild that. It’s not about sales. It’s about service. If we don’t tell you what we offer, we’re failing. We’re also building three new branches by 2026, the first since July 2020.

Kyle, what has stood out most about your onboarding experience?

KS: The executive team has been incredibly supportive and open to collaboration from day one. I wasn’t handed a rigid playbook. I was asked, “What ideas do you have?” That’s made all the difference.

This interview has been edited and condensed.