When Alissa Sykes was named the first chief growth officer at Sunmark Federal Credit Union ($678.3M, Latham, NY) in January, it continued a trajectory of personal and career growth that began in high school. Her job shadowing experience at local businesses, including a bank, cemented her comfort in doing math and serving people. Soon after, she began her financial services career at the intersection of the two: as a teller.

Sunmark recruited Sykes to set up a mortgage department some 14 years ago, and she quickly discovered how much better it felt focusing on what’s best for homebuyers, not how much money you can make off them.

“That wasn’t my path anymore,” she says in a 2018 interview conducted by the Sunmark 360 Content Studio. Sykes was chief lending officer and senior vice president when she was named to her new post this past January.

Sykes says she never envisioned herself as an executive when starting out; however, she has always set goals for personal and professional growth. Now, her charge includes broad responsibilities for guiding the growth at her upstate New York credit union. In this Q&A, she shares her priorities, her routine, and how she tracks success in her role.

Why was the title of chief growth officer created? What strategies and priorities does it address?

Alissa Sykes: The title was created to better align our strategic goals with the overall organizational structure. All lines of business reporting to my position strategically impact Sunmark’s growth and revenue.

Was it specific to you?

AS: Yes, the alignment was created so that all growth departments reported to one senior manager. The operational departments would then report to the SVP/COO.

What are your areas of responsibility?

AS: Marketing, mortgage lending, consumer lending, business lending, investment services, insurance services, payment services, sales, business development, and our foundation.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What made you a great fit for this job?

AS: My career in banking has been built on growth every position, from retail branch management to mortgage sales, to creating new programs, products, and positions, as well as the startup of new departments within the credit union.

What’s your daily routine?

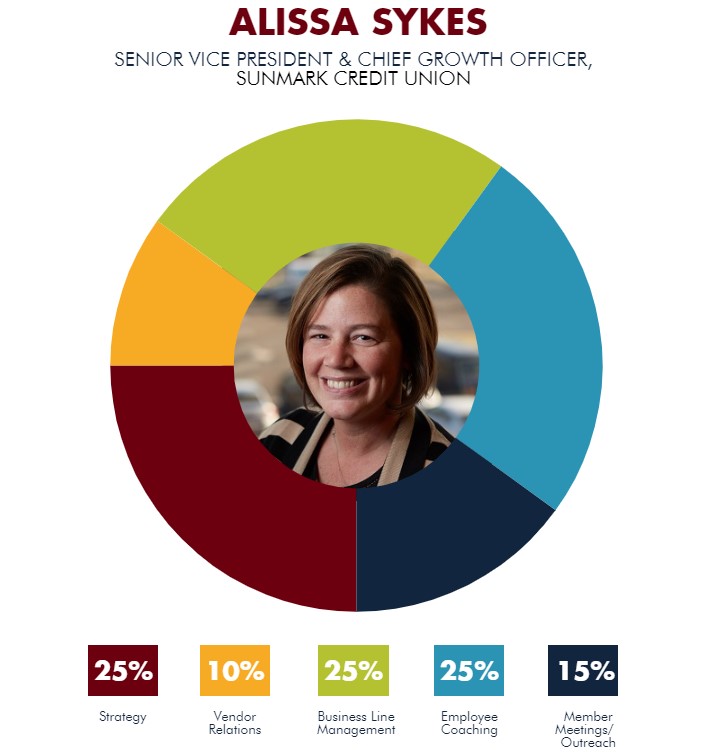

AS: I live on my phone. Emails/calendar/texts keep me organized and informed. I oversee many business lines so most of my days are filled with meetings. These can range from strategic discussions to employee coaching sessions to member and vendor meetings. I also find great value in researching growth strategies. I use various social media channels, articles, trade journals, videos, etc., to stay abreast of new ideas and/or disruptors.

How do you track success in your job?

AS: Numbers. My job is based on growth. Growth is tracked easily by member growth, member satisfaction (Net Promoter Score), income growth, expense control, product penetration, etc.

Who do you report to? Who reports to you?

AS: I report to the EVP/CFO. Reporting to me are the following: VP of marketing, VP of sales and business development, AVP of mortgage operations, AVP of mortgage fulfilment, AVP of payment services, AVP of business services, AVP of loan servicing and collections, insurance manager, investment coordinator.

How do you stay current with topics that fall under your role?

AS: I read various LinkedIn articles, CU Times, CU Journal, Rob Chrisman’s blog, Albany Business Review, ACUMA Pipeline Magazine, and Callahan ‘ Associates content. I attend numerous conferences annually and serve on many boards of directors and advisory committees within my area of responsibilities.

This interview has been edited and condensed.