Ami Iceman Haueter’s role and responsibilities have grown significantly since she joined Michigan State University FCU ($6.9B, East Lansing, MI) as the big cooperative’s associate vice president of research and digital experience in February 2019.

After less than a year in the seat, she moved into a vice president role as part of a reorganization that blended analytics and member digital service. That reorg eventually led both to a newly created member digital experience division and Iceman Haueter’s new role as chief research and digital experience officer.

Here, she talks about MSUFCU’s strategic focus and her new responsibilities overseeing nearly 10% of MSUFCU’s approximately 1,100 employees.

Why did MSUFCU create the role of chief research and digital experience officer?

Ami Iceman Haueter: Our CEO and executive team identified the need for a digital and innovation focus. Leveraging data collected in the research areas and actively making changes in our digital spaces aligned well, and the role was born. This has progressed as the credit union has cemented this focus as a key to our growth.

We now have a single source for this kind of work. I previously had a specialized team of eight. Then I took on a merged e-services department that has more than 100 people collaborating on a wonderful and inclusive digital experience. Our e-services department is responsible for technical support, live chat, loan apps, and really, all our members’ digital needs.

Did the credit union create the role for you?

AIH: I’m the first to hold the role. Before I joined the team, others in the credit union contributed to these areas, but their management wasn’t centralized. I’ve worked with our leadership team to spotlight these areas and grow them to support the needs of the credit union.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What challenges and opportunities does your role address? How do you plan to address them?

AIH: We are an experience hub that works to meet compliance and regulatory requirements while also meeting the members and our employees where they are.

My role addresses how we envision our future digital spaces, how we gather insight from members, and how we make the next best choice for the credit union and our membership. This comes with both challenges and opportunities, but it gives us room to explore what the future of finance can be.

What does creating a C-level position with these responsibilities say about the credit union’s commitment to meeting those challenges and leveraging those opportunities?

AIH: Having a C-Level position like this is an intentional statement about the credit union’s goals and focus. We know digital and human interactions have to work together to create the best experiences for our members, and we’re committed to delivering in new and creative ways.

What initiatives in place at MSUFCU address innovation and improving the member experience?

AIH: I work in close partnership with our chief of digital strategy and innovation. His team focuses on bringing new and emerging ideas into the credit union for testing and exploration. Once an idea is greenlit for long-term use, my team establishes a plan to support our fintech partners in the development. This partnership between teams allows us to support and grow our innovation initiatives and offer unique products and services.

We also work with other leaders and business units to establish where we can gain efficiencies, how we can more effectively share education with our members, and how we can partner to find creative solutions.

Truthfully, our success lies in the culture of innovation within the credit union that allows everyone’s ideas to be heard. We’re all in this together to provide the best for our members.

What are your goals for strengthening member relationships and engagement?

AIH: We’ve established KPIs for our team and throughout the credit union to track the success of our initiatives while also leaning into our member feedback and insights to drive change.

We work daily to meet the members where they are and provide products and services that fit their needs now yet allow them to dream big for the future. We’ve also established a member panel that is currently 600-strong that provides feedback and insights on our innovation projects to help us gauge interest and engagement.

CU QUICK FACTS

Michigan State University FCU

DATA AS OF 12.31.22

HQ:East Lansing, MI

ASSETS: $6.9B

MEMBERS: 336,117

BRANCHES: 23

EMPLOYEES: 1,128

NET WORTH: 10.1%

ROA: 1.35%

How do you envision working across the enterprise to create and execute on your goals?

AIH: Essentially, my role is to learn and understand. The best way to work throughout the organization is to be willing to listen and collaborate. I don’t know what I don’t know, but I’m willing to learn.

When you understand the employee journey and the member journey, you can create better solutions. So, listening, understanding, and adapting is how I like to approach our plans, and bringing those teams along to provide insight and direction — and allowing the members to weigh in — ensures we all see the outcome as valuable.

What makes you a great fit for the job?

AIH: I’m willing to learn, collaborate, and adapt. I meet people where they are, and I have a knack for helping people come together and make concepts accessible to everyone. I hope other people would say that, too.

How has your career prepared you for this new role?

AIH: I oversaw the communications division of a branding and marketing agency previous to my role in the credit union. That environment taught me to be ready for anything — to adapt and be flexible. Things can change in an instant, but you have to provide what is best for the client, their customer, or the member and never stop trying to come up with the next best thing. That environment, in some ways, forced me to lean into my strengths.

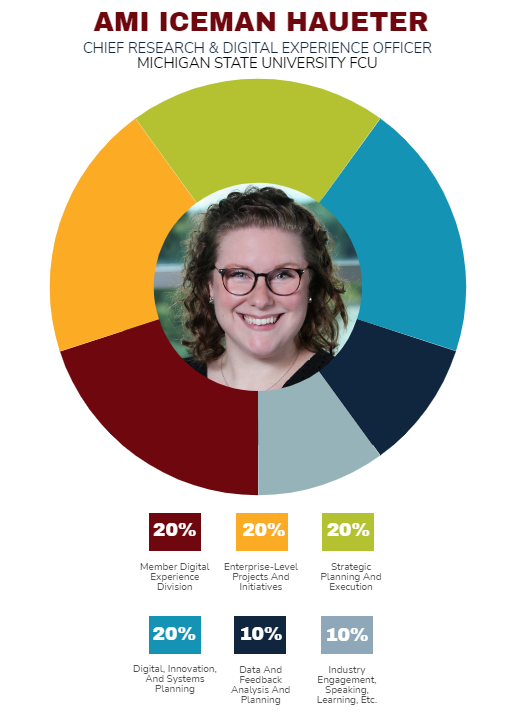

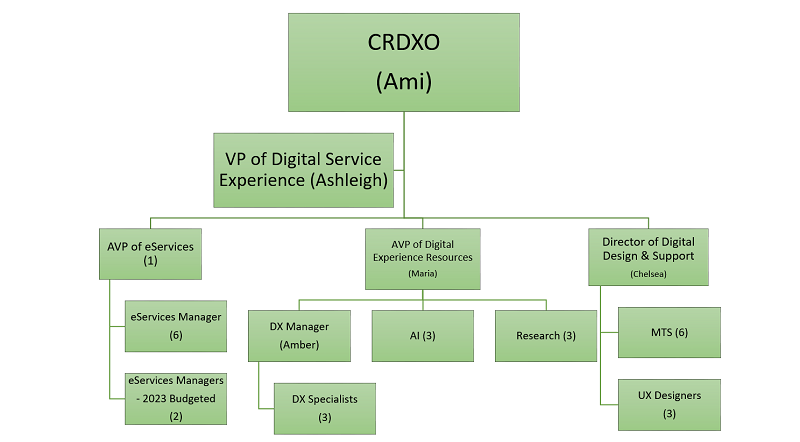

To whom do you report? Who reports to you?

AIH: I report directly to our CEO. My team consists of two areas: our e-services department, which is our digital member communications and service area — live chat, online loan and membership applications, social media, etc. — and our digital resources department, which houses our UX team, digital experience team, researchers, AI trainers, and member technical support teams. I have a vice president that reports directly to me and two AVPs and a director who report to her. We then have eight managers that support those teams.

How Do You Compare?

Claim Your Custom Scorecard

What’s your daily routine at the credit union?

AIH: I spend a lot of my time in strategic planning discussions, partner and vendor planning and communication, industry tracking, team support and building, and organizational communications. I might do this from my desk or while traveling to present at conferences or symposiums. I enjoy having a different day every day.

How do you track success in your job?

AIH: By looking at feedback from other business units and key standards I track. How is our team working alongside others? Employee satisfaction also is important. Do my team members feel fulfilled and positively challenged in their roles?

We have KPIs for each of our areas, tickets we process, digital performance measures we track, onboarding, member product use, and all those quantitative measurements. We also do a lot of qualitative feedback.

How do you stay current on topics that fall under your role?

AIH: I read a lot of articles from inside and outside our industry. I attend conferences, talk to my peers, participate in committees and workgroups, and take every chance I get to engage in training and listening.

I’ve also had the privilege to speak at several industry events and to participate in MDC’s NextUP program, Filene’s i3 program, CUNA committees, and many more exciting industry opportunities.

Goals For Digital Experience

Ami Iceman Haueter lays out her goals for the recently created member experience digital division.

- Make it easy for our team to support members and build lasting relationships.

- Make it easy for the members to find, and act, on what they need. Give them the control to create their own experience; that will, in turn, allow us to support them in personalized ways.

- Create digital spaces and solutions that are flexible enough to allow us to dream. Using data and insights to drive our understanding of our members and organization will allow us to create these spaces now and in the future.

This interview has been edited and condensed.