It was a typical day at Fortera Federal Credit Union ($883.8M, Clarksville, TN) when a pair of individuals walked in and asked for Jay Hall by name. The duo explained that their father, a Fortera member, had died and, they found Jay’s business card stapled to the top of the folder containing their father’s important financial documents.

“Around the time I started, this man’s wife had passed,” Hall says. “He was going through a lot, but part of my advice to him was that he needed to name beneficiaries to make sure his money didn’t have to go through probate.”

The man listened, and, a year later, his children knew exactly who to reach out to.

“It’s a very serious job for me,” Hall says. “It’s not something people like to talk about, but it’s something that is inevitable.”

That’s why Fortera created a role — the member care specialist — to ensure members’ accounts are settled properly and with care when they pass.

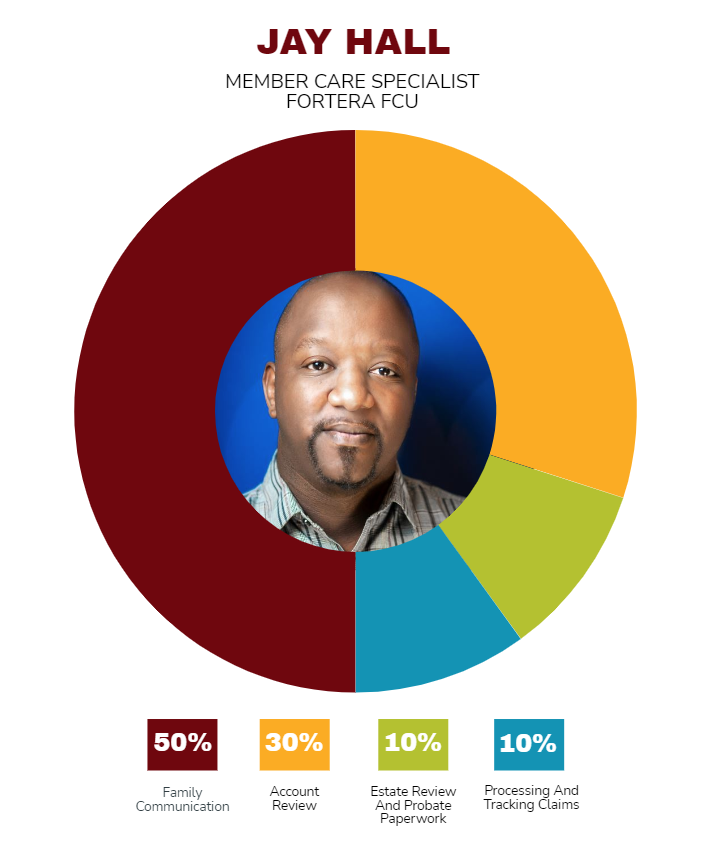

Here, Hall shares more about his primary responsibilities, his approach to difficult conversations, and how his role fits into the overall goal of helping members during every stage of life.

What are your primary responsibilities as a member care specialist?

JH: My role is to provide support during a challenging time for families. This includes reviewing the member service agreement for confirmation of joints and beneficiaries and making any necessary adjustments. I also file any payment protection claims they might have for their loans and credit cards. I mainly seek to provide what we call a white glove service for those families — being there and doing everything I can to assist.

Who do you report to? Who reports to you?

JH: I report directly to the regional operations manager. I don’t have any direct reports, so I’m able to focus on my responsibilities.

When did Fortera create this role? How has it evolved over time?

JH: Fortera created the position in March 2023. I had already been with the credit union for about a year working with our contact center team. When I came over, there really wasn’t much of a set process in place. It was more or less handling things case by case.

When I came into my role, we developed a game plan to try to better help the families. Now we provide a more constant, consistent voice for our members. We’re not having to worry that if a member goes to one branch, they get one answer, and if they go to another branch, they could get a different answer. It’s providing that consistent message.

Want to see Fortera FCU’s job description for its member care specialist? Browse hundreds of ready-to-use job descriptions in the Callahan Policy Exchange and tweak your favorites to make hiring as efficient as possible. Learn more today.

How do you collaborate with other departments in the credit union when managing a deceased member’s accounts?

JH: Part of our company values is that we are one team. I work with every department. I can work with payment operations for handling deposits and any reclamations that need to be sent back to DFAS. I can work with consumer lending to help with mortgages, payment protection claims, or if a member simply needs to pay off the loan or get the title.

I also work with our current resolutions department. They handle a lot of collections, debts, and assets. They also offer hardships for some of our members, so that’s always an option.

Our contact center works with our front-line teammates because they assist with that conversation, usually. I can’t be everywhere at the same time. So, for me, it’s about giving them the tools they need so when the family comes in we’re able to give them the information just the same as if it came directly from me.

What qualifications made you a great fit for this job?

JH: I was in the military for 13 years and did death notifications, notifying families their brother, sister, husband, wife had passed away overseas. During that time, I honed my ability to handle sensitive and very challenging situations with empathy and professionalism. It equipped me to manage the delicate task of assisting families through the process of managing their loved one’s financial affairs.

Military training also emphasizes precision and thoroughness, which is crucial. You want to make sure you’re providing accurate information because that’s how you lose trust.

I’ve also been in the customer service industry for more than 10 years. That, of course, has improved my communication skills and problem-solving. Really, my life experiences put me in a great position to better help our members.

Do you have specific training or certifications?

JH: The main requirement for the role was having an in-depth understanding of the credit union’s product, services, and systems. This means familiarity with financial products, member services and internal processes.

I also have my credit union financial counselling certification. It allows me to offer informed advice on financial planning and help families understand their options for estate management, paying debts, and distributing assets.

What are the first steps you take when notified of a member’s passing?

JH: The first step is an account review. I have to confirm if the account has joints or beneficiaries. That’s the most important step because it allows us to understand who has the authority to close the account and what additional steps they might need to take to close it if there aren’t any beneficiaries or joints.

Next, I review deposits, safe boxes, loans, and things like that. That way we can develop a game plan when communicating with the family so they have the tools they need to move forward.

How do you approach sensitive situations when dealing with grieving families?

JH: I always start by acknowledging the loss of their loved one. I validate their grief and show I’m aware of the emotional stress they are under. It’s important to give them time and space to express their feelings. I’m active listening while giving them a chance to say how they feel and not rush them.

I try to show I care about their wellbeing. I introduce myself and let them know what my role will be in helping them. Some members need time. We have other members who immediately get into the mission mindset where they need to do something. So, it’s matching their pace and making them comfortable.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com. Read more today.

What challenges do families typically face when managing a deceased loved one’s finances?

JH: Being unprepared, even for those families where the member was sickly and not doing well for several years. The finality of it can be emotional.

How do you help alleviate those challenges?

JH: A lot of the time they don’t know a lot about their family member’s finances. What deposits have they been receiving? What automatic payments do they have set up? That’s where I come in.

Say I’m speaking to a joint member whose husband just passed away. Let’s see who he was set up with for automatic payments and get her the phone numbers for those agencies. Let’s get her some addresses so she can go speak with them and get that taken care of.

Was he receiving Social Security? Was he receiving VA retirement payments? OK. Let’s get those phone numbers. Let’s speak to them and establish any survivor benefits they might offer.

Of course, there is also the unpopular side of this. Did the member have any debts and obligations? How do we address those? Let’s help them get situated so that losing a loved one doesn’t also mean they have to lose everything else, too.

Encountering grief so often could be challenging for anyone. How do you make sure you are looking out for yourself as well?

JH: I had a squad leader in the military that used to always tell me to be personally impersonal. There’s no way for me to explain that other than it’s being able to be personal with someone, but I don’t take it personally. You have to create some distance between yourself and what you’re doing because I can’t help you if we’re both sitting here crying.

I will say, my team is amazing. We have so much fun working with one another. Honestly, it is a pleasure doing what I do because anytime it is heavy on me, I can talk to my team, and they put me back in a great place.

I have also been married for 11 years, so I can always talk to my wife to kind of snap me out of it. I’m never in a position where I’m alone.

This interview has been edited and condensed.