From The Gridiron To The Concert Hall, Credit Unions Are Redefining Sponsorships

Three seasoned marketers share tips and tactics to turn everyday sponsorships into avenues for connection and prosperity.

Three seasoned marketers share tips and tactics to turn everyday sponsorships into avenues for connection and prosperity.

How a trio of credit unions from across the country are tackling a universally difficult housing market.

Leaders dish on their own approaches to leading with conscious intent.

SF Fire reaches younger consumers through trusted local social media personalities.

Five specialists embedded across various departments spot opportunities to improve workflow and the member experience.

The cooperative boosts its standing with Southern California’s Hispanic community as part of a bid to expand financial inclusion.

After conducting in-depth research on income disparity and wealth gaps throughout California, Golden 1 made a five-year, $10 million investment in a local community.

Risks are evolving as rapidly as the technology. Here’s how some cooperative leaders are coping.

Credit union executives dish on network building, reciprocal participation, and how to determine when it’s time to opt out.

It takes the right people, the right tools, and the right processes to create a data-driven culture.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

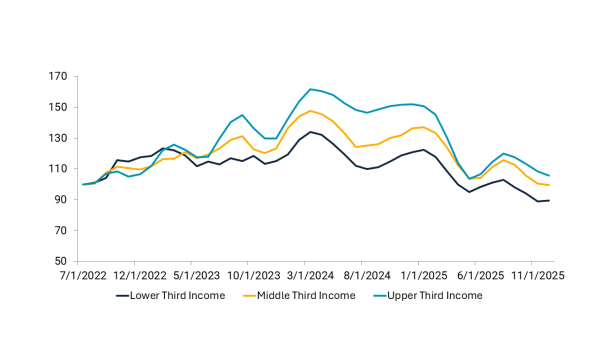

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

A veteran branch manager takes indirect lending to a new level at Erie FCU.

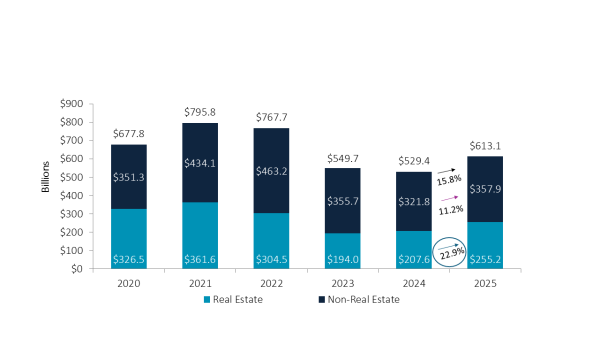

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.

Get Inspired: 3 Mortgage Marketing Pages That Sell