How Mission And Momentum Have Revolutionized Great Lakes Credit Union

Putting people first has transformed the Illinois-based cooperative into a local powerhouse that stands apart from the competition — and this is only the beginning.

Putting people first has transformed the Illinois-based cooperative into a local powerhouse that stands apart from the competition — and this is only the beginning.

The first book from Callahan CEO Jon Jeffreys outlines how credit unions can grow and differentiate themselves by putting purpose at the center of their business strategy.

How an on-campus branch supports immediate financial needs and builds lifelong relationships with members.

The first full day of the Governmental Affairs Conference included a frank assessment of threats to the credit union tax status, news about the future of the NCUA, and more.

The industry newcomer brings a deep history of development and networking to OnPath Foundation.

Mountain America’s Jennifer Tarazon helps create quality member experiences, no matter a member’s background.

The IC Federal Credit Union chief reflects on how decades spent outside of financial services have shaped his approach to credit union leadership.

An executive in charge of communications and change management aligns people and purpose to create lasting organizational impact.

Employee engagement was a top credit union priority in 2024, as the industry worked to tackle challenges like mental health, financial wellness, change management, and more.

With the Fed poised to continue cutting interest rates, the near-term outlook for the credit union earnings model is much more promising.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

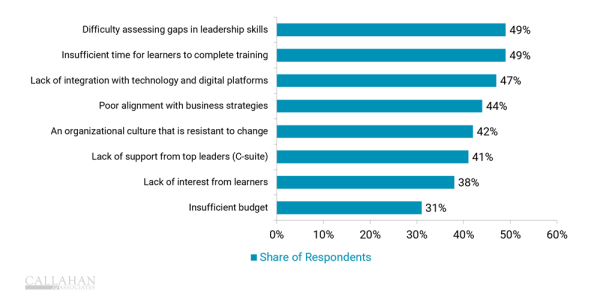

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

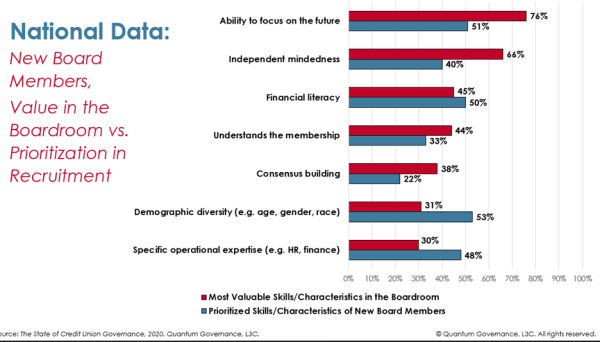

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.

Kirtland Credit Union’s five-tiered scoring system and rigorous approval process might look like red tape, but it’s streamlining resource allocation and improving efficiency for credit union for growth.

A New Framework For Growth