What’s In A Name: Chief Efficiency Officer

Kelli Wisner-Frank serves as the linchpin between finance and innovation at Community Choice Credit Union, aligning automation, smarter processes, and cost discipline to turn front-line

Your hub to learn how credit unions manage assets and liabilities, boost non-interest income, improve efficiencies and productivity, and maximize returns.

Kelli Wisner-Frank serves as the linchpin between finance and innovation at Community Choice Credit Union, aligning automation, smarter processes, and cost discipline to turn front-line

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

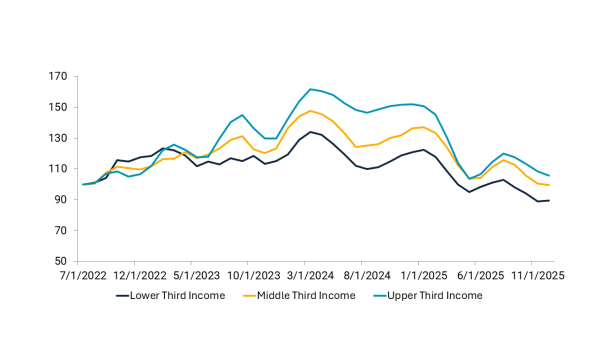

Inflation, debt, and income inequality are fueling a K-shaped, post-pandemic recovery, widening the gap between different economic segments and challenging lower-income households.

How do credit unions in Nevada stack up against the nation?

Surging credit union metrics combine with startling measures of Americans’ financial woes to paint picture of opportunity and challenge.

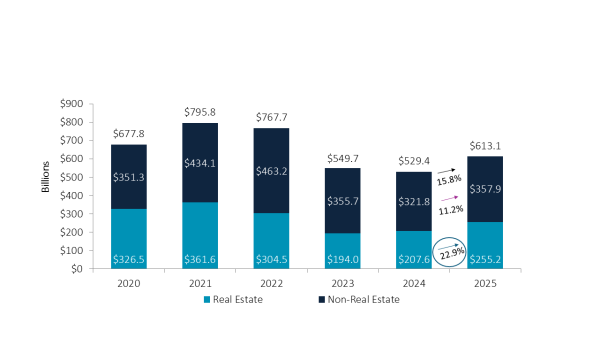

Second quarter performance data showcases current and future areas of growth for credit unions, including loans, shares, and variety of income.

A balanced salary strategy considers what other executives make as well as the credit union’s financial health.

A 53% year-over-year increase in auto loans underpins strong lending performance at the Georgia credit union.

How WSECU turned a coasting RV lending program into a true income vehicle.

While banks drop free checking and debit reward programs, credit unions see checking accounts as the first stepping stone in building deeper member relationships.

This indecision over whether to tighten rates is wasted angst.

As of March 31, 2015, natural person credit unions reported a total of $217.4 million in supplemental capital. What is this capital and where does it come from?

What sources of supplemental capital can credit unions access and how are they using those funds to improve the long-term health of their organizations and membership? Learn this and more on CreditUnions.com.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

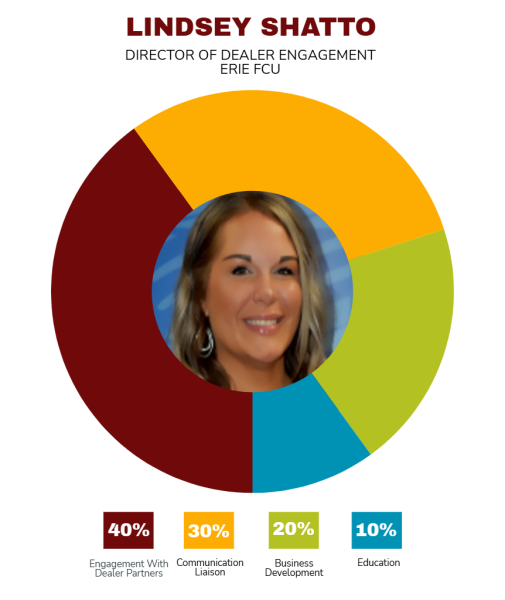

A veteran branch manager takes indirect lending to a new level at Erie FCU.

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.

The Fed Should Give Itself Room To Breathe