Strategies To Enhance Mortgage Efficiency Without Cutting Jobs

Credit unions are shuffling staff and reimagining operations to make up for a slowdown in home lending.

Our Lending page is the spot for credit union strategies on product development, operations, and pricing.

Credit unions are shuffling staff and reimagining operations to make up for a slowdown in home lending.

Credit unions are navigating regulatory compliance and setting guidelines to help mortgage, investment, and deposit teams gain more traction on social.

Forget the Beige Book — these credit union executives offer insights on what it will take to see green.

30% of college students surveyed for a LendEDU study said they used student loan money for spring break. That’s their business … and their burden.

A California credit union buys loans to ease excess liquidity while a Colorado crew sells first mortgages to firefighters.

Some mergers now appear to be little more than bank-like takeovers, without the transparency.

To serve consumers of alternative financial services, credit unions must first understand who they are and what they want.

The strong lending growth posted by U.S. credit unions in fourth quarter 2016 is an apt wrap-up for a successful year.

Targeted promotions generate enough volume to make up for the smaller margin on home equity lines at SECU of Maryland.

The inability to properly measure, manage, and predict risk appropriately has been the ruin of many a lender.

Credit Union of Southern California moved to a centralized lending environment in summer 2016. Here’s how the credit union built its team and adjusted policies.

Non-member deposits join indirect lending, MBLs, and loan participations as liquidity strategies.

There’s help out there for ensuring QC happens among people and processes.

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

Discover how First Alliance Credit Union is redefining success by putting values and member needs at the heart of everything it does.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

The combination of the right philosophy and the right technology can set credit unions up for success even during difficult economic times.

Nearly 100 credit unions are providing Buy Now, Pay Later to their members, and their banking cores are giving them a surprising competitive advantage.

A perspective from Garrhett Petrea, vice president of sales and a Zillennial, on why outdated cores threaten the next generation of members and what leaders must do now.

Driving digital delivery? Evaluating vendor platforms? Sharpening tech strategy for a new year? This week of insights is built for credit union leaders looking to stay ahead.

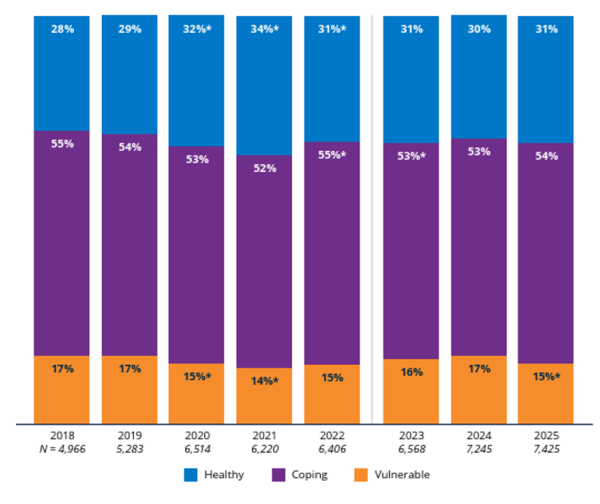

Having weathered a difficult five years, U.S households have modestly improved their financial situation in the short term; their long-term prognosis is murkier.

Third quarter performance data is a reminder that credit unions perform best when conditions are hardest.

From cross-cooperative collaboration to well-timed relief products and services, credit unions are lightening the holiday budget burden.

Credit Union “Sales” Use Secrecy To Undermine The Movement