Strategies To Enhance Mortgage Efficiency Without Cutting Jobs

Credit unions are shuffling staff and reimagining operations to make up for a slowdown in home lending.

Our Lending page is the spot for credit union strategies on product development, operations, and pricing.

Credit unions are shuffling staff and reimagining operations to make up for a slowdown in home lending.

Credit unions are navigating regulatory compliance and setting guidelines to help mortgage, investment, and deposit teams gain more traction on social.

Forget the Beige Book — these credit union executives offer insights on what it will take to see green.

The American Dream is a strong national ethos that defines this country. But has that dream evolved, and does it mean the same thing for me as it once did for past generations?

Enrollment in college and the amount of student loan debt are at an all-time high. See where two millennials at the University of South Carolina fall into the student debt narrative.

A Cleveland credit union is one of only seven of its size in the country that makes auto leases, and it does a lot of them.

How a hybrid indirect business model helps a Palmetto State credit union earn auto loan referrals and new member face time.

The St. Louis-based credit union makes a nice niche business out of a lease-like product.

There’s no secret code to control members’ actions, but gamification can still help credit unions encourage financially sound behavior.

At year-end 2016, see which credit unions lead the way in six key cooperative metrics.

At year-end 2015, see which credit unions lead the way in six key cooperative metrics.

Five can’t-miss data points featured this week on CreditUnions.com.

How a Northwest credit union partners with three other credit unions and a local CDFI lender to help microbusinesses prosper.

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

Discover how First Alliance Credit Union is redefining success by putting values and member needs at the heart of everything it does.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

The combination of the right philosophy and the right technology can set credit unions up for success even during difficult economic times.

Nearly 100 credit unions are providing Buy Now, Pay Later to their members, and their banking cores are giving them a surprising competitive advantage.

A perspective from Garrhett Petrea, vice president of sales and a Zillennial, on why outdated cores threaten the next generation of members and what leaders must do now.

Driving digital delivery? Evaluating vendor platforms? Sharpening tech strategy for a new year? This week of insights is built for credit union leaders looking to stay ahead.

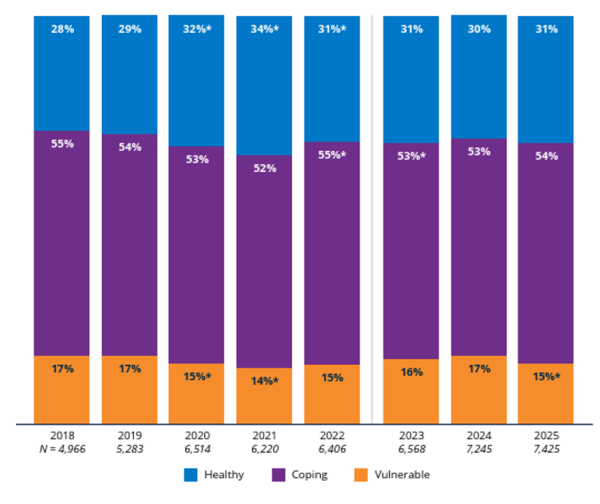

Having weathered a difficult five years, U.S households have modestly improved their financial situation in the short term; their long-term prognosis is murkier.

Third quarter performance data is a reminder that credit unions perform best when conditions are hardest.

From cross-cooperative collaboration to well-timed relief products and services, credit unions are lightening the holiday budget burden.