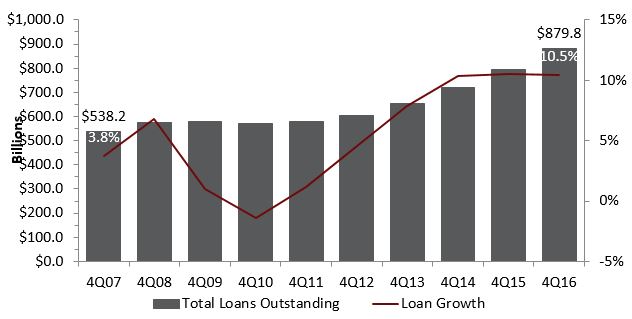

Total loan balances at U.S. credit unions surpassed the $800 billion markduring the fourth quarter of 2016. More specifically, loan balances reached $879.8 billion as the industry closed out a successful year.

This marks three consecutive years in which the credit union industry has posted double-digit lending growth.

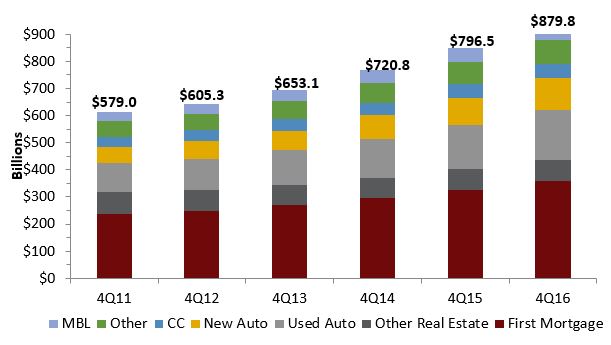

The two largest segments of the loan portfolio by dollar amount, first mortgage and used auto, increased 9.8% and 12.4%, respectively, underpinning total loan growth of 10.5%. The average loan-to-share ratio also increased from 77.4% to 79.5%.This is the highest level since the great recession and is a positive sign for consumer demand and efficient balance sheet management.

TOTAL LOANS OUTSTANDING

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.16

Source: Callahan & Associates.

Auto

According to Autodata Corp., auto sales in the United States increased 0.4% over 2015 to reach 17.55 million by the end of 2016. Credit unions captured 18.0% of theauto finance market share, an increase of 1.4% over last year. The most notable growth came from the new auto segment of the loan portfolio, which expanded 16.8% year-over-year, totaling $117.9 billion. Although new auto loans recorded the largestgrowth rate, used auto remains atop the auto loan portfolio as the largest amount, $183.9 billion as of year-end 2016.

Mortgage

Fourth quarter data confirms the advancement of Fintech companies as they competed with credit unions in the mortgage lending marketplace.

Credit union first mortgage originations rose 14.1% YOY, topping $143.5 billion. The credit union market share of first mortgages, however, decreased slightly, falling 10 basis points to 7.6% as non-bank competitors returned to the market.

With more interest rate increases from the Fed looming, consumers are actively seeking to lock in low rates for first mortgage and other real estate loan products.

ANNUAL LOAN COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.16

Source: Callahan & Associates.

Credit Cards

Credit card balances increased from $49.3 billion to $53.2 billion year-over-year, making fourth quarter 2016 the largest annual growth quarter of the past five years. This growth is the result of increased member product usage, which has also contributedto a steady growth in average member relationship balances.

The average member relationship defined as total loan balance plus member deposits, less member business lending, divided by total members increased 4.3% YOY to total $17,714 as of fourth quarter 2016.

Member Business Loans

Credit unions are investing in their communities and have financed an array of business types over the past year. Annual member business lending growth reached 14.6% in fourth quarter 2016, and MBLs amounted to $60.7 billionof the credit union balancesheet. Member business lending recorded the second-fastest growth rate in the credit union loan portfolio, trailing only new auto lending.