Every Member Has A Story. Here’s How To Use Them.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

Differences in how men and women view financial inclusion contribute to a drop in global ranking for the United States.

This year’s member analytics solutions provide inventive ways for credit unions to serve members.

A billboard contest from Financial Plus Credit Union has been a boon for BIPOC businesses owners in Michigan.

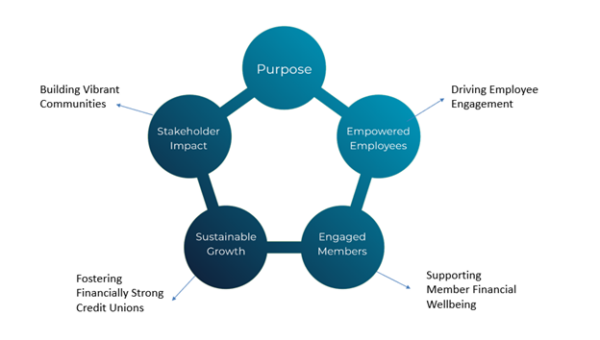

Steph Harrill Kyle helps UW Credit Union take a holistic approach to doing business by the cooperative principles.

The credit union jettisoned an outsourcing arrangement and hired more than 20 call center employees to unify retail and direct banking under a single member experience.

Watch this webinar to hear CU Strategic Planning experts talk about their next level assessment of what you’ll need to do to keep winning CDFI FA/TA grant dollars and understanding the steps to recertification. We will be looking at our Green/Yellow/Red 2024 assessments of CDFI recertification and what you’ll need to do to comply. Download

Callahan is helping leaders make the most of their time with stories meant to inspire creative, different thinking.

Daniel Garcia works across his credit union — and his community — to ensure True Sky FCU has the products, services, and relationships it needs to serve all members in its diverse market.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

Differences in how men and women view financial inclusion contribute to a drop in global ranking for the United States.

This year’s member analytics solutions provide inventive ways for credit unions to serve members.

A billboard contest from Financial Plus Credit Union has been a boon for BIPOC businesses owners in Michigan.

Steph Harrill Kyle helps UW Credit Union take a holistic approach to doing business by the cooperative principles.

The credit union jettisoned an outsourcing arrangement and hired more than 20 call center employees to unify retail and direct banking under a single member experience.

Watch this webinar to hear CU Strategic Planning experts talk about their next level assessment of what you’ll need to do to keep winning CDFI FA/TA grant dollars and understanding the steps to recertification. We will be looking at our Green/Yellow/Red 2024 assessments of CDFI recertification and what you’ll need to do to comply. Download

Callahan is helping leaders make the most of their time with stories meant to inspire creative, different thinking.

Daniel Garcia works across his credit union — and his community — to ensure True Sky FCU has the products, services, and relationships it needs to serve all members in its diverse market.

When Members Talk, Listen