Coloramo Rolls Out A ‘Real’ Strategy To Attract Young Members

The Colorado credit union has debuted a digital brand targeting young consumers and plans to make it available to the entire industry.

The best place to learn about credit unions strategies like branding, PR, social media, and engagement to attract members!

The Colorado credit union has debuted a digital brand targeting young consumers and plans to make it available to the entire industry.

Caroline Santangelo uses data insights to help Workers FCU deepen its understanding of members’ needs.

How a trio of credit unions from across the country are tackling a universally difficult housing market.

Omnichannel scheduling provides the perfect bridge from intent to action.

Credit card users today base their choice of credit card on more than four factors. Convenience is important, but so are rewards, data security, credit-building tools, and more.

Tips and tricks from three cooperatives that present personality and add a human touch to social posts.

A focus on reining in costs and changing organizational culture have transformed the Ohio-based institution.

A Massachusetts cooperative shows what financial coaching looks like when it’s done the Workers way.

VSECU is one of a few financial institutions that serves the needs of cannabis businesses in Vermont. By doing so, the credit union addresses an area of financial exclusion within its field of membership.

As a values-based organization, VSECU takes seriously the cooperative principle of concern for community. This is evident in the community programs it supports, which range from securing better fuel prices to fighting food insecurity.

VSECU participates in a number of programs to improve the lives of the members and communities it serves. Serious support for a range of groups and projects should not be surprising coming from the second-largest credit union in Vermont one that prides itself on being a values-based organization that publicly focuses on member economic prosperity,

Three ways credit unions are creating engaged, loyal members.

Inside the cooperative’s pandemic response effort and remote working strategy.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

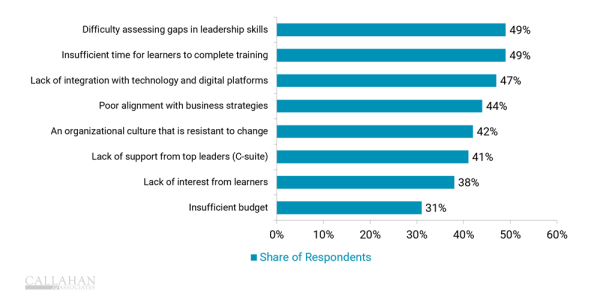

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

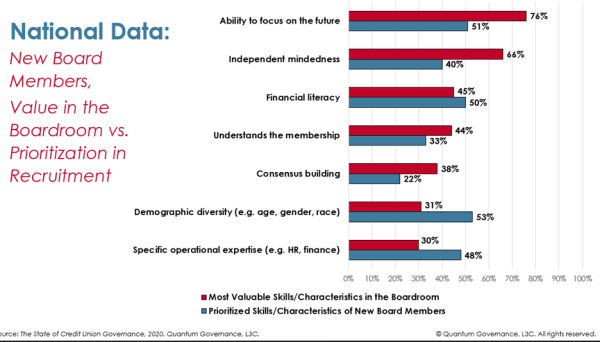

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.