3 Ways To Build A Better Member Experience

Credit unions improve the member experience through training, bilingual service, and bold branch strategies. Explore three stories that show what it takes to connect.

Our Retail & Member Experience page is the place to find credit union insights on branching, contact centers, teller technology, websites, and more.

Credit unions improve the member experience through training, bilingual service, and bold branch strategies. Explore three stories that show what it takes to connect.

A credit union branch at Lamar Institute of Technology combines products, education, and philanthropy to support job training and technical education in Southeastern Texas.

Bay FCU’s Brooke Morley improves communication and collaboration across departments to offer members the products they want and need.

Half of Americans are not ready for retirement, and with an uncertain economic environment, aging credit union members need their financial institutions more than ever.

Key steps to help credit unions thoughtfully integrate AI across different areas to ensure a secure, effective approach to artificial intelligence.

A senior technology leader at Interra Credit Union discusses being an “AI champion” and offers advice for credit unions starting their AI journey.

The California cooperative uses artificial intelligence to help staff build rapport with members. Employees love it, efficiency is up, and service is better than ever.

As digital innovation reshapes banking, physical branches remain essential for trust, expertise, and personalized service.

How a family-driven app powers more swipe, more stick, and more growth.

Learn from 2025’s top innovators in member engagement

The Rhode Island-based credit union is using internal and third-party data to better understand branch traffic patterns and consumer banking behaviors — and the results are paying off far faster than expected.

Better rates, lower fees, and steadfast community presence are returning real financial results for the credit union movement.

Best practices to encourage employee adoption and overcome change management challenges when implementing new technology across the institution.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

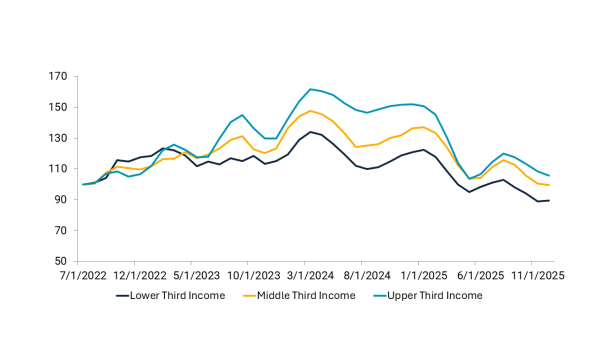

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

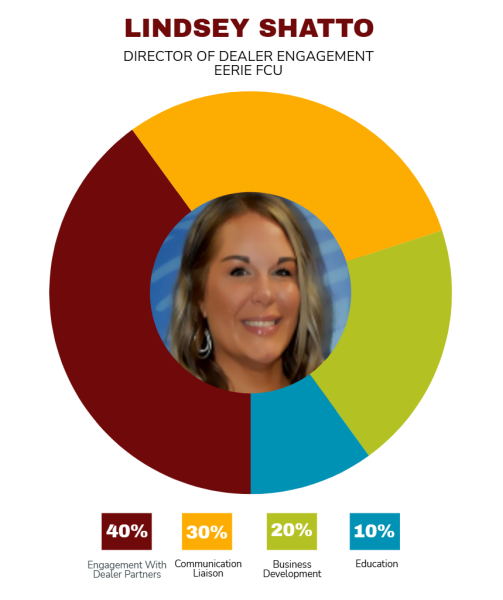

A veteran branch manager takes indirect lending to a new level at Erie FCU.

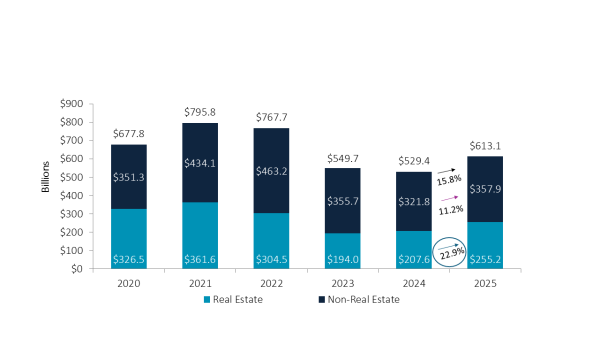

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.