Financial Wellbeing Isn’t What You Think It Is

Financial wellbeing isn’t about budgets or education; it’s about trust, confidence, and a sense of control.

Financial wellbeing isn’t about budgets or education; it’s about trust, confidence, and a sense of control.

From funerals to education to gender-affirming care and beyond, credit unions are punching up the personal loan.

A 2025 BlackRock survey presents a snapshot of retirement readiness and shows Americans are saving, struggling, and still working.

A year after launching its HUSTL digital banking brand, the Arizona-based credit union has revamped its approach.

A partnership with the Institute of Gerontology at Wayne State University has helped the credit union reduce reports of elder fraud by as much as 50%.

The next evolution in consumer payments — and credit unions that wait risk falling behind.

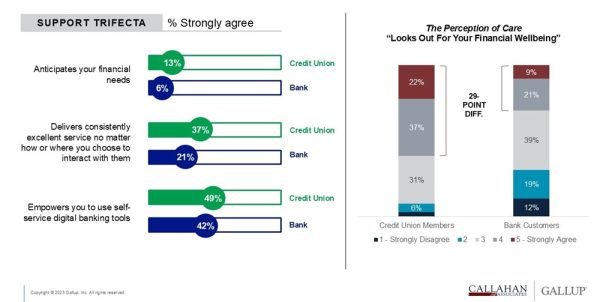

Digital experiences must be a direct reflection of the care and service credit unions are known for. Here’s where to start.

Identity continuity helps create frictionless experiences to connect credit unions with every member touchpoint across digital and physical channels.

From access to education and beyond, credit unions are putting members first in a way that’s not just about banking – it’s about financial empowerment.

Consumers are adjusting their financing habits to the new economy, and as economic realities shift, members are rethinking how — and where — they access credit.

Blaze, Consumers, and Interra credit unions pioneer a new path to liquidity under the guidance of Alloya Corporate.

A one-day event to give back has transformed into an initiative that spans several states and generates hundreds of thousands of dollars in community impact.

Are members thriving, struggling, or suffering? Just a few simple strategies can foster member financial wellbeing and boost the bottom line.

Lending, savings, community support, and more. Cooperatives unite to create lasting prosperity.

Bad actors don’t rest. Credit unions are beefing up cybersecurity with smarter tools, stronger teams, and sharper defenses.

Cyber threats never stop. Credit unions share how collaboration, AI, and smarter strategies protect members and institutions.

October is Cybersecurity Awareness Month, and CreditUnions.com has the lowdown on assessment tools, AI strategies, the role of collaboration in fighting fraud, and more.

A quartet of Northeastern Pennsylvania credit unions came together to share strategies and best practices for combatting check fraud, account takeover, and more.

From check fraud to suspicious logins, see how well you can sniff out red flags before they cost members money.

Credit unions can simplify compliance, reduce risk, and enhance member trust by rethinking loan servicing with outsourced solutions designed to keep pace with evolving regulations.

Financial Wellbeing Isn’t What You Think It Is