How KeyPoint Made $7.2 Million On Investments In 2017

The Silicon Valley cooperative consistently ranks among the top performers nationally in terms of yield on investments.

The Silicon Valley cooperative consistently ranks among the top performers nationally in terms of yield on investments.

Changes in auto lending and questions of liquidity highlight credit union performance in the fourth quarter of 2017.

Credit unions share their best practices with CreditUnions.com all year. Here, Callahan’s staff writers share their selections for a handful of lesser-known pieces that are worth revisiting.

Five can’t-miss data points this week on CreditUnions.com.

KCT Credit Union shows how arbitrage through the Federal Home Loan Bank adds income where there was none.

Five can’t-miss data points featured this week on CreditUnions.com.

A new strategy at Purdue Federal has delivered a $1.5 million bump in interest income and an anticipated 3-basis-point jump in ROA.

Five can’t-miss data points featured this week on CreditUnions.com.

Interchange income at credit unions swaps places with punitive fees as a growing driver of industry revenue.

Interest on loans drive the income train, but other revenue streams are steaming along.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

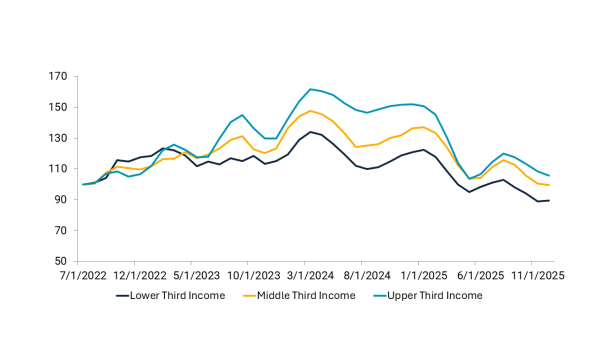

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

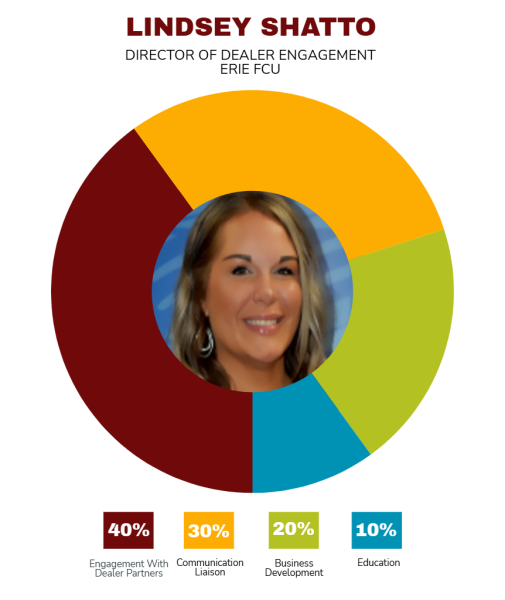

As many credit unions pull back from indirect lending to manage the balance sheet, Erie FCU is leaning in. By elevating dealer engagement to a dedicated role, the cooperative is investing more resources in a business line others are rethinking.

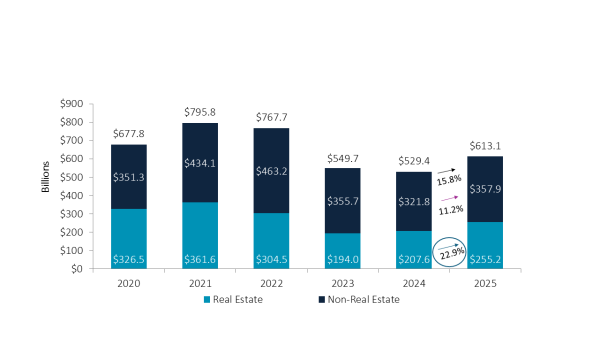

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.

The Virtuous Circle Of Lower Fees And Higher Income