As credit unions prepare for the challenges and opportunities of 2026, staffing strategy is emerging as a critical component of long-term success. Beyond growth metrics and member engagement, the right roles can strengthen resilience, drive innovation, and keep mission at the forefront.

Leaders across every level of the organization rely on CreditUnions.com for trusted guidance and actionable insights underpinned by Callahan’s collaborative work with credit unions. Conversations with everyone from CEOs and board members to branch managers and specialists offer firsthand perspectives on the strategies, challenges, and innovations shaping the industry today.

CreditUnions.com highlights six critical roles cooperatives might be overlooking. Filling these gaps is essential for success in 2026 and beyond.

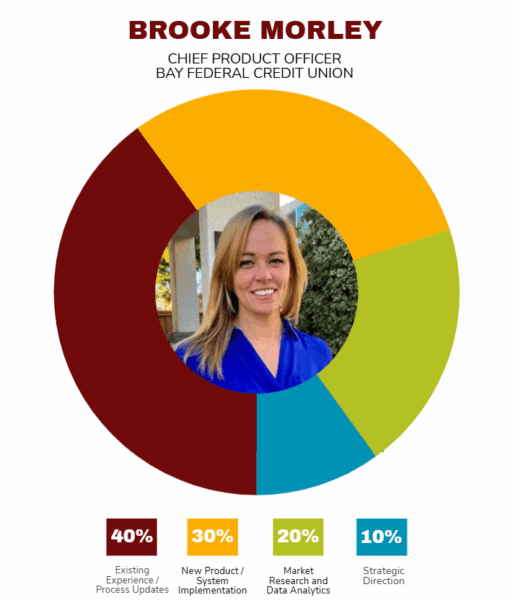

Chief Product Officer

At Bay Federal Credit Union ($1.8B, Capitola, CA), Brooke Morley focuses on streamlining implementation, bridging departments, and aligning product delivery with strategic goals.

That means monitoring things like new-product adoption rates, usage metrics, Net Promoter Scores, and more, along with asking critical questions about relevance, performance, and overall alignment with member needs.

“This role isn’t just about launching new products,” she says. “It’s about connecting dots across departments.”

Why It’s Important: This role is critical because it ensures that innovation doesn’t happen in isolation and that every product launch aligns with the credit union’s mission and delivers measurable value to members.

Senior Vice President Of Loan Analytics And Automation

No matter the size, charter, or field of membership, every credit union wants to blend efficiency and member satisfaction while reducing risk.

That’s what Andy Henline has been tasked with as senior vice president of loan analytics and automation at State Employees’ Credit Union ($56.2B, Raleigh, NC). The role entails ensuring loan-related reporting for the board and management team are timely, while also equipping back-office loan-administration staff with tools information, and process automation to complete their daily tasks.

“We want automation to enhance the member experience but never replace the personal touch our people can provide,” he says.

Why It’s Important: Automation done right helps credit unions strike the balance between operational efficiency and personalized service. By streamlining back-office processes without sacrificing human connection, SECU can reduce risk, improve turnaround times, and deliver the member experience that sets credit unions apart.

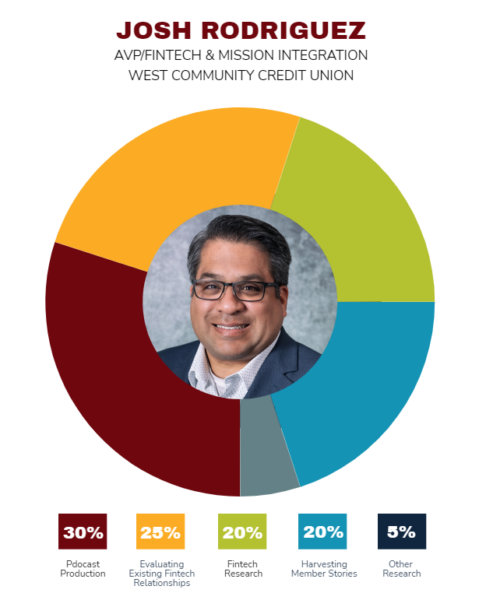

AVP Of Fintech & Mission Integration

Josh Rodriguez spent more than a decade at the helm of Missouri Valley FCU before its merger into West Community Credit Union ($494.8M, O’Fallon, MO). His new role at the combined institution blends fintech research and relationship management with ensuring the credit union is living and sharing its mission.

The role reflects his experience with IT and technology, his comfort managing people, balance sheets, and vendor relationships, and a passion for storytelling via podcasting.

“We want to bring our mission, vision, and values back to the forefront to inspire our staff and our community about how our credit union can make a difference for them,” he says. “Storytelling in podcast form and in training is how we’ll meet this challenge.”

Why It’s Important: In an era where technology and human connection must coexist, Rodriguez’s approach bridges innovation with culture. By pairing fintech research with authentic storytelling, he’s ensuring the credit union’s mission resonates with staff and members alike.

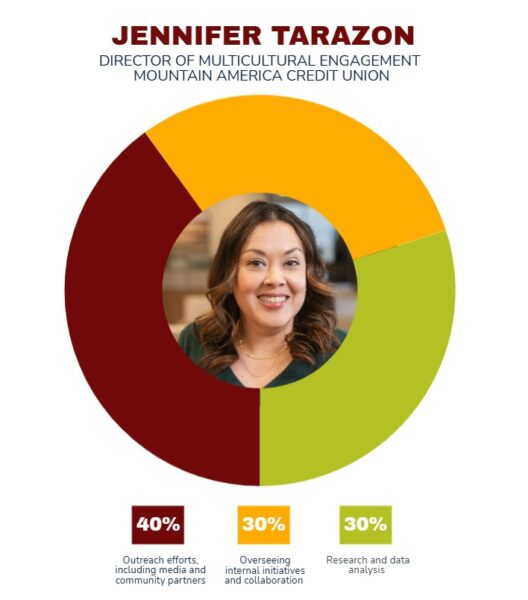

Director Of Multicultural Engagement

Credit unions that aren’t tapping into the multicultural mix that exists in their markets could be missing major opportunities. Understanding the diversity present in a market is key to unlocking those opportunities, but it’s also a key part of building a superior member experience and making authentic connections.

At Mountain America Federal Credit Union ($21.5B, Sandy, UT), that responsibility falls to Jennifer Tarazon, the cooperative’s director of multicultural engagement.

“The population is changing, and we can either lead the way or fall behind,” she says. “The goal for the credit union is always to provide an exceptional member experience, but an exceptional member experience for you could be very different from what I consider an exceptional member experience. It’s important to go somewhere that is going to be culturally competent while serving you.”

Why It’s Important: Multicultural engagement is as much about relevance and growth as it is inclusion. By understanding and honoring cultural differences, credit unions can build trust, deepen relationships, and deliver experiences that truly resonate with every member. In a competitive market, cultural competence is a differentiator that drives loyalty and long-term success.

Director Of Organizational Change Management

Change is inevitable, and organizations that plan for it rather than react to it position themselves for success.

At Desert Financial Credit Union ($9.1B, Phoenix, AZ), Allison Worthington is tasked with helping the entire organization adapt to any number of changes. The role requires not only deep interpersonal relationships but also understanding of a variety of business functions.

“My role addresses the challenge of change saturation,” she says. “It also addresses the challenge of surprising people with change and making change happen to people versus for people. We’re now able to plan intentionally for changes that are impacting our employees. Plan early, plan often, plan for resistance, and ultimately ensure we are bringing information that’s necessary to help somebody adopt change.”

Why It’s Important: Unmanaged change can erode trust, stall progress, and overwhelm employees. By approaching change intentionally and proactively, Desert Financial ensures clarity and support, turning potential disruption into an opportunity for growth and engagement.

Director Of Financial Inclusion And Community Engagement

Balance sheets and operations are only one part of running a credit union. The softer side of the business arguably has a greater impact, and that’s where a role like this comes into play.

Steph Harrill Kyle has been director of financial inclusion and community engagement at University of Wisconsin Credit Union ($6.1B, Madison, WI) for more than three years, bringing to the role a background centered on financial literacy and an MSW in social work from Columbia University with an emphasis on social enterprise administration and school-based services.

That and other elements of her background are key to the credit union’s goals of advancing financial inclusion for the communities it serves.

“One of my favorite conversations is when people find out I’m a social worker,” she says. “They often ask, ‘Why would a social worker work for a bank?’ This opens the door to talk about the difference between a credit union and a bank. I explain financial inclusion is at the heart of social justice, so I believe there’s no better place for me to make social change than in my role with UW Credit Union.”

Why It’s Important: Financial inclusion isn’t a product offering — it’s a mission that shapes communities. By combining expertise in social work with financial literacy, Harrill Kyle ensures the credit union’s efforts go beyond transactions to create meaningful change. Her role demonstrates how credit unions can lead on equity and access and turn financial services into a platform for social justice.

Is It Time For A New Role At Your Credit Union? Browse hundreds of ready-to-use job descriptions in the Callahan Policy Exchange, then tweak your favorites to make hiring as efficient as possible. Learn more today.