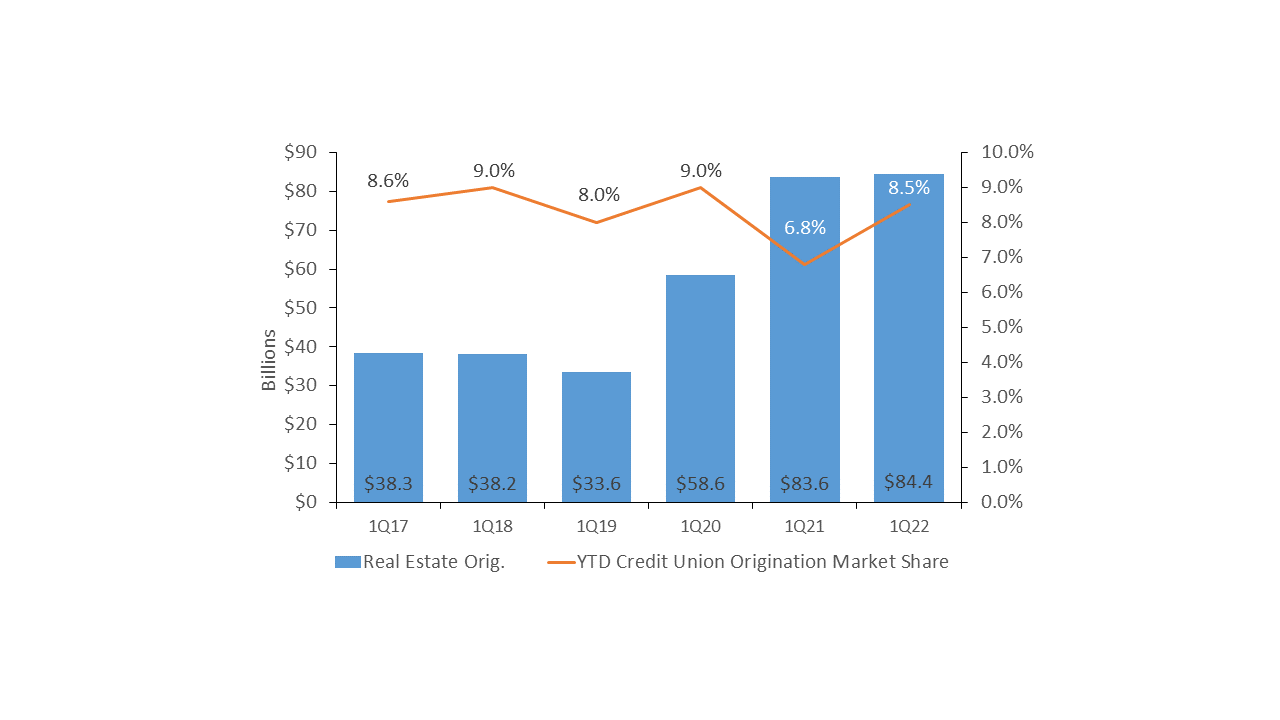

TOTAL REAL ESTATE ORIGINATIONS AND MARKET SHARE*

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

CALLAHAN ASSOCIATES

Residential mortgage originations in the United States slowed in the beginning of this year, contracting from $893 billion in the fourth quarter of 2021 to $689 billion in the first quarter of 2022, according to the Mortgage Bankers Association. Originations peaked at $1.3 trillion in the fourth quarter of 2020 and have decreased every quarter since then.

For credit unions, a cooling residential market didn’t stop them from increasing their origination market share, which increased 1.7 percentage points to 8.5%.

A surge in demand the past two years has diminished housing inventory in the United States. According to Realtor.com, there were fewer than 400,000 homes for saleat the end of the quarter, down from the more than 1 million norm for this time of year. Rising mortgage rates have already impacted refinances, and tempered demand from continued rate increases is unlikely to cause the housing market to reach equilibrium, as buyers still far outnumber available homes.

Analyze Your Mortgage Market

Take a data-driven look at leaders and competitors in your financial market with Peer+. Backed by data from HMDA, the 5300 Call Report, and the U.S. Census Bureau, Peer+ offers endless opportunities to pull custom research to make strategic, member-driven decisions for your institution.

* Market share is calculated as a percentage of residential first mortgage originations. Total real estate values include other real estate types, such as commercial and HELOCs, which are not included in the market share calculation.