In 1948, Father Edward J. McCarthy founded Guadalupe Credit Union ($217.7M, Santa Fe, NM) to serve the parishioners of Our Lady of Guadalupe Church in Santa Fe, NM. In its nearly 75-year existence, the credit union has grown organically as well as by merger and now serves approximately 23,000 members of all faiths, professions, ages, and backgrounds through seven branches in communities across northern New Mexico.

The cooperative became a Community Development Financial Institution in 2010 and earned the Juntos Avanzamos designation in 2015 for its financial products and services specifically tailored to serve Hispanic and immigrant communities. Financial wellbeing and wellness are primary missions for the credit union, and the cooperative’s efforts in this area require marketing outreach combined with personal outreach and coaching. At GCU, one person coordinates it all.

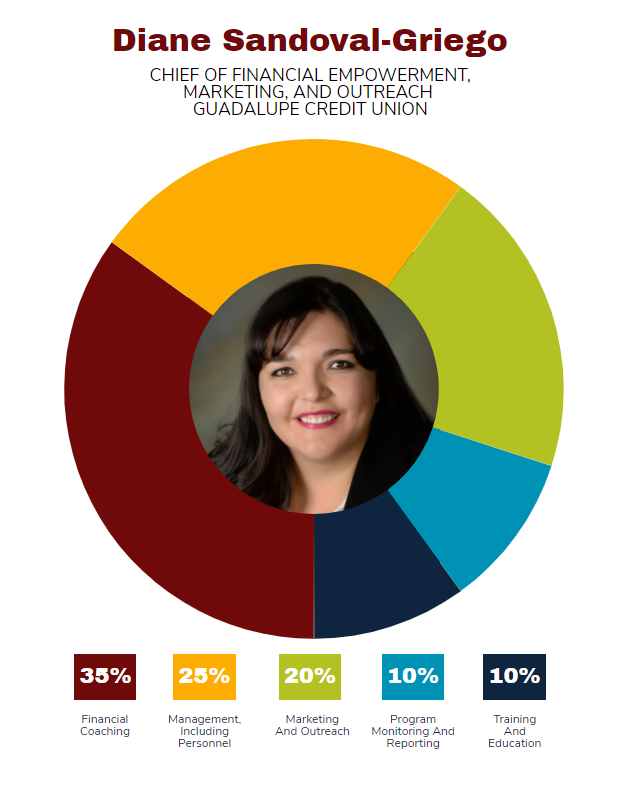

GCU created the position of chief of financial empowerment, marketing, and outreach one year ago and named Diane Sandoval-Griego to the role. Sandoval-Griego joined the credit union in 2006 and had spent eight years overseeing financial coaching and outreach at the Santa Fe cooperative.

Here, she talks about the position.

Why did GCU create this role?

Diane Sandoval-Griego: Many of the projects we were working on overlapped. Financial coaching, outreach, and marketing often collaborated on product development, presentations, advertising classes, promotional materials, reality fairs, member testimonials, grant applications, and reporting. Combining these areas helped streamline our projects and day-to-day activity.

New Mexico is known for our multicultural diversity. It’s important to have feedback and reflection from our staff with different points of view, especially since we cover a large area. We gather feedback from members and staff to find ways to address diverse needs, through product development, legislative advocacy, and credit union growth. Every department plays an important role, and it made sense for Guadalupe Credit Union to combine these areas.

What challenges do you address in your work as chief of financial empowerment, outreach, and marketing?

DS: Predatory lending is one area where we’ve really tried to make a difference. We created a loan product that helps our members out of predatory debt. It combines a loan with financial coaching and emergency savings. Budgeting and follow-ups are part of the support systems we offer to help them stay on a good financial path. We did so well with the program that it was recognized by CUNA with first place in the Louise Herring Award competition.

We’re now advocating with the New Mexico Legislature for a rate cap of 36% for small-dollar loans. These lenders strip wealth from our communities; as a state, we can do better than that. If the bill passes, we can concentrate more on helping our communities build wealth including buying homes and learn more about financial literacy.

What opportunities do you address?

DS: Our departments have worked hard during the COVID crisis to make sure members are well informed about how to access their money, have help to find resources, and know their financial institution is safe.

We rely a lot on both financial coaching and marketing to help members understand what we do to help our communities. The great part is, we have laid great groundwork over the years and our communities trust us.

We work from within, analyzing reports to find opportunities. We reach out to our members whose accounts are showing distress. Guadalupe Credit Union strives to understand where our members are coming from and what they’re facing. We hold focus groups to learn more about the needs of a particular community, and we’re involved with community functions, sponsorships, and other projects that support community wellbeing.

Download the job description for the role of chief of financial empowerment, marketing, and outreach at Guadalupe Credit Union. This description and many more, along with strategic and tactical documents of many other types, are available for download from the Callahan Policy Exchange.

What made you a great fit for this job?

DS: I’m a Certified Credit Union Financial Counselor (CCUFC) and Credit Union Development Educator (CUDE). I also have a lending background and have advanced through levels within the credit union. I’ve attended numerous conferences and training sessions and loved our work with Duke University’s Common Cents Lab to learn about behavioral economics and the pilot programs we started with its guidance. The world is continually changing if you aren’t continually learning, you and your members will be left behind.

Describe your own advancement and the evolution of those coaching and marketing roles at GCU.

DS: I advanced to a branch manager and transferred to become the first financial coach at Guadalupe Credit Union. We weren’t exactly sure how to develop a model that fit us. I acted on faith and did my best. As situations arose and our products and services weren’t meeting the needs of the people, I would bring it to management’s attention.

CU QUICK FACTS

Guadalupe Credit Union

DATA AS OF 12.31.20

HQ: Santa Fe, NM

ASSETS: $217.7M

MEMBERS: 22,737

BRANCHES: 7

12-MO SHARE GROWTH: 22.6%

12-MO LOAN GROWTH: -4.9%

ROA: 0.63%

I often presented to our management ideas for products, research, and compiling data, which helped us expand our financial coaching department. Of course, not every idea was accepted; however, we now have a team of seven in that department. Our marketing department also expanded to assist with coordination of events, grants, and other reporting with community partners.

What is the key to success in your role?

DS: It’s important to keep an open mind and be adaptable. Things change from day to day and everything moves fast. Some days we will have classes at a homeless shelter, the next day we’re working on internships for students.

During the past year we’ve tried to keep up with the ever-changing needs of families dealing with the pandemic through finding resources, preventing eviction, and anything else to keep our people afloat. I am proud to work in a place that does such remarkable things in the community. It keeps the goal of people helping people at heart.

Who do you report to? Who reports to you?

DS: I report to our CEO, Winona Nava. My reports are the marketing director, marketing and outreach coordinator, and six financial coaches across seven counties in northern New Mexico.

What are your areas of responsibility? How do they connect?

DS: Staff management, outreach activities, community partnerships, marketing promotions, materials, and events. I monitor some of our higher-risk lending programs and products. Advocacy for issues facing our members.

Financial coaching is a safe place for people to seek assistance or guidance without judgement. Outreach is present through educating, volunteering, and working in our communities. Marketing keeps communication channels open to make sure people feel comfortable working with us and are well informed. Combining these areas helped streamline our processes because we were able to collaborate much easier to serve all our communities.

What’s your daily routine?

DS: It’s hard to say exactly. Different projects require different attention. Financial coaching has been a main focus because we have so many members experiencing financial hardship during the pandemic.

Our legislative sessions are active right now, so I’ve been involved with that. We’re seeking a rate cap of 36% for lending in our state from its current rate of 175%. I see the families impacted by these lenders every day. I hold on to the hope that our local government will protect New Mexicans from this type of financial exploitation.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How has the COVID-19 pandemic changed strategies and tactics at GCU? What has been your role in that response?

DS: In the beginning, we created policies, products, and resource guides to help people deal with the financial impact of the pandemic. Skip payments, emergency loans, interest forgiveness, finding resources for food and shelter, supporting COVID testing sites, and, most significantly, our contactless services. We introduced our chat options for our website, implemented the Spanish language website, and dedicated more staff to phones to keep up with the volume.

We evaluated reports to find out what areas were in highest need. We called members and sent emails to see if they needed help. We wanted to do that before people started falling behind on loans or overdrawing checking accounts to let them know we weren’t there to collect, we were there for them and we knew it was an uncertain time. We called our senior citizens who were already in financial coaching to see if they needed help accessing their accounts. As a low-income designated CDFI, we were created for a time such as this.

How do you track success in your job?

DS: Loan growth, lower delinquency, product uptake, feedback from staff, and the volume of outreach we are involved in. Before COVID, we had been recruiting volunteers to help with outreach because we were having trouble meeting the needs and keeping our branches staffed.

How do you stay current with topics that fall under your role?

DS: Creditunions.com! I’m constantly reading and attending webinars and conferences to stay current. One of my favorite ways to stay current is to be in our communities. We are only one piece in the puzzle, and Inclusiv, National Credit Union Foundation, Native CDFI Network, and CUNA are also helpful in keeping me up to date with changes.

This interview has been edited and condensed.