The United States’ economy is proving resilient for now, with pockets of strong consumer activity and investor demand. However, several forces are converging to suppress overall loan growth in 2025.

From rising student loan delinquencies and tight auto lending conditions to a housing market frozen by mortgage rate lock-ins, consumer behavior is shifting in response to a complex economic landscape. Credit unions are feeling the ripple effects as they navigate reduced demand, changing borrower profiles, and evolving member needs across loan categories.

Higher Student Loans Delinquency Dampens Growth

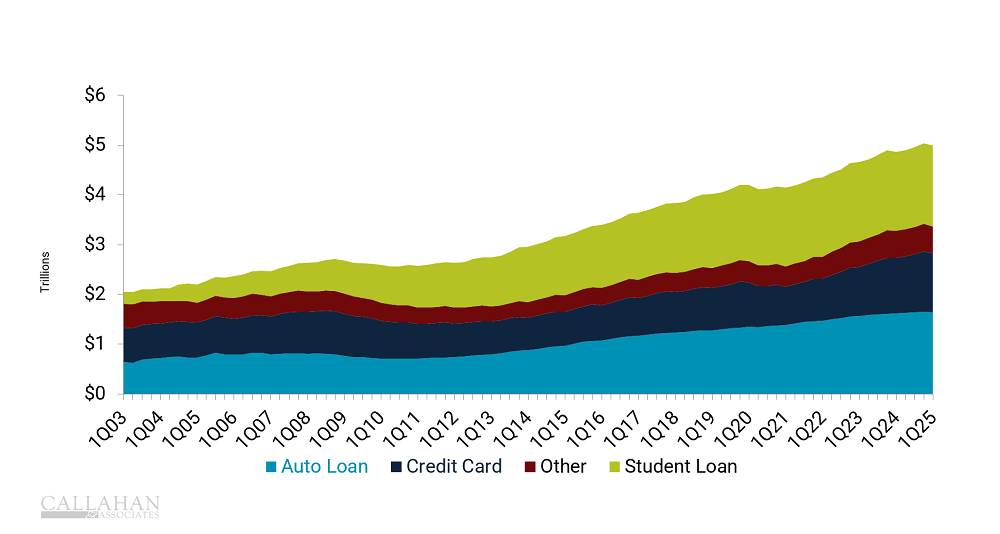

- In 2025, student loans nearly tied auto for the highest non-housing-related debt in the United States, according to data from the Federal Reserve Bank of New York.

- In the first quarter of 2025, the Department of Education lifted the freeze on student loan repayment. Student loan delinquency subsequently shot up to near 8% and now trails only credit cards. Credit scores also have been negatively impacted, limiting the availability of credit for delinquent borrowers and dragging down borrowing.

- Although this loan type accounts for a small portion of the credit union loan portfolio, the burden of repayment for members who hold student loans can have profound downstream effects on credit union lending. Just as important, it can severely impact the overall financial wellness of members.

NON-HOUSING DEBT BALANCE

FOR U.S. HOUSEHOLDS | DATA AS OF 03.31.25

SOURCE: FEDERAL RESERVE BANK OF NEW YORK | EQUIFAX

Locked-In Homeowners Suppress Supply

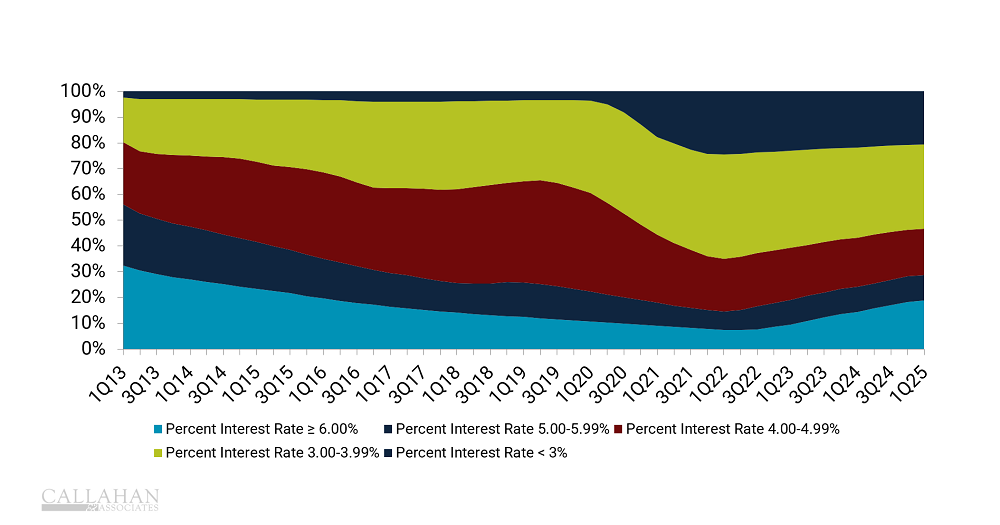

- As of January 2025, 81% of U.S. mortgages were locked in at a rate lower than 6.00%; approximately 50% were locked in at a rate lower than 4.00%. Conversely, a current 30-year fixed-rate mortgage hovers around 6.70%. That variance presents a serious incentive for homeowners to stay in their home, consequently suppressing supply of units available on the market.

- According to a spring 2025 Bankrate survey, only 3% of homeowners said they would feel comfortable selling their home this year if mortgage rates remained at 6% or higher, challenging lender balance sheets.

- Credit unions have begun offering rate incentives to entice members to move. WSECU’s “Meet Me Halfway” loan splits the borrower’s existing rate with the rate they’d pay on their mortgage today. And in Minnesota, Wings Financial unlocked opportunity in its mortgage portfolio by drawing in members with a desirable rate and a few other perks.

OUTSTANDING RESIDENTIAL MORTGAGE BY INTEREST RATE

FOR U.S. HOUSEHOLDS | DATA AS OF 03.31.25

SOURCE: FEDERAL HOUSING FINANCE AGENCY

Surging Home Equity Means More Credit To Tap

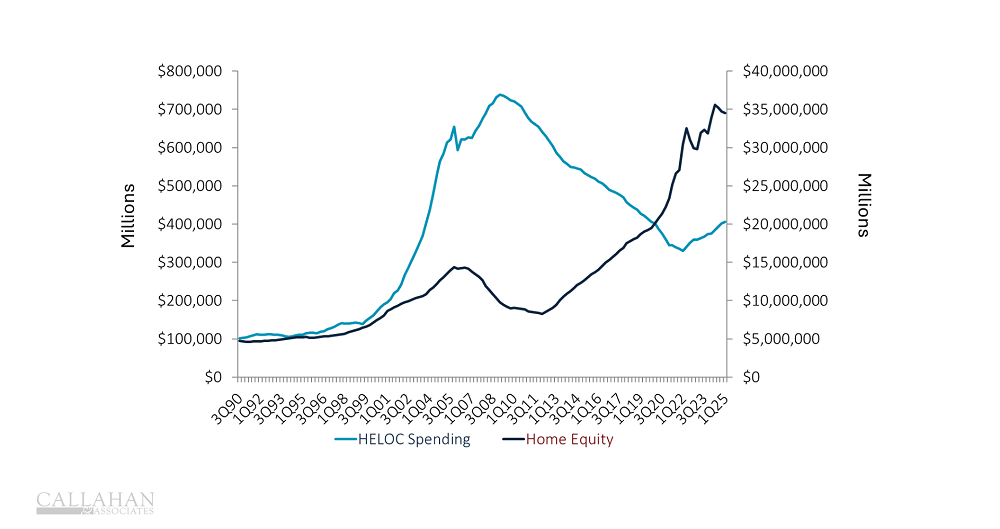

- The dollar value of outstanding HELOCs has increased significantly since hitting multi-decade lows during the pandemic. It currently stands at $406 billion as Americans tap into home equity to cover major purchases, such as home repair.

- The amount of equity owners hold in their homes has surged as strong demand and limited supply (see above) underpin substantial increases in real estate values. Elevated interest rates have slightly depressed equity growth the past few quarters; however, that has not meaningfully dented the increase recorded following the pandemic.

- The interest rate lock-in effect plays a role here as well. Instead of moving, homeowners are tapping into home equity to cover the repairs and renovations necessary to make their homes fit their needs.

HELOC SPENDING AND HOME EQUITY

FOR U.S. HOUSEHOLDS | DATA AS OF 03.31.25

SOURCE: FEDERAL RESERVE

Rush To Purchase Autos Does Not Translate Into Lending

Don’t Stop Here

Wings Financial gives card users the option to reduce auto loan interest rates as a points redemption. Read more in “Interest Buy Downs Take Flight At Wings Financial.”

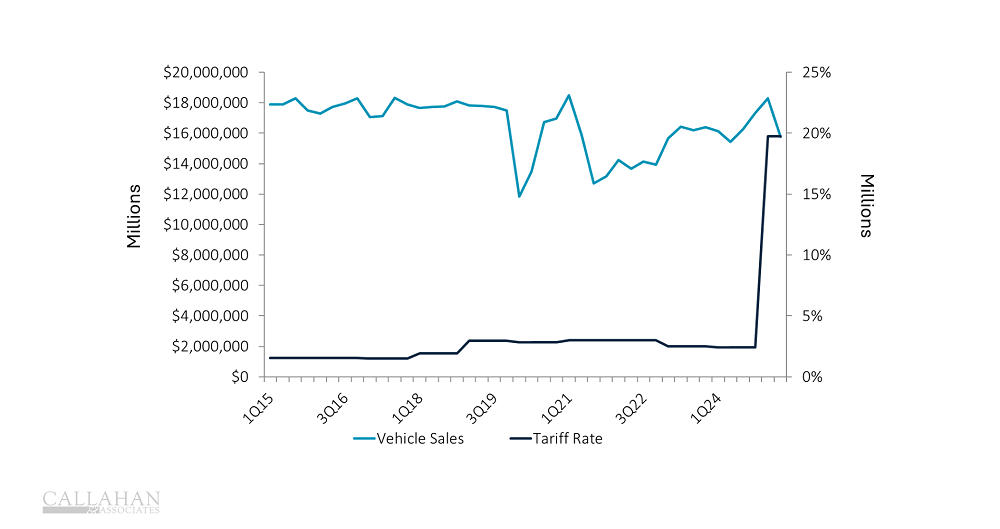

- In the first quarter of 2025, Americans rushed to purchase cars ahead of expected tariffs; however, auto loan balances declined quarter-over-quarter for only the second time in 14 years.

- Despite vehicle sales spiking, a credit crunch in the first quarter tightened financing, limiting the participation of lower income borrowers and pushing up the average credit score of auto financing eight points. Higher income purchasers — where the market was more concentrated — often pay cash and have no need for financing.

- As with home loans, high interest rates make auto loans less attractive, especially for used cars. In 2022, buyers financed 80.2% of new cars and 41.6% of used. In the first quarter of 2025, new car financing stayed the same, 80.5%, but used car financing fell to 37.1%, according to Experian’s State of the Automotive Finance Market.

VEHICLE SALES AND TARIFF RATE

FOR U.S. HOUSEHOLDS | DATA AS OF 06.30.25

SOURCE: FEDERAL RESERVE | YALE BUDGET LAB

Yesterday’s Inflation Still Impacts Today’s Consumers

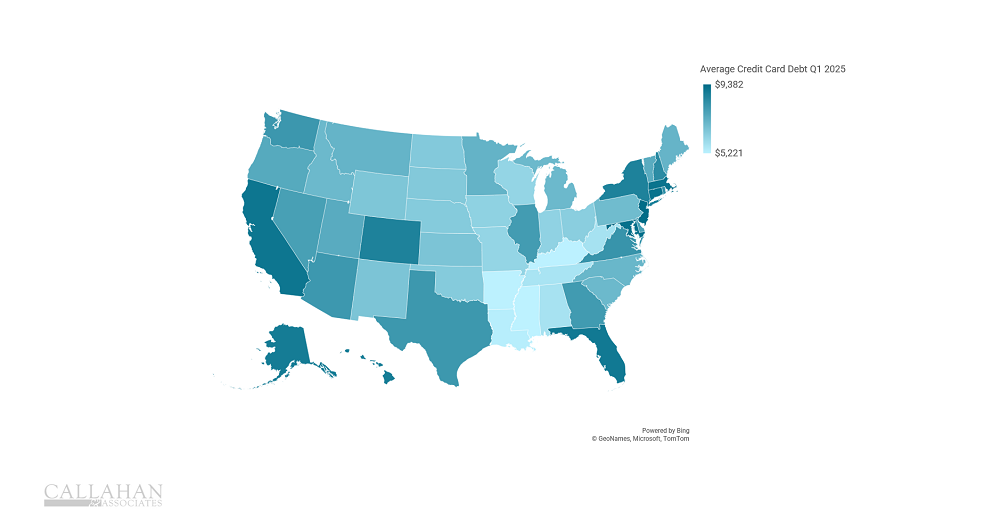

- Consumer reliance on credit is not evenly distributed across the nation. According to a report by Lending Tree, high-cost states such as New York, California, and Florida likewise have some of the highest reliance on credit. In states like Ohio and Mississippi, there is less reliance.

- What does this suggest? Debt from the era of high inflation has lingered on household balance sheets. With the exception of a few outliers, the states that experienced the highest inflation on a dollar basis, as per the U.S Congress Joint Economic Committee, are often the states with the highest average credit card debt.

- In the second quarter, credit card balances rose 6.1% year-over-year. Although the $1.18 trillion nationwide balance is a decline from the first quarter, it shows that affordability is still weighing on many across the country.

AVERAGE CREDIT CARD DEBT BY STATE

FOR U.S. HOUSEHOLDS | DATA AS OF 03.31.25

SOURCE: LENDING TREE

What’s Happening In Your Loan Portfolio? The trends are clear — now see how your credit union stacks up. Peer Suite helps credit unions dig into loan performance, compare against competitors, and uncover strategic insights to drive smarter decisions. Go from industrywide data to actionable intelligence in just a few clicks. Book your analysis session with a Callahan advisor today.