The national personal savings rate hit 14.3% in September, according to data from the St. Louis Fed. This is the second-highest rate since 1975. Higher savings paired with low interest rates drove up deposits at U.S. credit unions nearly all of that landed in core deposit accounts. Balances in checking, savings, and money market accounts increased while the cost of funds dropped. Credit unions are battling earnings pressures and balance sheet shifts brought on by COVID-19, and as leaders look to past trends for insight into how to better navigate the coming year, four stand out.

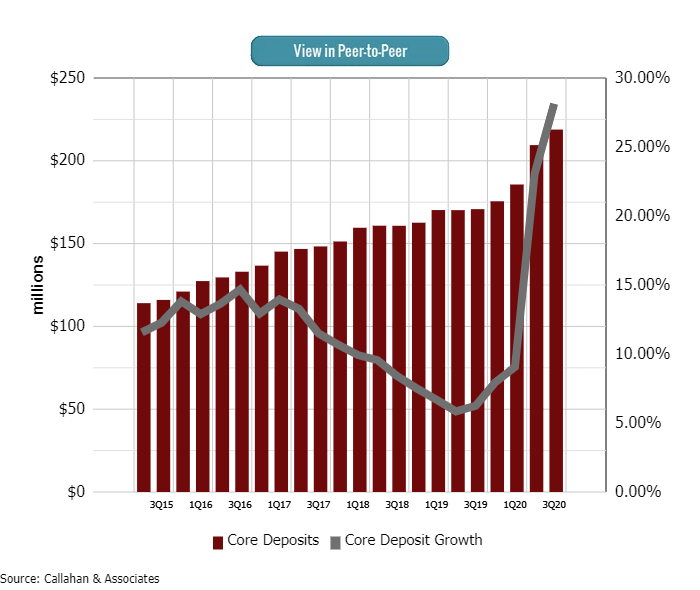

CORE DEPOSIT BALANCES AND ANNUAL GROWTH

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Source: Callahan & Associates.

No. 1: Core deposit growth underpins total share growth and increased liquidity.

Consumers are saving money in preparation of a personal financial downturn; consequently, core deposits at credit unions are on the rise. Total share balances grew 18.2% in the third quarter, with core deposits checking, savings, and money market accounts accounting for 94.8% of that growth. Core deposit balances increased 24.5% annually, nearing $1.2 trillion as of Sept. 30.

Core deposits generally command a lower interest rate; consequently, the cost of funds at credit unions is declining. The average cost of funds rate fell 15 basis points year-over-year to 0.84%, which, in part, resulted in a 13-basis-point decrease in the interest expense ratio to 0.74%.

In December, a second Federal relief bill provided $600 to eligible citizens; a Democratic-controlled Congress and White House will likely lead to additional coronavirus relief measures in the coming months. As members continue to sock away savings, credit unions must contend with swelling core deposits that will shape balance sheets and income statements through 2021.

FIRST MORTGAGE ORIGINATIONS AND SALES TO THE SECONDARY MARKET

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Source: Callahan & Associates.

No. 2: First mortgage origination sales offer one-time income gains.

The average interest rate for a 30-year fixed-rate mortgage dropped 27 basis points to 2.9% as of Sept. 30, 2020. Refinancing is soaring, and first mortgage originations as well as balances are at record levels for credit unions. The movement funded $211.7 billion in first mortgages through the first nine months of the year, up 76.6% year-over-year. At nearly $514.1 billion in balances, first mortgages accounted for 44.0% of all loans at credit unions.

Sales to the secondary market increased, too 100.5% annually to $87.2 billion. Credit unions sold 41.2% of first mortgages originated year-to-date. This is a year-over-year increase of 4.9 percentage points as credit unions exchanged low-margin loans for upfront gains from sales. And, despite low interest rates, these one-time payments have propped up income at credit unions.

The Federal Reserve has held down interest rates, but the pipeline for refinances will likely shrink in the coming year. The Democratic party now controls both houses of Congress and the White House, and the 10-year treasury has increased 20 basis points since the end of the year. As mortgage rates edge up, fewer borrowers will refinance. As the refinance boom tapers off, credit unions will need to lean on investments and consumer lending for income.

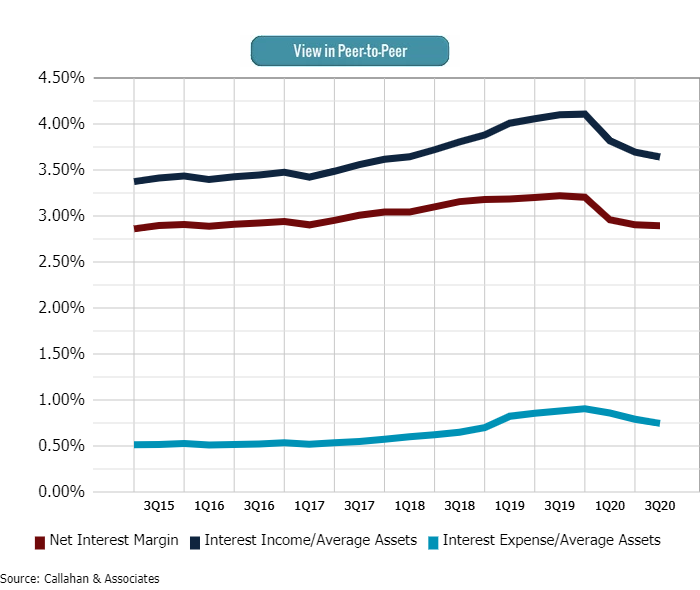

NET INTEREST MARGIN

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Source: Callahan & Associates.

Callahan & Associates is conducting a survey to identify the process and the extent to which credit unions around the country offered loan repayment and relief programs to their membership base during COVID-19. Participating credit unions will receive a copy of the full report upon completion. Click here to take the survey.

No. 3: Interest rate dynamics underpin earnings pressures.

The net interest margin at U.S. credit unions decreased 29 basis points year-over-year to 2.87% as of Sept. 30. Contributing to the decline was a reduction in total interest expense which was down 5.1% to $9.4 billion as members increasingly opted for core deposits in lieu of interest-bearing accounts.

Asset balances surged 16.1% year-over-year, pushing down the interest expense ratio 13 basis points to 0.74%. However, this was not enough to offset the decrease in the interest income ratio, which was down 45 basis points to 3.61%.

In response to the pandemic, consumer lending slowed, spending fell, and consumers paid down debt. Consumer loans generally hold higher interest rates, and the net interest income from loans was up 3.2% annually. However, this is 10.2 percentage points lower than one year ago. Additionally, annual share growth of 18.2% outpaced loan growth of 6.3%; consequently, cash and investment balances increased 44.8% to $552.6 billion. Despite that bump, income from investments decreased 23.6% annually to $4.9 billion as of Sept. 30.

Consumer sentiment is beginning to rebound, but federal relief packages could continue to feed liquidity and suppress interest rates through 2021. Credit unions will have to monitor these pressures on their earnings statement throughout the year.

PROVISION FOR LOAN LOSS/AVERAGE ASSETS

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.20

Source: Callahan & Associates.

No. 4: ALLL and provision account allocations slow but remain high in case of potential defaults.

In 2020, credit unions increased their allowance for loan and lease losses to protect themselves against increased future default rates. Their total loan delinquency in the third quarter, however, was down 13 basis points year-over-year to 0.54% as members took advantage of payment deferral programs and federal relief packages.

Total provision for loan and lease losses was up 47.5% through the first nine months of 2019 to $7.1 billion as of Sept. 30, 2020; however, total annualized provision expense decreased 2.7% on a quarterly basis. On the balance sheet, the total allowance for loan and lease losses was $12.7 billion as of Sept. 30. Its 32.2% annual growth is the fastest rate reported since March 2010; quarterly, its growth slowed to 3.2 percentage points.

Total delinquent balances decreased 13.5% year-over-year to $6.4 billion, yet credit unions are holding nearly double the provisions they held one year ago. U.S. unemployment remains high 6.7% at year’s end and the future remains uncertain. As such, credit unions are preparing for potential loan defaults and a downturn in members finances.

Request a Data Scorecard

We want to pull a custom scorecard for your credit union. Pick 10 ratios most important to your credit union and we’ll customize a scorecard for you that compares you to relative credit union and banking peers. .

We’ll work together to get the more relevant data and peer group for your credit union.

REQUEST NOW