COST OF DEPOSITS VS. COST OF BORROWING

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

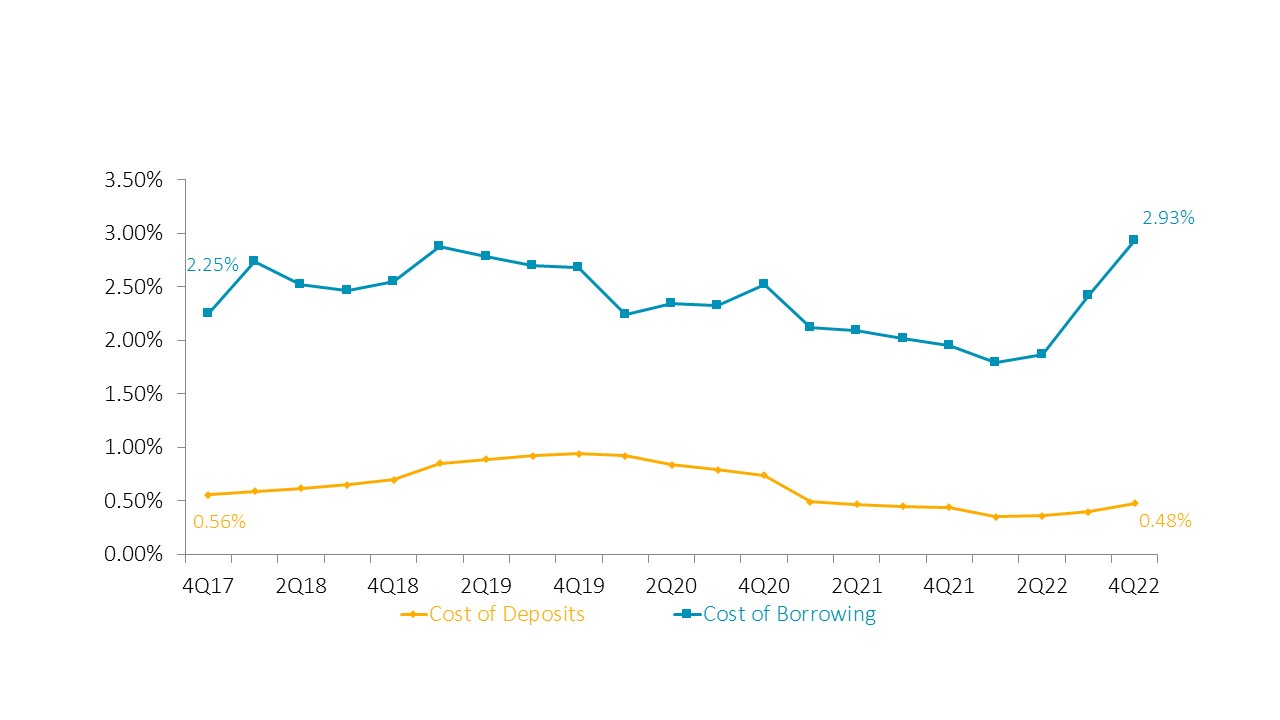

- Loan growth outpaced share growth in the fourth quarter, and the loan-to-share ratio jumped to 81.4%. Credit unions looking for a source of liquidity to fund loans have two options: raise deposits from members or borrow on a line of credit.

- Credit union borrowing, such as from the Federal Home Lending Bank, increased 125.7% year-over-year. And when the Federal Reserve began to hike interest rates, borrowing costs increased for credit unions across the country.

- Creditors are charging on average 2.93%. When borrowing and interest rates increase, it can put the pinch on credit unions that use borrowing as a source of liquidity.

- The cost of deposits, however, has barely budged, meaning credit unions have not raised deposit rates to attract shares. With shares declining and borrowing costs increasing, credit unions could shift their focus to attracting deposits to gain liquidity.

- Are members thinking strategically about where they stash their savings? Possibly. Share certificates — which offer higher rates in exchange for allowing the credit union to hold onto those shares for a longer period of time — increased 20.2% in 2022.

How Do You Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo

Schedule Your Peer Demo