Credit unions have struggled to make loans in recent quarters. High interest rates, appreciating asset prices, and rising costs for common loan products have left their mark on loan demand. From home loans to credit cards, cars, and beyond, there are few loan products that have not been impacted.

The trends are clear: since the interest rate cycle began in early 2022, the financial industry has not been the same. The graphs below offer insights into some of the underlying trends driving demand — or, in some cases, lack of demand — for loans.

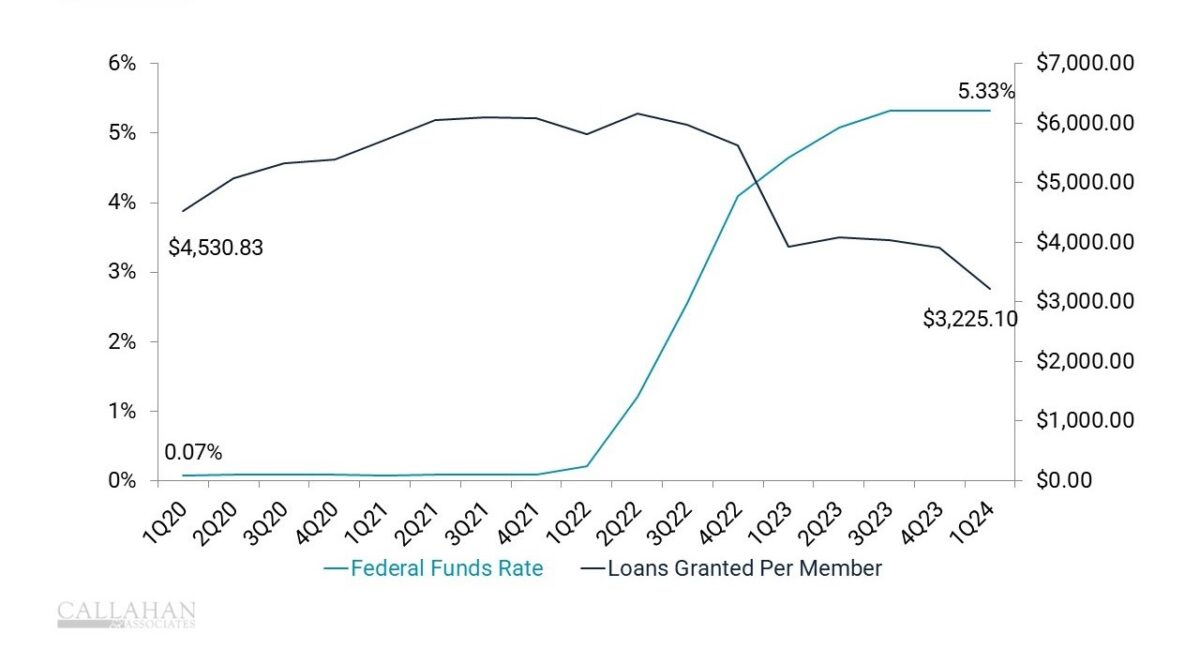

Rising Rates Are Driving Down Loan Demand

FED FUNDS RATE AND LOANS PER MEMBER

SOURCE: FEDERAL RESERVE, NCUA

© Callahan & Associates | CreditUnions.com

Any discussion of loan demand in 2024 has to start here. As the federal funds rate began to rise in 2022, it changed the dynamic for lending in nearly every market and for nearly every product. In short, as rates rose, demand declined. Average originations per member dropped to $3,225.10 at the end of the first quarter, a 47.6% decline from when rates began rising in the second quarter of 2022. This has had ramifications on most loan products, and nearly every credit union has been impacted.

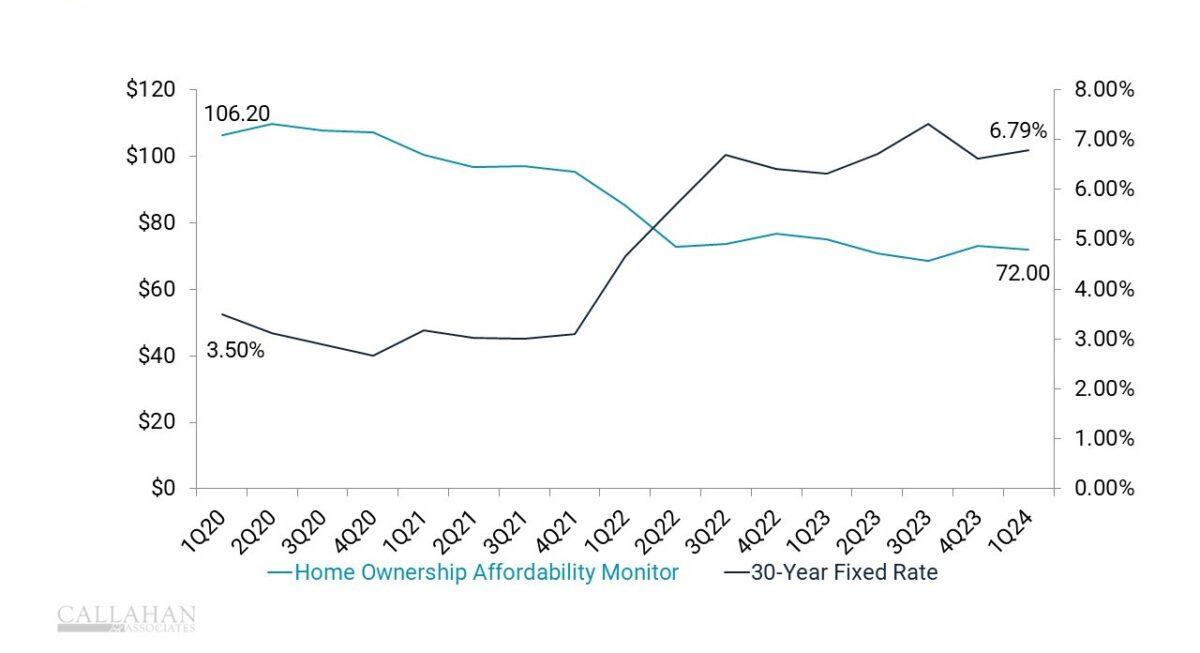

High Home Prices: Bad For Loan Demand, Good For The Balance Sheet

30-YEAR FIXED-RATE MORTGAGE AND HOMEOWNERSHIP AFFORDABILITY

SOURCE: Federal Reserve, Federal Reserve Bank Of Atlanta

© Callahan & Associates | CreditUnions.com

A mortgage is generally a member’s largest purchase and their biggest loan. Unfortunately for members, those loans aren’t likely to get any smaller. Since the start of the pandemic, the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor — which registers the rate of relative affordability — has declined more than 30 points, falling from 106.20 in early 2020 to just 72 at the end of March. Meanwhile, interest rates on 30-year fixed-rate mortgages — the most common product used to buy a home — have nearly doubled in that same time frame, rising to 6.79% at the end of the first quarter.

These two factors have kept many would-be borrowers on the sidelines, but it has had a double impact on credit unions. Higher interest rates and housing prices have not only suppressed demand but also led more credit unions to hold those loans on the balance sheet, bringing in additional interest income. During the past three years, credit unions have added first mortgages to their balance sheet to the tune of a compounded annual rate of 9.6%.

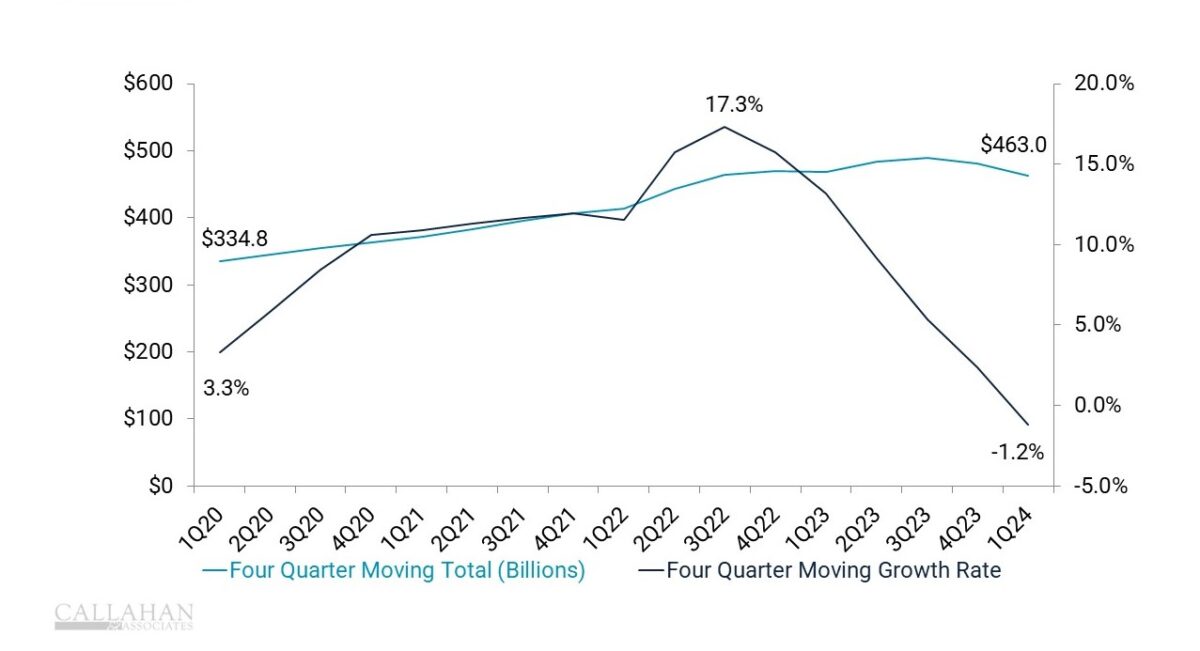

HELOCs Are Still Big Business

HOME IMPROVEMENT SPENDING AND GROWTH RATE

SOURCE: Harvard University Joint Center for Housing Studies

© Callahan & Associates | CreditUnions.com

Frozen out of upgrading to larger homes, many consumers are instead opting for renovations. During 2022 and 2023, homeowners renovated their homes to the tune of more than $450 billion per year. Whether it was adding a room, expanding a deck, or redoing a lawn, homeowners often found themselves tapping into the equity gained from the rise in home prices, financing HELOCs in the process to pay for these projects. This increase in HELOC popularity had a positive impact on the bottom line: Credit unions have added HELOCs to the balance sheet at a 21.6% compounded annual growth rate during the past three years.

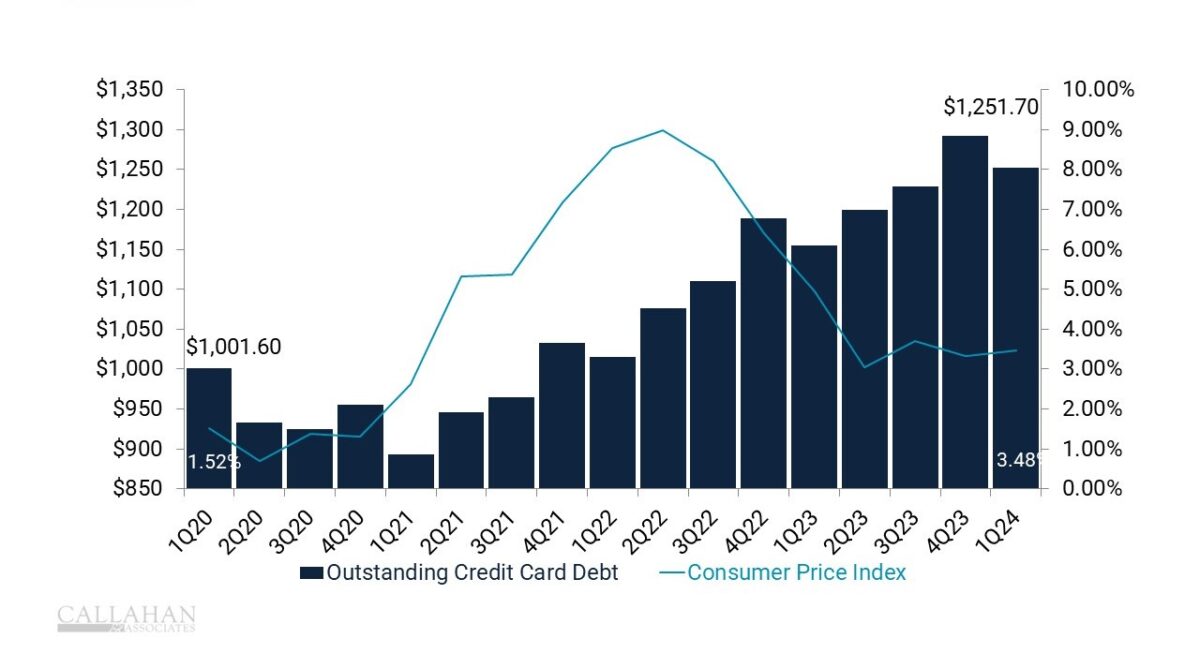

Credit Card Spending On A Steady Rise

CREDIT CARD DEBT AND INFLATION

SOURCE: WalletHub Credit Card Debt study, Federal Reserve

© Callahan & Associates | CreditUnions.com

Americans are accumulating a steadily increasing pile of credit card debt, partly as a result of inflationary trends not seen in decades. The rise in interest rates was precipitated by a rise in inflation. The Federal Reserve increased rates in an attempt to tame inflation, but that put a strain on lending even as inflation strained household budgets. As inflation rose, more households needed to rely on credit card spending to make ends meet, leading to spikes in credit union credit card balances.

With inflation cooling, the nation’s outstanding credit card debt has fallen slightly but remains well above pre-pandemic lows. Average credit card balances at credit unions grew to $3,216 in the first quarter, up nearly $500 from the second quarter of 2021.

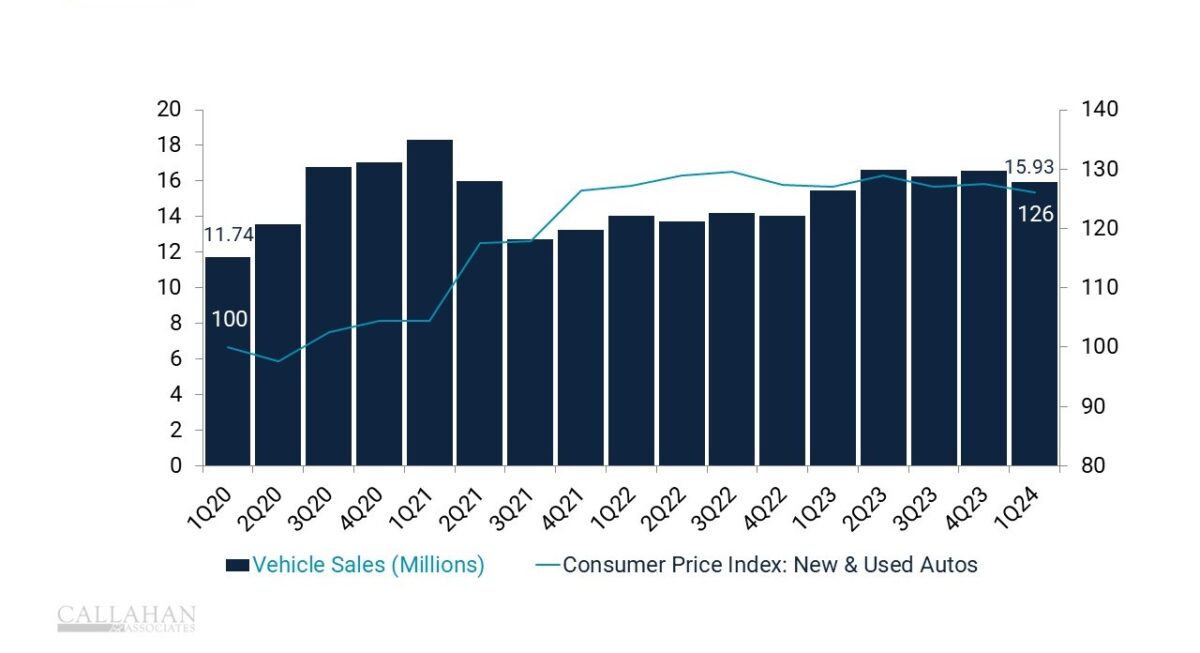

Despite Price Hikes, Vehicle Sales Keep On Truckin’

VEHICLE SALES AND THE CONSUMER PRICE INDEX

SOURCE: U.S. Bureau of Labor Statistics, Bureau of Economic Analysis

© Callahan & Associates | CreditUnions.com

Car prices are up 26% since the start of the pandemic. Multiple factors have played a role in this, including COVID-era supply chain issues that drove up used car prices. New technology has also raised the price of some car parts, with those costs being passed on to consumers. On top of all that, cars remain in high demand, with nearly 16 million units sold last year.

That means more demand for auto loans at credit unions. Although some members might have previously been able to make cash purchases, that’s becoming increasingly rare. This has translated into a compounded annual growth rate of 8.9% during the past three years and a total of $496.8 billion in total credit union auto loans on the balance sheet.