Competitive rates and good service help credit unions stand apart from the competition. They also help credit unions attract new members, who, in turn, bring in new share deposits that serve as the primary source of funding for lending activity. New members also offer new lending and cross-selling opportunities, which are the backbone of business models at most financial cooperatives.

Credit union membership in the United States has expanded 3.0-4.0% annually since 2011. Before then, however, member growth was relatively stagnant, fluctuating between -1.5% and 1.5% across the first decade of the new millennium. What changed?

Investments in technology, expanding branch footprints, and industry consolidation impacted membership growth. Improvements in secondary outreach and recruitment also played a key role. Credit unions that have leaned into auto lending — particularly through the indirect channel — have increased membership at a consistently greater rate than those who have avoided outside channels.

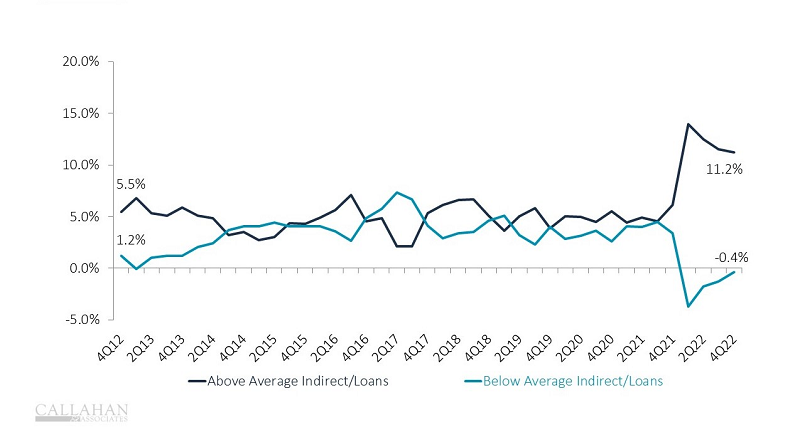

Credit unions with a higher percentage of indirectly sourced loans reported 11.2% membership growth year-over-year through the fourth quarter of 2022, whereas membership declined 0.4% year-over-year at institutions with below-average indirect lending. This is largely consistent with performance during the past 10 years.

On the surface, this might seem like an easy avenue for lending, but a look at top-level member growth metrics reveals indirect lending is anything but a free lunch. As with nearly every business decision, there are trade-offs.

MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.30.22

© Callahan & Associates | CreditUnions.com

Credit unions have cultivated new customer relationships through indirect lending partnerships with fintechs, dealerships, and other third parties. But this strategy comes at a price. Indirect loans tend to be an expensive way to attract members. They offer lower yields and higher delinquency rates. And indirect borrowers generally don’t invest in a long-term credit union relationship. Above-average indirect lenders do not report significantly higher average member relationships.

Beyond that, increased membership comes with increased operating expenditure. Credit unions must consider how far to push membership growth, as too much too soon can be a drag on efficiency. All told, indirect lending comes with a litany of pros and cons. Every credit union must carefully consider the potential of indirect in the context of its field of membership and business strategy.

Renewed Popularity Of Indirect Lending

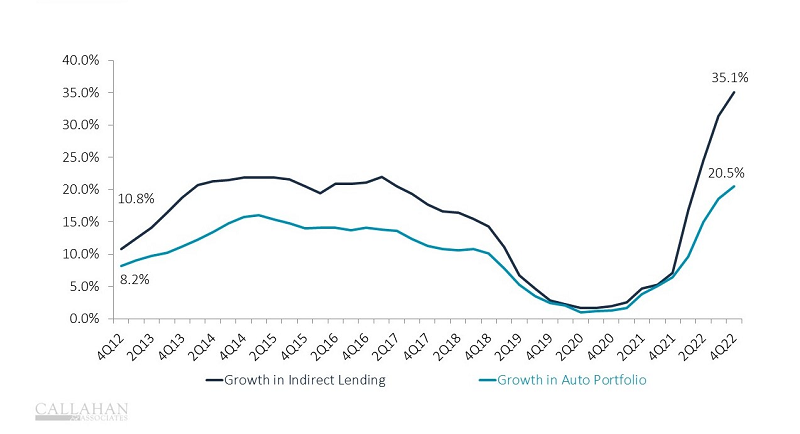

Despite a slowdown in the growth rate of indirect lending for several years, the approach has picked back up in popularity. The return to indirect is particularly notable in recent quarters. Industrywide, the dollar value of indirect loans increased 35.1% year-over-year in the fourth quarter of 2022. The percentage of loans made via indirect channels climbed from 13.0% in the fourth quarter of 2012 to 22.3% in the fourth quarter of 2022.

These dynamics drove substantial growth in the auto loan portfolio for both new and used cars. During the past 10 years, the industry’s auto loan portfolio has grown at a compounded annual growth rate of 11.2%, the highest rate on record for a 10-year period.

INDIRECT LENDING AND AUTO PORTFOLIO GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.30.22

© Callahan & Associates | CreditUnions.com

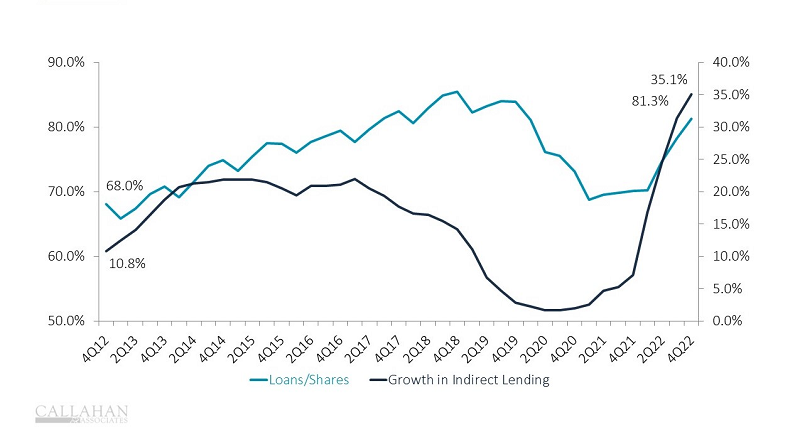

Indirect lending flourishes during periods of excess liquidity. Indirect lending initially boomed following the Great Recession, when credit unions had more shares than they could lend in a troubled economy and searched for creative ways to repurpose this cash.

INDIRECT LENDING AND LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 12.30.22

© Callahan & Associates | CreditUnions.com

During the COVID-19 pandemic, credit unions received a new influx of shares as members deposited Federal economic relief funds. However, quarantines constrained branch traffic and credit unions had a difficult time lending to members outside of the hot mortgage space. Many credit unions returned to indirect channels as a way to repurpose excess liquidity, and now that the pipeline is back, indirect loans are surging into 2023.

Drawbacks Of Indirect

One drawback of indirect lending is that it is often difficult to fully immerse these members into the larger membership pool. They came for an attractive rate, not for a community. Consequently, few credit unions have developed successful methods of cross-selling to indirect members.

Additionally, the sourcing fees that credit unions must pay to the originator of an indirect loan — usually dealerships or FinTechs — eat into interest margins. From an operational standpoint, the influx of applications means more loan servicing expenses, and new members means more member support.

In the past 10 years, indirect loan balances have grown 329.9%; membership has increased 43.0%. During the same timeframe, the number of full-time equivalent employees has increased 38.1%. Although hiring and retention are major strategic initiatives for 2023, indirect lending continues to put significant pressure on HR.

Tough Balance For Credit Unions

How do credit unions balance membership growth and the high cost of sourcing? Some experts peg the cost of attracting a new member at several hundred dollars. And when a credit union has that member, it can cost several hundred dollars in annual operating expenses to serve them. Conversely, the nationwide average for credit union revenue per member is $701 per year, meaning it can easily take a year or longer to recoup the cost of acquisition.

These margins are even tighter for members who join through costly indirect channels. Given the fact these members are less likely to stick around for more than a few years, it’s worth asking whether credit unions recoup their investment.

Indirect lending is a powerful operational lever when it makes sense for a credit union’s business. When credit unions have excess liquidity and difficulty sourcing loans, indirect partnerships can work wonders for balance sheet management. Even an expensively sourced loan is generally better for net interest margins than a low-yielding investment. Additionally, the built-in marketing footprint of indirect partners can be useful for introducing people to the credit union movement. The effect on overall membership growth is also undeniable.

However, the quality of indirectly sourced members is often of concern, and a few indirect members actually stick around for the long term. With liquidity crunches growing in concern in 2023, credit unions should carefully weigh the costs and benefits of indirect lending to decide whether it is the necessary tool of the moment.

How Does Your Lending Strategy Stack Up?

LEARN MORE TODAY