A host of studies released the past few years shows Americans are losing confidence when it comes to their finances.

A report earlier this year from the Pew Research Center indicated nearly one-third of consumers, 28%, believe their financial picture will be worse one year from now. That’s a 12-point increase from last year’s data. Meanwhile, 35% percent expect things to be about the same, down from 49% last year, and the number of those who think things will be better by this time next year rose just three points to 37%.

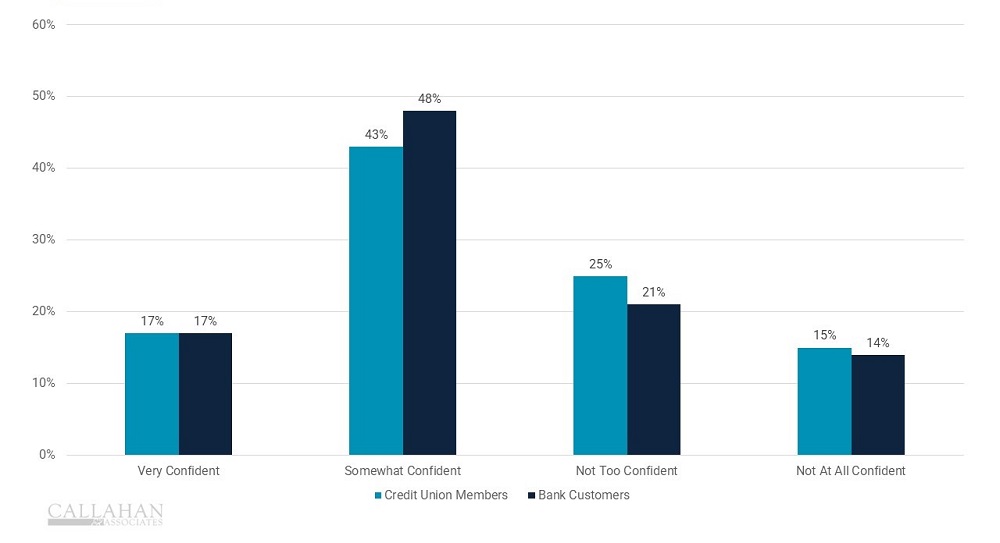

Despite that, a majority of credit union members still feel confident about their financial futures, according to recent Gallup data, though bank customers report slightly higher confidence levels.

The bottom line? Consumer confidence is fragile, and despite a small uptick in optimism, more people than last year are anticipating worsening conditions.

FINANCIAL CONFIDENCE

FOR U.S. CONSUMERS | DATA AS OF 2025

SOURCE: GALLUP

For credit unions, this fragile confidence presents both a challenge and an opportunity. As consumers navigate uncertainty, the institutions best positioned to respond are those that already prioritize financial wellbeing. Credit unions, with their mission-driven focus and history of member support, are designed to meet this moment — not just with education, but with empathy, trust, and practical tools that help members feel more secure.

Strategic Insights

- Perhaps not surprisingly, much of the Pew data can be sliced and diced along partisan lines. A slight majority, 55%, of those who lean Republican expect things to improve in the next 12 months, whereas 47% of those who lean left expect things to worsen.

- Regardless of politics, things don’t look good for those of modest means. Nearly half, 45%, of lower-income consumers can’t pay their bills in full each month, compared to 19% of middle-income earners and just 7% of those in upper income brackets.

- Other demographic considerations also come into play. Two studies conducted in 2023 found more than half of women 25 years and older said they were not financially secure; a full 75% of low-income women had no emergency savings and 66% said they did not have the tools to plan for retirement.

- Additionally, one-third of Gen X and millennial consumers — 35% and 33%, respectively — feel financially worse off than their parents, according to a 2025 study from Credit One Bank, and younger generations are feeling anxious about their long-term financial futures.

How Are Credit Unions Supporting Members?

- Knoxville TVA Employees FCU is making it easier for younger members to set aside a little money for a rainy day. Learn more about how a little saving goes a long way.

- Meanwhile, UVA Community integrates financial education with products tailored to young people to help these members build confidence and independence. Read more about how to tackle teen banking.

- In 2022, InTouch expanded services for those nearing or in retirement to help members take an active role in planning their financial future. Read more about how this credit union makes retirees’ golden years brighter.

- Canopy Credit Union has invested in its front-line staff via certified financial coach training to empower employees and reinforce the institution’s commitment to community wellbeing. Read more about turning tellers into teachers.

- A partnership between Hello Credit Union and United Way’s local 211 service directs callers struggling with financial needs to Hello for credit counseling, budget assistance, or more. Learn more about answering the call for help.

- The Boost Center by Blue Federal Credit Union is a one-stop, centralized family resource center that offers help for everything from housing and transportation to food insecurity and financial services. Read how Blue boosts its community.

Join Callahan & Associates and Gallup to learn about exclusive research and insights on how emotional engagement and the perception of care drive member participation and, ultimately, credit union growth. Watch “A Roadmap To Credit Union Growth” today.