High Rates + Costly Assets = Slow Lending

Following years of elevated output, lending returned to historic norms in 2023.

From the credit union take on current industry events to best practices from outside (and inside) the industry, the latest data to notable trends, you’ll find a little bit of everything in this company-powered blog.

Following years of elevated output, lending returned to historic norms in 2023.

Look beyond the headlines to discover the driving forces behind market trends and consider how they impact a credit union’s investment portfolio.

The curse of cable TV, servant leadership, and more concerns around AI were among the major topics as the annual event continued.

The fate of fee income, AI, and consolidation (of a sort) were top of mind on Monday.

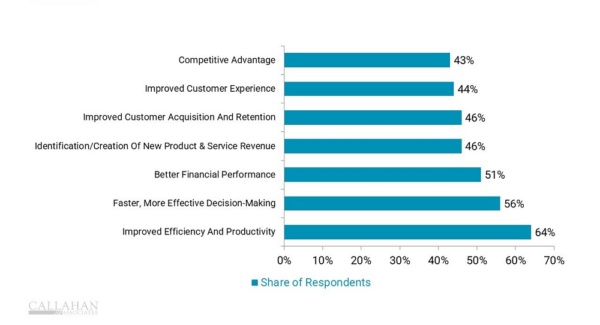

Turning raw data into actionable insights can reduce costs, head off risk, drive innovation, and more.

Credit union leaders can lead their organizations through a period of uncertainty by looking at results through a different lens.

A look at how CDFI credit unions stack up in performance as well as geography.

The average share balance per credit union member dropped more than $200 across 2023 as high inflation weakened savings.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

Differences in how men and women view financial inclusion contribute to a drop in global ranking for the United States.

Following years of elevated output, lending returned to historic norms in 2023.

Look beyond the headlines to discover the driving forces behind market trends and consider how they impact a credit union’s investment portfolio.

The curse of cable TV, servant leadership, and more concerns around AI were among the major topics as the annual event continued.

The fate of fee income, AI, and consolidation (of a sort) were top of mind on Monday.

Turning raw data into actionable insights can reduce costs, head off risk, drive innovation, and more.

Credit union leaders can lead their organizations through a period of uncertainty by looking at results through a different lens.

A look at how CDFI credit unions stack up in performance as well as geography.

The average share balance per credit union member dropped more than $200 across 2023 as high inflation weakened savings.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

Differences in how men and women view financial inclusion contribute to a drop in global ranking for the United States.

Markets Pare Back Pivot Expectations